European Power Gets Biggest Shakeup in Years With 15-Minute Trades

(Bloomberg) -- Europe is making the biggest change to how power is traded in years, in a move that brings the market closer to the needs of a system increasingly reliant on renewable energy.

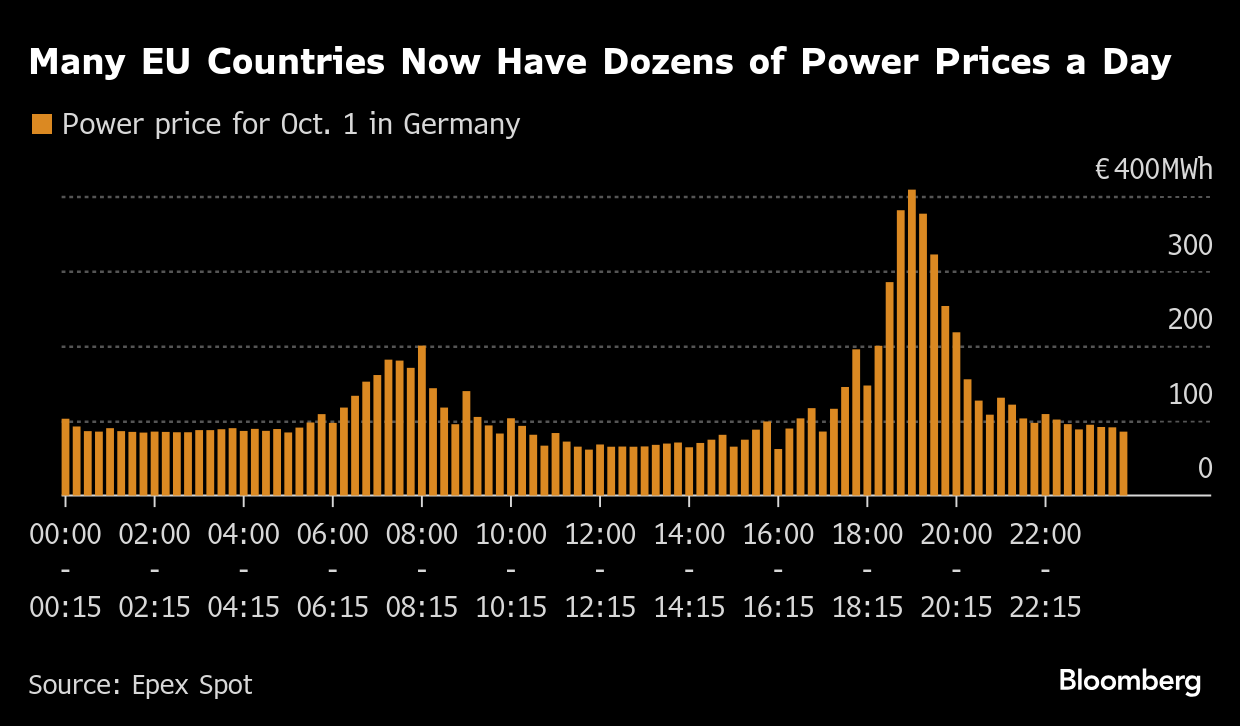

Day-ahead prices have traditionally been set on an hourly basis to track shifts in demand that drove prices higher during mornings and evenings. But from Tuesday, new 15-minute blocks are being introduced in an auction run by the Epex Spot SE exchange in Paris.

Volatile wind and solar power increasingly dominate the grid, only to sometimes plunge within minutes. The new contracts will allow traders to bet on a shorter time span that more accurately reflects these swift changes between supply and demand.

