Global LNG Market Faces Looming Supply Glut After Years of Scarcity

(Bloomberg) -- The global market for liquefied natural gas faces a multiyear supply glut starting in 2026, potentially pushing prices for the crucial fuel to the lowest since the energy crisis triggered by Russia’s full-scale invasion of Ukraine.

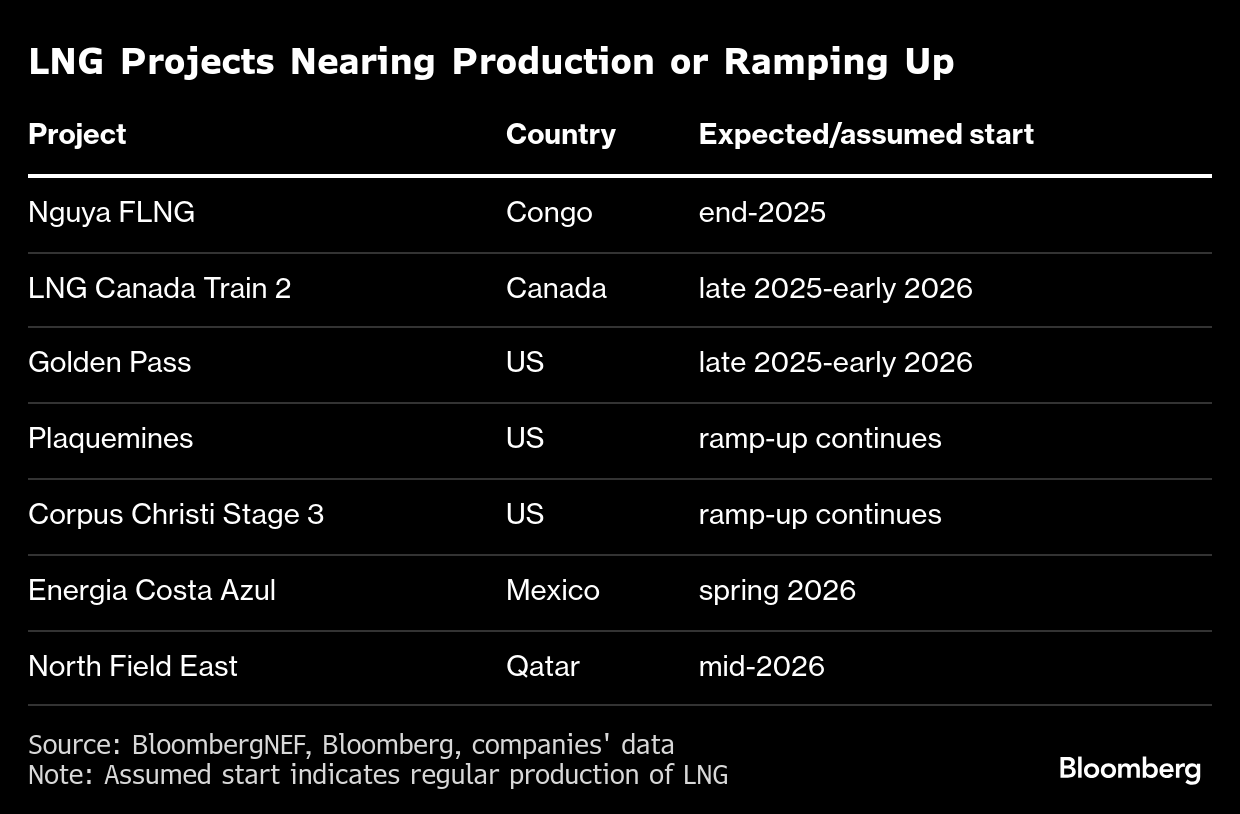

After four years of tight markets, the International Energy Agency expects the biggest boost in LNG production next year since 2019. Exports from the US are already booming as Venture Global Plc’s new plant in Plaquemines, Louisiana ramps up faster than expected, and more big projects will follow.

Meanwhile in China, which was supposed to be the main growth market for the fuel, imports are contracting. The country’s domestic gas output has risen and a major pipeline deal with Russia is seen further squeezing its LNG purchases.

