Global LNG Suppliers Wager That China’s Demand Slump Is Fleeting

(Bloomberg) -- Global gas giants are betting the current lull in Chinese demand is temporary, and that the country will underpin their multibillion-dollar investments for years to come.

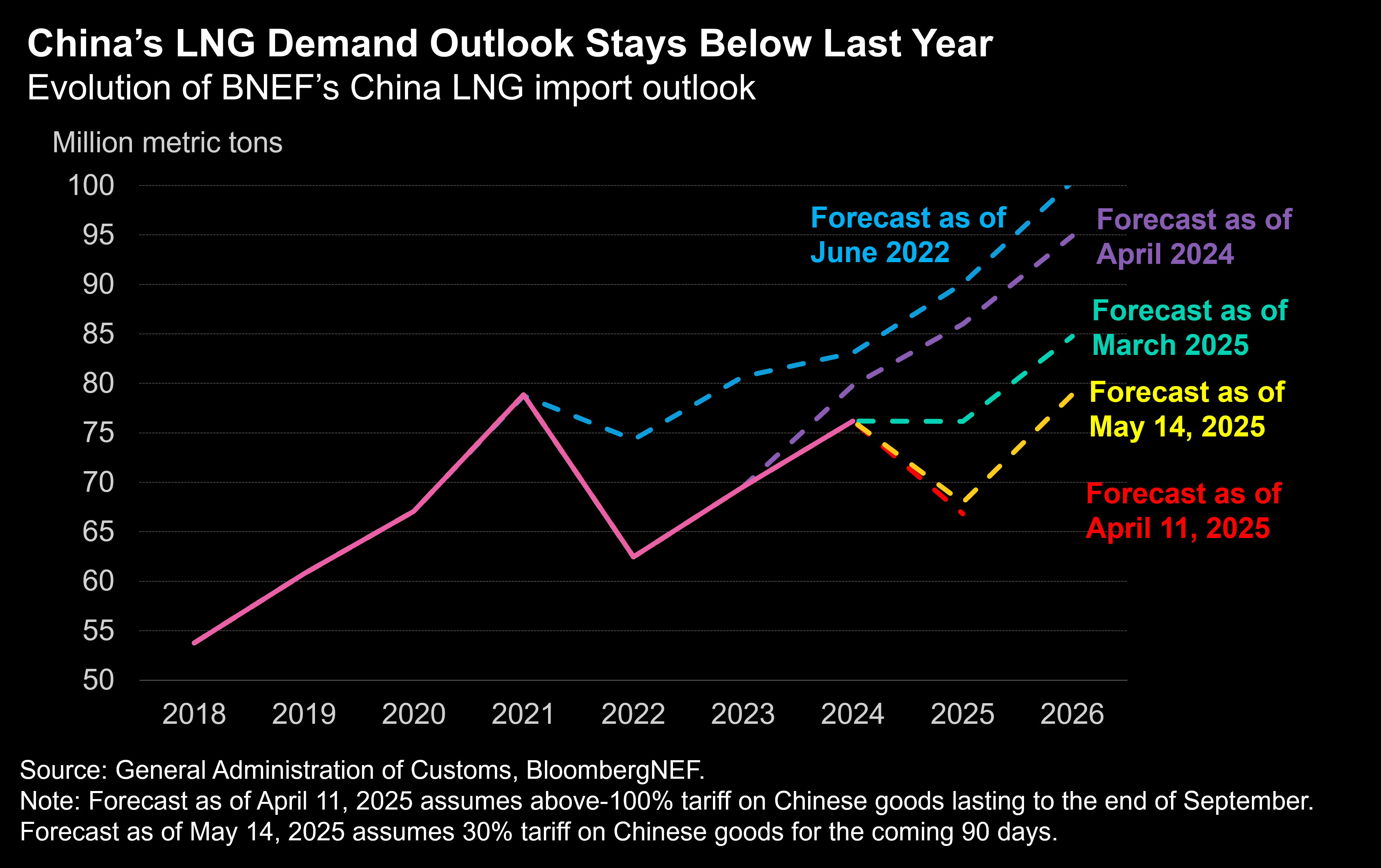

China’s gas imports have fallen in 2025, a decline centered on seaborne shipments of liquefied natural gas that slumped 22% through April from the previous year. Demand for LNG — the fuel carried in super-chilled tankers — is headed for its first annual drop since the height of the pandemic, just as new export projects are slated to come online, led by the shale gas fields of the US.

