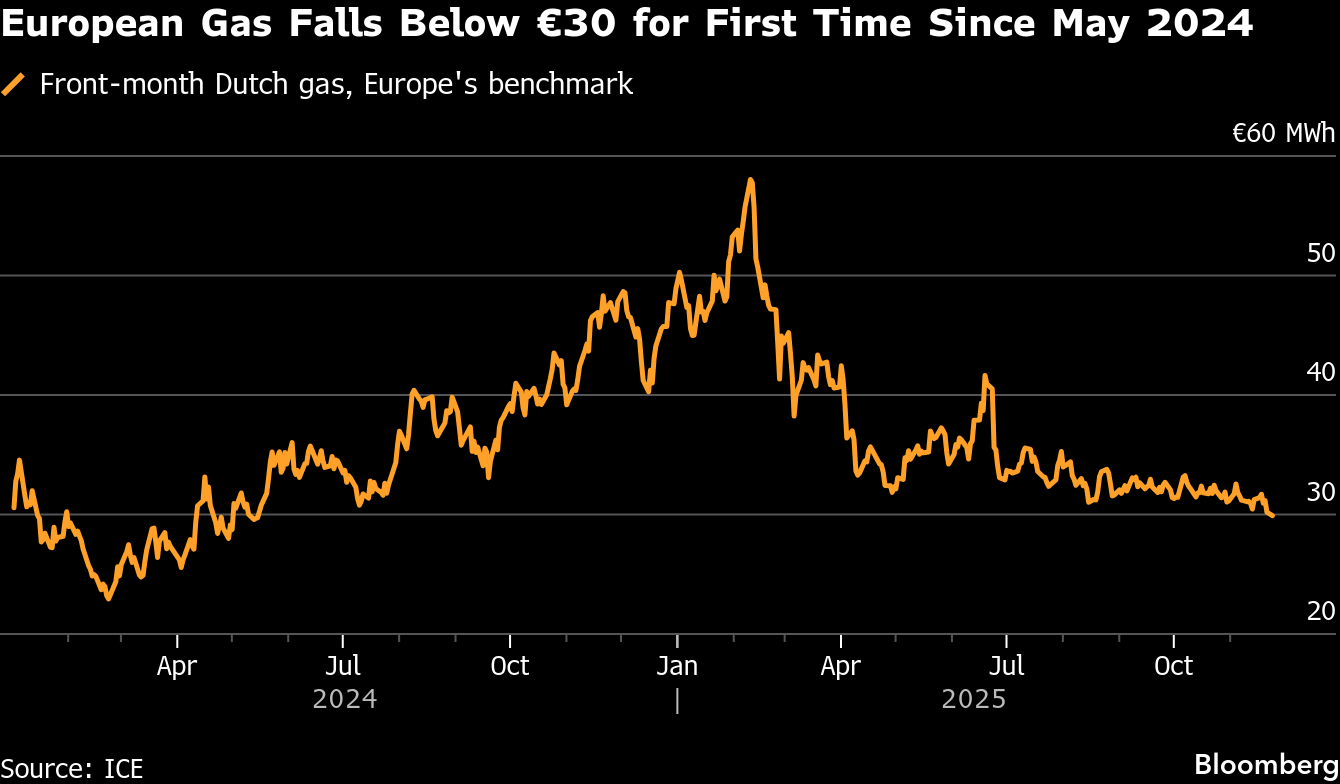

Europe Gas Slips Below €30 as Imports Surge and Cold Spell Eases

(Bloomberg) -- European natural gas fell below €30 a megawatt-hour for the first time in more than a year, weighed down by rising imports and talks to end Russia’s war in Ukraine.

The milestone demonstrates the turnaround prices have made this year after initial expectations of a difficult winter. Depleted stockpiles at the start of 2025 and struggles to replenish them to their usual levels over the course of the summer created expectations that Europe could be vulnerable to price spikes. Instead, strong LNG arrivals, steady Norwegian flows and mild weather have eased pressure in recent months, showing how far the region has come since the 2022 energy crisis.

Benchmark futures hit their lowest levels since May 2024 after weeks of narrow trading, and are down 39% since the start of the year. Temperatures are now expected to rise above seasonal norms in early December, helping to cap heating demand and drive prices lower. Investment funds have also pared their bullish bets on Europe’s gas.

Efforts to end the war in Ukraine are also impacting sentiment. On Sunday, US-Ukraine talks in Geneva signaled progress toward a deal to end the war, though US Secretary of State Marco Rubio said Washington’s proposed Nov. 27 deadline to secure Kyiv’s support could drift into next week. An agreement would require signoff by Ukrainian President Volodymyr Zelenskiy, as well as US President Donald Trump and Russia’s Vladimir Putin.

Progress toward peace in the region could affect global energy supplies and prices before new liquefied natural gas projects start up late next year. While the European Union has plans to halt Russian energy imports from 2027 — and currently gets only around 10% of its gas from the country — it vies with other regions for fuel and extra gas in the global market helps ease that competition.

“Geopolitics will dominate this week and temperatures appear to be above seasonal norms, which may add further pressure,” said Arne Lohmann Rasmussen, chief analyst at Global Risk Management. “We nevertheless entered winter with storage at low levels and it will not take many gas-positive news items for the price to rise again.”

Gas prices are still higher than before the 2022 energy crunch, when skyrocketing futures triggered a cost-of-living crisis across the continent. But they’re a fraction of the peaks seen that year, and additional supplies from the US and elsewhere are expected to help drive prices lower in the coming years.

Dutch front-month futures, Europe’s benchmark, traded at € a megawatt-hour by 10:31 a.m. on Monday, almost half the level reached in February this year.

©2025 Bloomberg L.P.