Exxon and Chevron Cut Divergent Paths as Global Oil Glut Looms

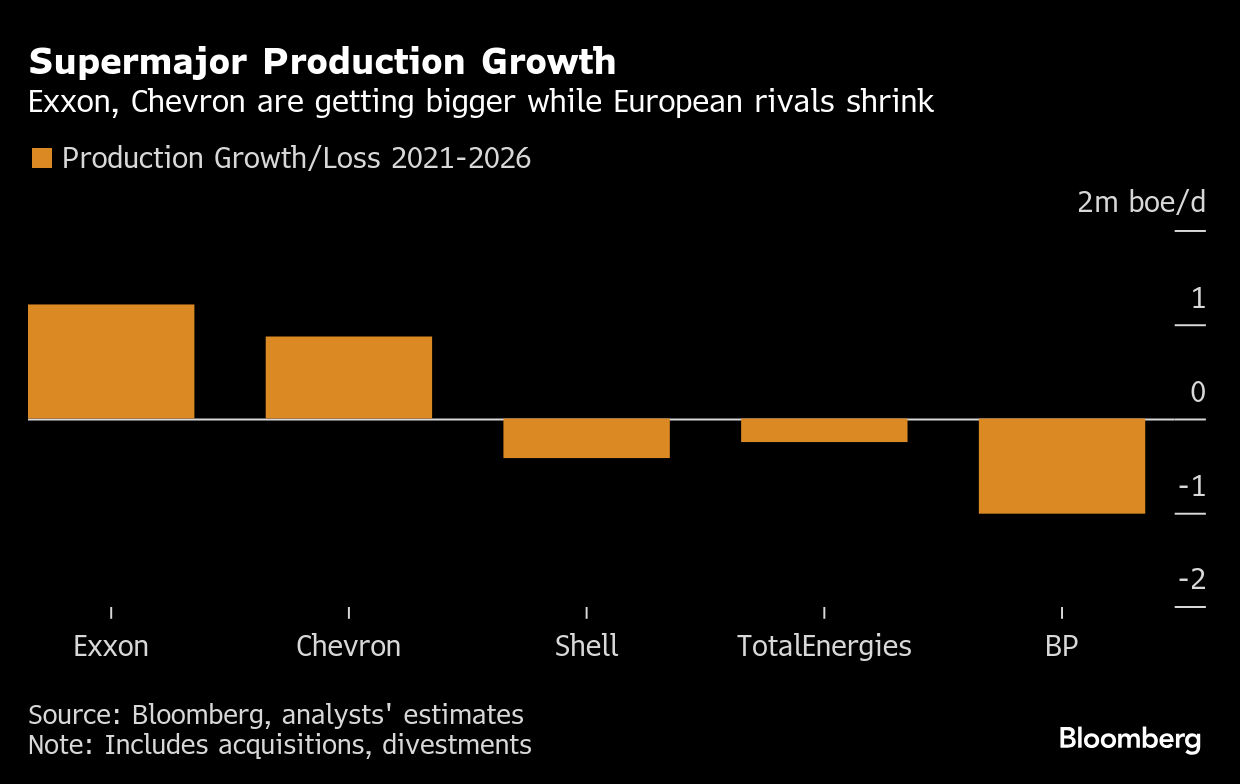

(Bloomberg) -- North America’s two dominant oil companies are carving divergent paths as the global crude market staggers toward what’s widely expected to be a hefty supply glut.

Exxon Mobil Corp. is pressing ahead with a raft of expansion projects, even as OPEC and its allies increase production and oil futures hover near a four-year low. Chevron Corp. meanwhile is positioning itself to wring cash from existing operations to weather the market downturn.

In the short term, investors are applauding Chevron’s approach, bidding its stock up as much as 3.5% Friday after both companies reported third-quarter results that exceeded Wall Street’s expectations. Exxon dipped as much as 1.8%, in part thanks to a spate of acquisitions that squeezed free cash flow.

This is all happening against the backdrop of efforts by the OPEC+ alliance to recapture market share by unleashing more crude onto global markets. The group led by Saudi Arabia is expected to revive another round of oil production hikes in December, targeting about 137,000 barrels a day as a base case when members meet this weekend.

Brent crude, the international benchmark, already is on pace for its worst annual decline in half a decade, trading around $65 a barrel Friday.

The US supermajors followed European rival Shell Plc in posting stronger-than-expected results. TotalEnergies SE reported profit that was in-line with expectations. BP Plc is scheduled to disclose results next week.

