Europe’s Energy Giants Show They’re in Better Shape Than Feared

(Bloomberg) -- Europe’s energy firms did much better than expected in the third quarter, as stronger refining margins offset the impact of subdued oil prices, though the outlook going into 2026 remains uncertain.

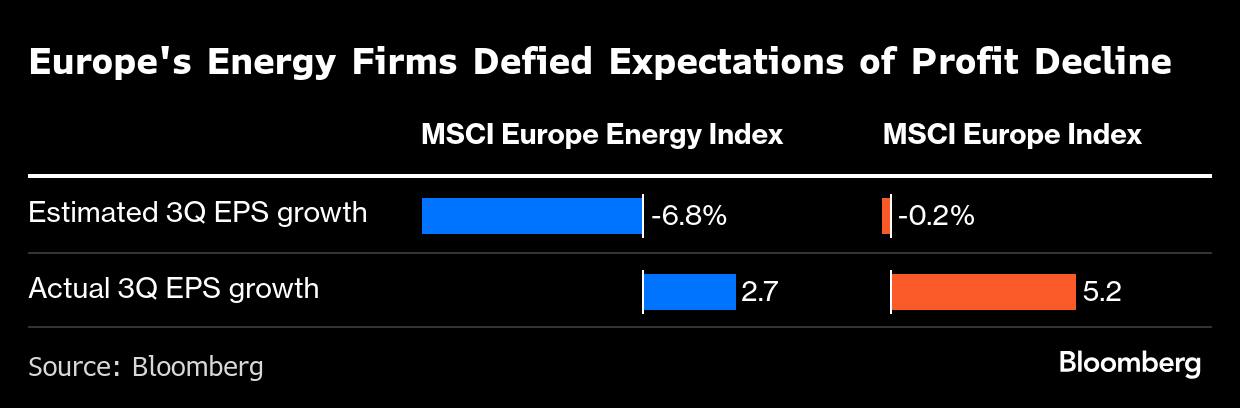

The MSCI Europe Energy Index delivered earnings-per-share growth of 2.7% for the third quarter, compared with expectations of a 6.8% decline, Bloomberg Intelligence data shows. Oil and gas companies also delivered the highest percentage of earnings beats in the period.

While energy companies largely missed revenue expectations due to weaker oil prices, improved refining margins bolstered bottom lines, Bloomberg Intelligence strategist Kaidi Meng said in an email. UK-listed oil majors Shell Plc and BP Plc, as well as Italy’s Eni SpA, were the main drivers of the EPS beat, she added.

Despite muted oil trading, BP’s profit exceeded expectations in the third quarter, boosting investor confidence in the company’s turnaround. The refining and trading division delivered higher earnings than the previous quarter, having benefited from robust refining margins.

Shell also delivered better-than-expected profit and free cash flow, buoyed by strong gas trading, growing volumes in liquefied natural gas and improved refining margins. This echoed US peer Exxon Mobil Corp., projecting a $300 million to $700 million profit boost from stronger fuel-making margins.

Spain’s Repsol SA entered the fourth quarter “with positive momentum from refining strength that could help offset macroeconomic headwinds and softer benchmark pricing,” BI’s Salih Yilmaz said, adding that refining will help mitigate commodity volatility in early 2026.

Elsewhere in Europe, Portugal’s Galp Energia SGPS SA, France’s TotalEnergies SE and Austria’s OMV AG also reported solid profit, driven by refining strength. “We believe the market has yet to fully capture the extent of the ongoing strength in refining margins,” Citigroup analyst Alastair Syme wrote in a note about TotalEnergies.

Upbeat updates from Europe’s biggest oil companies helped reassure investors that share buybacks and dividends – a key part of the sector’s appeal to investors – can be sustained for now.

Shell’s decision to invest more in oil and gas and its cautious approach to expanding in renewable energy is “prudent and is bolstering medium-term earnings and shareholder distributions,” BI analyst Will Hares said.

Going forward, the sector remains vulnerable to further swings in oil prices. The 2026 consensus for the Stoxx 600 energy sub-index earnings implies an estimated oil price of around $68. If it falls to $60, it would trim the sector’s EPS by about 20%, BI calculations show.

The current strength in oil refining margins might also not last much longer, according to OMV Chief Executive Officer Alfred Stern. “It will normalize and not stay at the fourth quarter level,” he said on the company’s recent earnings call.

For now, there’s solid momentum in oil and gas. Earnings across the five supermajors – Exxon, Shell, TotalEnergies, BP and Chevron Corp. – are higher in the third quarter compared with the preceding three months. That said, it’s still less than half the levels seen in 2022, highlighting a long road to recovery for the sector.

©2025 Bloomberg L.P.