Hedge Funds Pile Into Once-Esoteric Commodity Curve Option Bets

(Bloomberg) -- Wall Street investors looking for a better way to bet on an oil glut or a frigid winter are piling into a suddenly booming corner of the options market that was long the province of physical commodity traders.

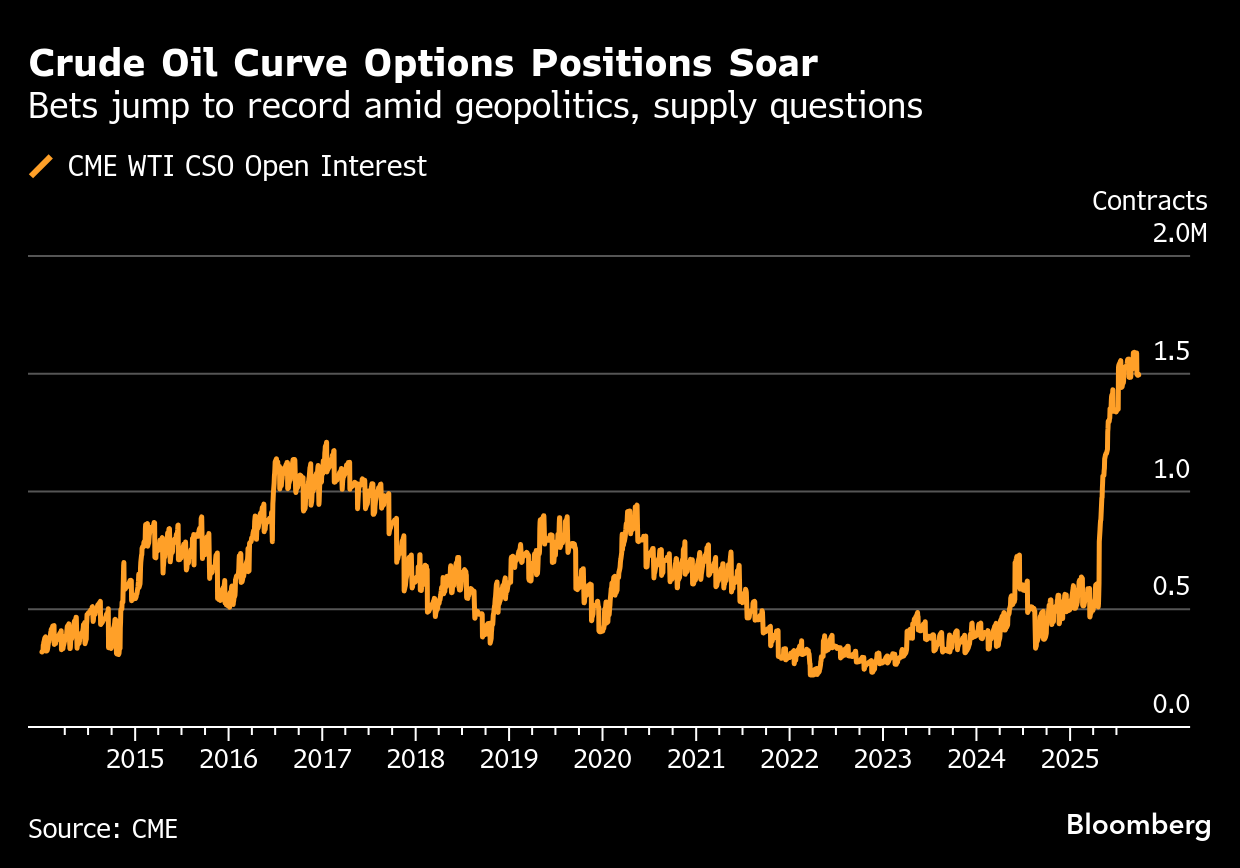

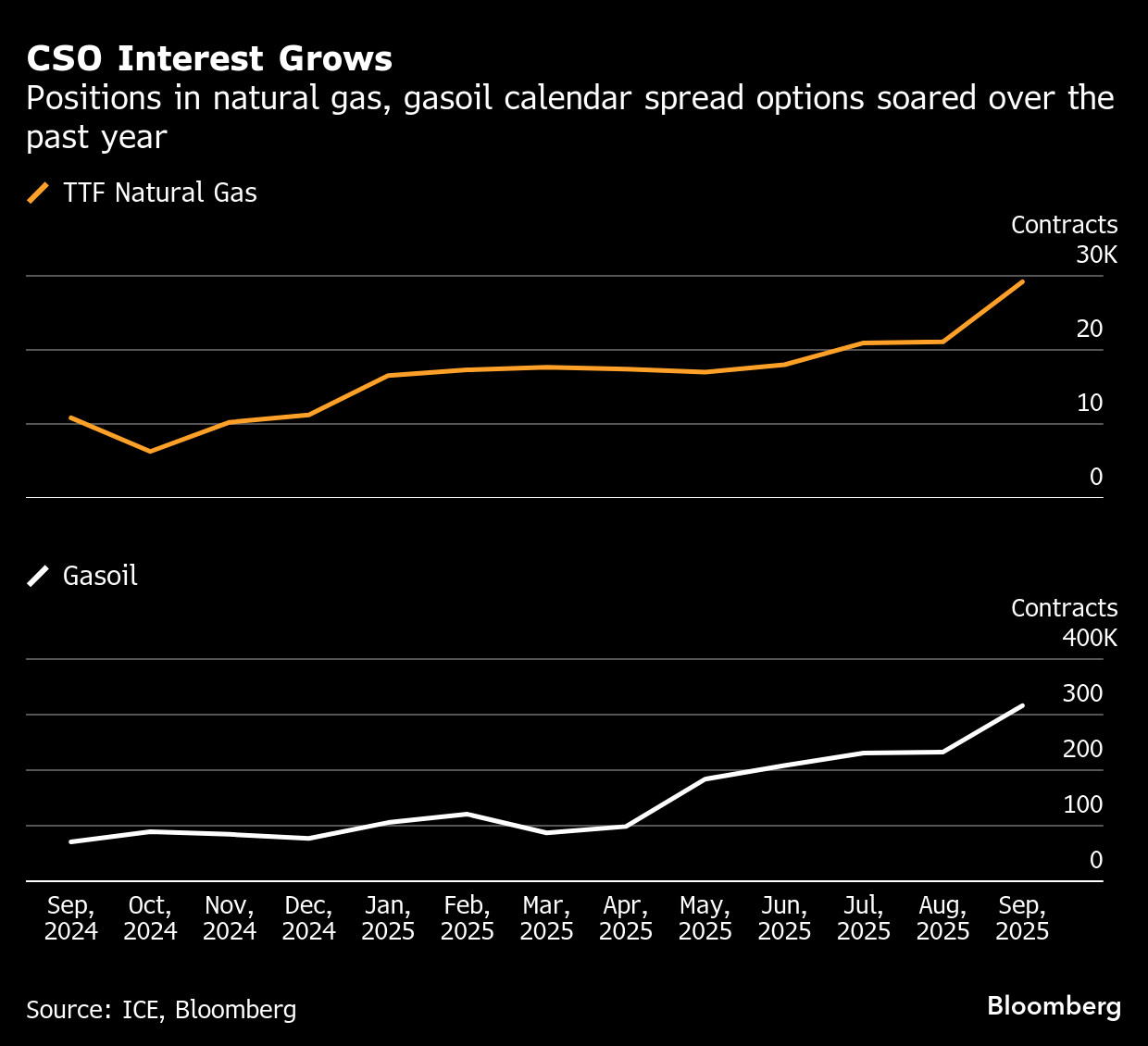

Calendar spread options — which bet on the difference between contracts expiring in different months — have seen a surge in trading to record levels in some markets. Positions in West Texas Intermediate crude have more than tripled over the past year, while Dutch natural gas curve bets have grown nearly as much.

The growth is a sign of the changing make-up of commodity trading, where multi-strategy hedge funds have expanded their presence enormously since the pandemic. Traders and brokers involved in a variety of raw materials markets said the multi-strategy funds were at least one of the drivers of higher volumes.

The wagers also come at a time that political volatility makes trading spot futures harder. President Donald Trump’s social media posts have moved everything from oil to wheat, with some of the world’s top energy companies bemoaning the wrong type of market volatility. The average open interest in agriculture CSOs has jumped 50% this year as trade conflicts heated up.

“CSOs are hot right now because the real story in crude isn’t just price direction, it’s the shape of the curve,” said Haris Khurshid, Chicago-based chief investment officer at Karobaar Capital LP. “With inventories swinging and geopolitics in play, traders see more juice in betting on spreads than outright.”