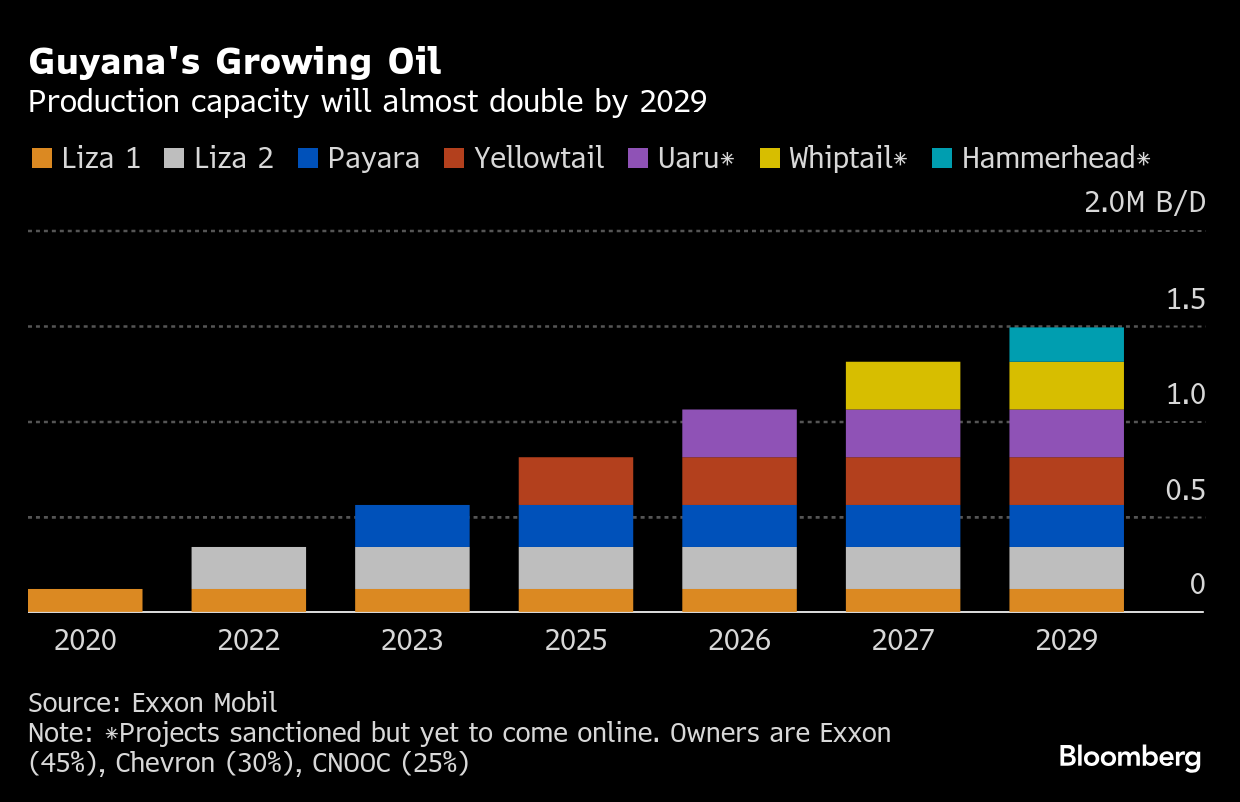

Exxon’s adjusted third-quarter profit per-share was 7 cents higher than analysts forecast. It was the company’s sixth consecutive beat, buoyed by the startup of the explorer’s latest Guyana development.

Eight of Exxon’s 10 new developments slated for this year have already started up, and the remaining two are “on track,” Chief Executive Officer Darren Woods said in a statement.

Woods is betting Exxon’s low debt level means he has ample capacity to fund growth projects that span from crude in Brazil to chemicals in China while maintaining a $20 billion annual buyback program despite weak oil prices. His goal is to be ready to capitalize on an upturn in commodity prices, which analysts say could come as soon as next year.

Exxon’s third-quarter earnings benefited from the start-up of Yellowtail, a 250,000 barrel-a-day development off the coast of Guyana, where Exxon made the biggest discovery in a generation in 2015.

During a conference call, Woods reassured analysts that the company’s liquefied natural gas project in Mozambique is progressing and that the security situation in the country has “improved dramatically.” Woods did not say, however, when Exxon would make a final investment decision on the project.

Exxon’s project execution success was mitigated by another increase in debt levels, indicating the company is not covering its dividend and buyback with free cash flow, Kim Fustier, an analyst at HSBC Holdings Plc said in a note.

“Tempering these positives is the second large quarter-on-quarter increase in net debt in a row,” she said. “This is evidence that Exxon’s distributions are uncovered in a $65 to $70 a barrel price environment.”

Exxon’s free cash flow was $6.3 billion in the period, compared with buybacks and dividends of $9.4 billion. Free cash, a key metric for Big Oil investors, was hurt by lower-than-expected refining earnings and some surprise acquisitions in the period.

Chevron’s third-quarter results beat expectations for adjusted earning per share by almost 20 cents.

The company’s global production rose 21% to the equivalent of 4.1 million barrels a day, boosted by the addition of Hess Corp.’s 30% stake in the Stabroek Block, the Exxon-operated discovery off Guyana. Cash flow from operations was up 20% from a year earlier despite tumbling oil prices.

In the Permian Basin of West Texas and New Mexico, Chevron’s output continues to grow, producing 60,000 barrels above the company’s 1 million-barrel a day plateau level. Chevron Chief Executive Officer Mike Wirth, however, expects this growth to moderate as Chevron focuses on generating cash.

During a call with analysts, Wirth said the company’s talks are going well with Kazakhstan over a new production-sharing agreement for the massive Tengiz oil field. He warned, however, that it’s early in the process.

Wirth has taken a series of steps to turn the company into a steady cash generator that can better withstand oil’s notorious boom-and-bust cycles.

Excluding the addition of Hess’ assets, Chevron was already on course to expand production by 7% this year and a further 5% in 2026 with so-called high-margin output from fields in Kazakhstan and the Gulf of Mexico that turn profits even if crude were to dip to $20 a barrel. The US benchmark price, known as West Texas Intermediate, has been trading around the $60 level for the past month.

Chevron is also working to boost cash flow by reining in production growth in capital-intensive shale fields in places like the Permian Basin and the Denver-Julesburg region, while cutting 20% of the company’s global workforce.

“We talked before about the cash flow inflection that was coming, and we saw that in the third quarter,” Chief Financial Officer Eimear Bonner said in an interview. The Hess assets “are significantly impacting the results already.”

©2025 Bloomberg L.P.