The problem is that LNG is being crowded out by cheaper alternatives such as coal and renewables, and gas produced domestically or piped overland from Russia and Central Asia. Slower economic growth and pressure to cut energy costs have also sapped China’s appetite for the fuel, which is generally a pricier option because of processing and shipping costs from plants as far afield as North America and the Middle East.

But China’s willingness to diversify its supply of gas could also strengthen the seaborne market’s prospects, given the variety of sources it offers.

“China’s very strategic in their energy policy and their approach to energy,” said Meg O’Neil, chief executive officer of Australian gas producer Woodside Energy Group Ltd. “They diversify energy types, with significant investment in renewables, coal, nuclear, and natural gas. And within each of those commodities, they source from a number of different locations,” she said in an interview at the World Gas Conference in Beijing.

China has been the driving force in the global gas market for much of the past decade, accounting for more than a third of the total increase in consumption. That lifted the country from a minor player in LNG to the world’s biggest importer in 2021.

Since then, Chinese growth has faltered. The pandemic and the economy’s lackluster recovery; an energy crisis after Russia invaded Ukraine; the country’s breakneck adoption of clean energy and record coal output; and the success of its state-owned companies in raising domestic production, have all crimped overseas demand.

BloombergNEF expects China’s LNG imports in 2025 at 68 million tons, an 11% drop from last year. But there’s an expectation that expanded supply and cheaper prices will rekindle demand, Samantha Dart, co-head of global commodities research at Goldman Sachs Group Inc., told Bloomberg Television on Wednesday.

Growth Hurdles

Even though total gas supplies will rise faster than consumption, a research institute affiliated with China National Offshore Oil Corp. projects that LNG imports will double by 2035, according to a report released on Tuesday.

“China is trying to create additional supplies of gas,” Menelaos Ydreos, the secretary general of the International Gas Union, said in an interview at the conference. “Whether it’s domestic or LNG or whether it’s Russian gas, the demand is there.”

Still, there are plenty of obstacles to LNG’s growth. At the level of geopolitics, the trade war with the US could damage China’s economy and its demand for power. Moscow, meanwhile, is very keen to expand its pipeline gas sales to its eastern neighbor.

Within China, gas output is overtaking crude oil as the main upstream business for energy giants like PetroChina Co., an effort that coincides with the government’s eagerness to ensure greater levels of self-sufficiency and cut its import bills.

The hurdles suggest that not every prospective LNG supplier will make the cut when it comes to securing Chinese customers. US producers are at a particular disadvantage given the tariffs imposed by Beijing. BNEF counts more than a dozen American projects on its radar of final investment decisions that need to be made.

There are “maybe too many” proposed US developments, TotalEnergies SE’s CEO Patrick Pouyanne said on a panel at the conference. “I don’t know if they will all find offtake.”

On the Wire

Contemporary Amperex Technology Co. Ltd. has raised HK$41 billion ($5.2 billion) for its Hong Kong share sale after arrangers of the deal exercised the so-called greenshoe option to increase the offering, making the world’s biggest listing this year even bigger.

The US Commerce Department set the stage for anti-subsidy duties on imports of key battery components from China, after concluding materials had been unfairly subsidized.

New London Metal Exchange warehouses in Hong Kong will help market participants in mainland China handle volatility more effectively, justifying their relatively high storage fees, said Chief Executive Officer Matthew Chamberlain.

A temporary trade truce between the world’s two largest economies has sparked a knee-jerk bounce across China’s ports and factory floors.

More than two years ago on the outskirts of a medieval German town, China’s biggest EV battery company placed a €1.8 billion ($2 billion) bet on the future of global trade.

China’s CMOC Group, the world’s top cobalt mining company, called on Democratic Republic of Congo last week to lift a ban on exports of cobalt, Reuters reports.

China’s four-year property crash has sent new housing construction back to 2003 levels and cement output to its lowest since 2009.

This Week’s Diary

(All times Beijing)

Wednesday, May 21:

- China-Africa economic and trade cooperation briefing in Beijing, 10:00

- LME Asia Metals Seminar in Hong Kong

- China tin conference hosted by Antaike in Anhui, Hefei, day 1

- World Gas Conference in Beijing, day 3

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

Thursday, May 22:

- Shanghai Futures Exchange Derivatives Forum, day 1

- China tin conference hosted by Antaike in Anhui, Hefei, day 2

- World Gas Conference in Beijing, day 4

- CSIA’s weekly solar wafer price assessment

Friday, May 23:

- Shanghai Futures Exchange Derivatives Forum, day 2

- World Gas Conference in Beijing, day 5

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2025 Bloomberg L.P.