Part of the attraction is managing risk. Spreads tend to move less than the outright price. But the contracts are also particularly valuable in commodities where seasonality and weather play outsized roles, like in agriculture or natural gas, where swings in the “widowmaker” spreads around winter peak heating season have made and lost traders billions of dollars.

“Traders and hedgers are increasingly interested in managing spread dynamics across different maturities,” Derek Samman, CME Group’s Senior Managing Director, Global Head of Commodities Markets, said in an email. The growth “indicates a higher level of sophistication in how market participants are managing their exposures, moving well beyond simple long and short directional bets.”

WTI calendar spread option open interest is more than 1.5 million lots — the equivalent of 1.5 billion barrels — including both physically and financial settled contracts, narrowing the gap to CME’s benchmark light sweet crude options total of nearly 2.3 million. A year ago the CSOs were less than one-fifth the size of the outrights.

This year’s oil market has been marked by long periods of low volatility as prices churned in a tight range, balanced by additional supplies both inside and outside of the OPEC+ alliance, as well as geopolitical risk.

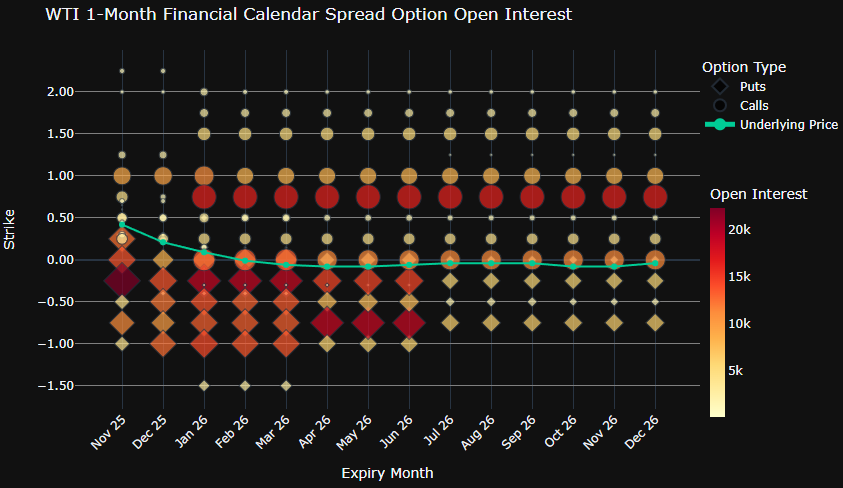

The data shows a range of outlooks across the market. Bets have been split between tighter supplies keeping the prompt prices more expensive than later contacts, versus a glut forming in 2026 — which would push the market into contango, where near-term prices are cheaper. An Israel-Hamas ceasefire and threats of higher US tariffs on China sent crude prices reeling on Friday, putting some of the bearish curve bets closer to paying off.

“Call it the most crowded trade in oil right now,” Peter Keavey, global head of energy and environmental products at CME Group, said at the Argus Global Markets Conference last month. “It’s the most concentrated exposure that folks have. There’s a lot of leverage that has to be taken on spread bets.”

One of the other markets showing the biggest growth is ICE Gasoil, where open interest in the CSOs is higher than in outright options. The threat of sanctions cutting off Russian supply of diesel fuel has attracted hedging to protect against price spikes, with more traders turning to contracts to bet on backwardation or contango, rather than flat price.

“The spike in diesel spreads in July and continued Russian sanctions threat has spooked the markets and we see a lot of demand on hedging against the exaggerated spikes in the curve structure,” said Udayan Bhattacharya, chief trader at Global Risk Management in Copenhagen.

Similarly, Dutch TTF natural gas trading has jumped, boosted by the growth of LNG from the US, balanced by traders racing to fill depleted storage before winter.

Europe’s gas reserves, which typically cover about a third of winter demand, remain a critical gauge for whether the region can finally move past the energy crunch triggered by Russia’s invasion of Ukraine. Many analysts expect global gas supply to start tipping into surplus in 2026 — making future stockpiling easier and spelling long-awaited relief for European consumers battered by years of volatility.

“Typically you get the summer/winter spreads that storages feed on,” said Bhattacharya. “However, with big LNG supplies predicted for coming years those spread dynamics are changing which creates opportunities on the spread options.”

©2025 Bloomberg L.P.