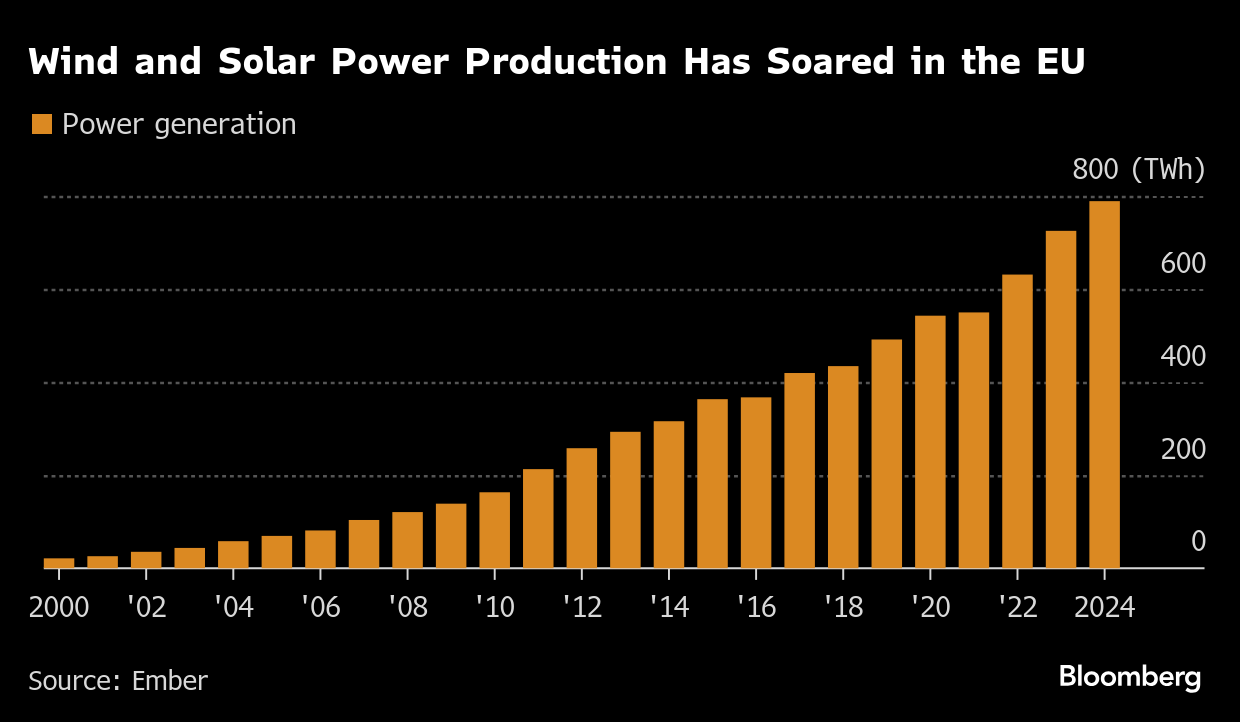

That rapid rise of renewable energy over the past few decades has led to a boom in short-term power trading. It’s a corner of the industry where specialist traders as well as hedge funds with strong capabilities to parse millions of data points about the weather and demand have become very successful.

“The move to quarter-hour products is a true paradigm shift for the energy transition,” Jörg Seidel, head of short-term asset optimization at Sweden’s Vattenfall AB, said in a statement. “The reform shows where the market is heading: it opens up opportunities to integrate electricity from wind and solar power into the market even more efficiently – and brings us closer to a future in which everyone has the choice to travel, produce and live without fossil fuels.”

Price swings are now greater than ever, with rates sometimes even falling below zero as more and more green electricity floods the market and strains the grid.

“The more renewables we install, the more trades are being done,” said Bo Palmgren, chief executive officer of MFT Energy A/S, one of those firms based in Europe’s power trading center of Aarhus, Denmark. “15-minute trading fits better with how renewable power actually runs.”

Countries adopting the change, which starts with deliveries for Wednesday, include Germany, Europe’s biggest power market, the Nordic region as well as France and the Benelux region. While both wind and solar power are important sources in the UK, it will not introduce the new contracts for now. Germany’s first auction showed just how volatile the new system can be, with a €234 swing in the price between the 6 to 6:15 pm slot and the period from 6:45 pm to 7 pm.

The 15-minute block is not completely new though. It’s been used in the market for same-day deliveries for some time, but volume is much smaller than in the auction.

For the wider world, outside the energy trading hubs in Aarhus, Essen or Geneva, a more efficient market could lead to lower prices for homes and businesses that have been struggling with soaring inflation and the cost-of-living crisis for the past few years.

As prices plunge during periods when renewables overwhelm the grid, consumers could opt to use more electricity then, Palmgren said. It could also reduce emissions as fossil-fuel plants will get clearer signals of when they are needed to prop up supplies.

Europe’s Power Market Is So Hot, Traders Are Leaving Retirement

With four periods instead of one for each hour of the day, Palmgren estimated that the number of trades could roughly quadruple, even though the total amount of electricity traded would stay the same. Ultimately, the market could get even more refined.

“It would be a good step to consider going even lower,” Palmgren said. “Eventually one minute.”

Regardless of what comes next, the change will also allow traders to more effectively move electricity from one market to another.

Europe’s power grid is highly integrated, with most countries sending electricity across their borders throughout the day. There could be an hour when maybe in the last fifteen minutes, wind output is set to rise in one country and drop in a neighbor. Then it could make sense to export electricity from the windier region just for that period.

“What you get is more products and more opportunity to optimize,” said Kasper Just, vice president and head of renewables and cross-border trading at Equinor ASA’s Danske Commodities A/S. “It should be more correct the way we are sending the power across the borders.”

(Adds quote in fifth paragraph, market data in 8th)

©2025 Bloomberg L.P.