LNG gluts have been predicted before and failed to materialize, but this time looks different because so much new capacity is on the brink of completion. Industry executives gathering in Milan this week at the Gastech conference will be discussing trends that could bring cheaper power and lower heating costs to consumers around the world, while also accelerating the shift away from dirtier fuels such as coal and oil.

“With more LNG capacities coming online in 2026, the market should loosen after the first quarter,” said Aldo Spanjer, head of energy strategy at BNP Paribas SA. “We’re going to see supply length coming in toward the second half of 2026 and into 2027.”

Consumers shouldn’t expect immediate price relief, especially in Europe where winter is set to start with lower inventories than usual. Over the next six months, the supply buffer will remain slim and the region will still be competing with Asia for LNG cargoes, with the potential for price spikes in colder periods, said Martijn Rats, global commodities strategist and head of European energy research at Morgan Stanley.

But, “as we are out of the winter, a mild surplus will start in the second half of the year, which will become a sizable surplus in 2027 as production ramps up,” Rats said.

Supply Surge

More than 174 million metric tons of annual gas liquefaction capacity is currently under construction, which should raise global LNG supply to 594 million tons a year by 2030, an increase of 42% from last year, according to BloombergNEF.

It’s possible not all of this will arrive on time. A chunk of the new supply for 2026 will come from Golden Pass in Texas, developed by Exxon Mobil Corp. and QatarEnergy, which has already been delayed by about 12 months due to labor, contractor and construction issues. Exxon says it’s now on track to deliver first gas by the end of this year or early in 2026.

But much of the US LNG expansion is already underway, with production up almost 19% in the first half compared with a year earlier. In addition to the growing shipments from Plaquemines, Cheniere Energy Inc.’s third-stage expansion of its plant in Corpus Christi, Texas will have added 10 million tons of annual capacity by end of the year.

Later in 2026, QatarEnergy’s North Field East expansion project should begin exporting, marking the start of the nation’s biggest expansion since delivering its first cargo of super-chilled fuel in 1997.

Project developers have been betting that demand for LNG will boom over the next two decades, with Europe needing alternatives to Russian pipeline shipments and China increasingly switching its power plants away from coal. Shell Plc, the world’s largest LNG trader, predicted that global demand will surge 60% by 2040.

Yet purchases from China, the top importer of LNG, have fallen this year and there’s little prospect of a significant rebound. The country’s domestic gas production is rising and its imports from Russia are set to expand significantly after recent deals to boost supply and proceed with the Power of Siberia 2 pipeline.

“The pipeline’s large capacity has the potential to significantly crowd out China LNG imports” equivalent to about 10% of current global supply, analysts at Goldman Sachs Group Inc. said in a note.

Lower Prices

Some uncertainties remain, particularly the impact of Western restrictions on Russia’s exports.

BloombergNEF’s base case assumes the country’s Arctic LNG 2 plant remains idle due to sanctions. However, the project recently manage to skirt these restrictions and export a cargo to China.

Russia’s LNG output could be 50% higher than expected if the facility was able to operate normally, according to BloombergNEF. On the other hand, shipments could be 39% lower than estimated if sanctions were imposed on more of the nation’s liquefaction plants.

Other traditional exporters could also fall short. Egypt looks likely to fail in its ambition to revive LNG exports as domestic production falters. Indonesia, once one of Asia’s largest suppliers, is importing more of the fuel to meet rising consumption amid depleting output.

BloombergNEF expects LNG supply to consistently exceed demand between 2027 and 2030. By the fourth quarter of 2026, gas prices in Europe and Asia are set to fall below $10 per million British thermal units, according to Morgan Stanley’s Rats, compared with an average price of $14 last winter. In 2027 it could fall as low as $8, according to BNP Paribas.

Prices at that level could stimulate additional demand by encouraging power generators in Asia to burn more of the fuel by switching away from oil, according to BloombergNEF. Cheaper cargoes could also open new markets in south Asia and Africa, where several nations have import terminals but have been put off by high prices.

Yet some of those countries would need to develop new infrastructure, limiting their scope to benefit from lower prices by quickly boosting LNG purchases, according to BNEF. Europe, with numerous import terminals, could absorb more of the surplus.

“New market demand will react to a lower price environment between 2028 and 2030,” according to ICIS’ outlook. “Yet, new supplies by far outstrip demand growth.”

©2025 Bloomberg L.P.