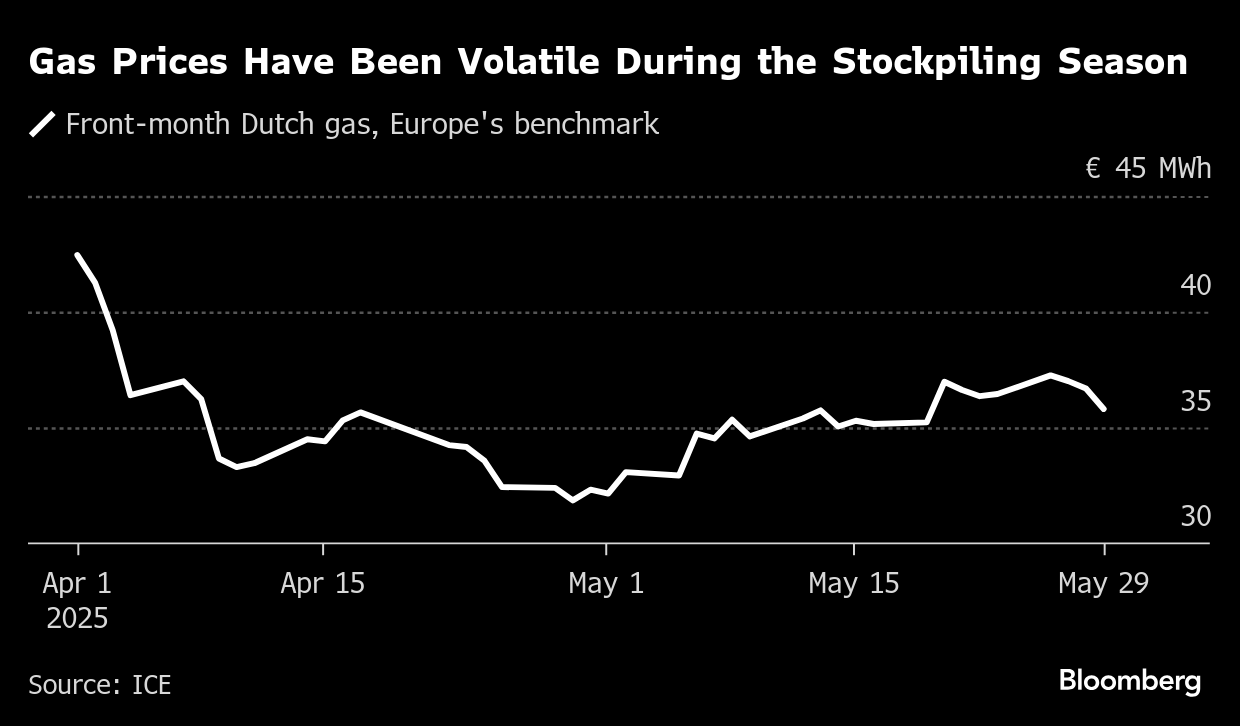

European Gas Slides as Demand Worries Linger After Tariff Ruling

(Bloomberg) -- European natural gas declined amid persistent demand concerns, despite a US court decision to block President Donald Trump’s sweeping global tariffs.

Benchmark futures slumped 4.2% for the biggest drop since April 9 on the last trading day of the June contract. Prices erased earlier gains as the White House plans to appeal the ruling and seek other ways to pursue an aggressive trade agenda that menaces energy consumption.

Volatility has roiled Europe’s gas market, with prices whipsawed by US trade policy, unplanned supply outages and the ebb and flow of global liquefied natural gas shipments. Demand, including in top importer China, is sluggish.

“Chinese demand remains stubbornly weak,” RBC Capital Markets analyst Adnan Dhanani said in a note. “Higher domestic production, increased pipeline imports and muted macro conditions are all contributing to this decline.”

That was briefly offset by the shift in sentiment prompted by Wednesday’s US court order, which blocked many of the import taxes announced by Trump last month. The levies have been seen as a significant drag on the outlook for global growth.

Storage Refills

Europe is currently in stockpiling season, when inventories are replenished ahead of winter. Weaker consumption in China has aided efforts to refill storage, but traders are watching for any spikes in consumption in Asia, where demand for cooling in the summer can push up competition for seaborne LNG.

On the supply side, flows from Europe’s largest gas provider, Norway, are slowly picking up after a period of seasonal maintenance. Yet unplanned works at the country’s giant Troll field continue into next week.

Dutch front-month futures, Europe’s gas benchmark, settled at € a megawatt-hour in Amsterdam. A public holiday across much of the continent cut trading volumes.

©2025 Bloomberg L.P.