Oil Surge Is Latest Headwind for Tariff-Rattled Global Economy

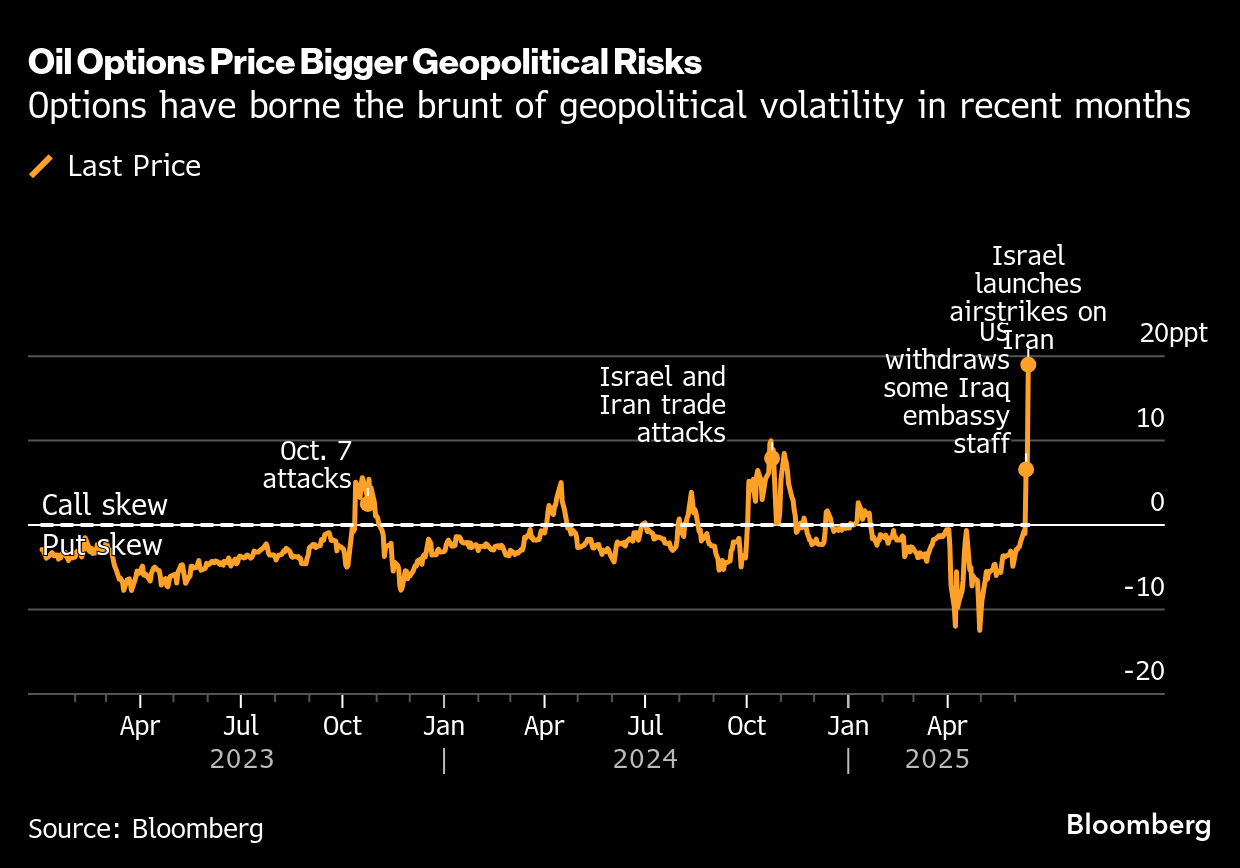

(Bloomberg) -- For a global economy that’s been buffeted by trade tensions all year, lower energy prices were one of the few positives. If a surge in the price of oil after Israel carried out airstrikes against targets in Iran is sustained, that tailwind will switch to become yet another headwind.

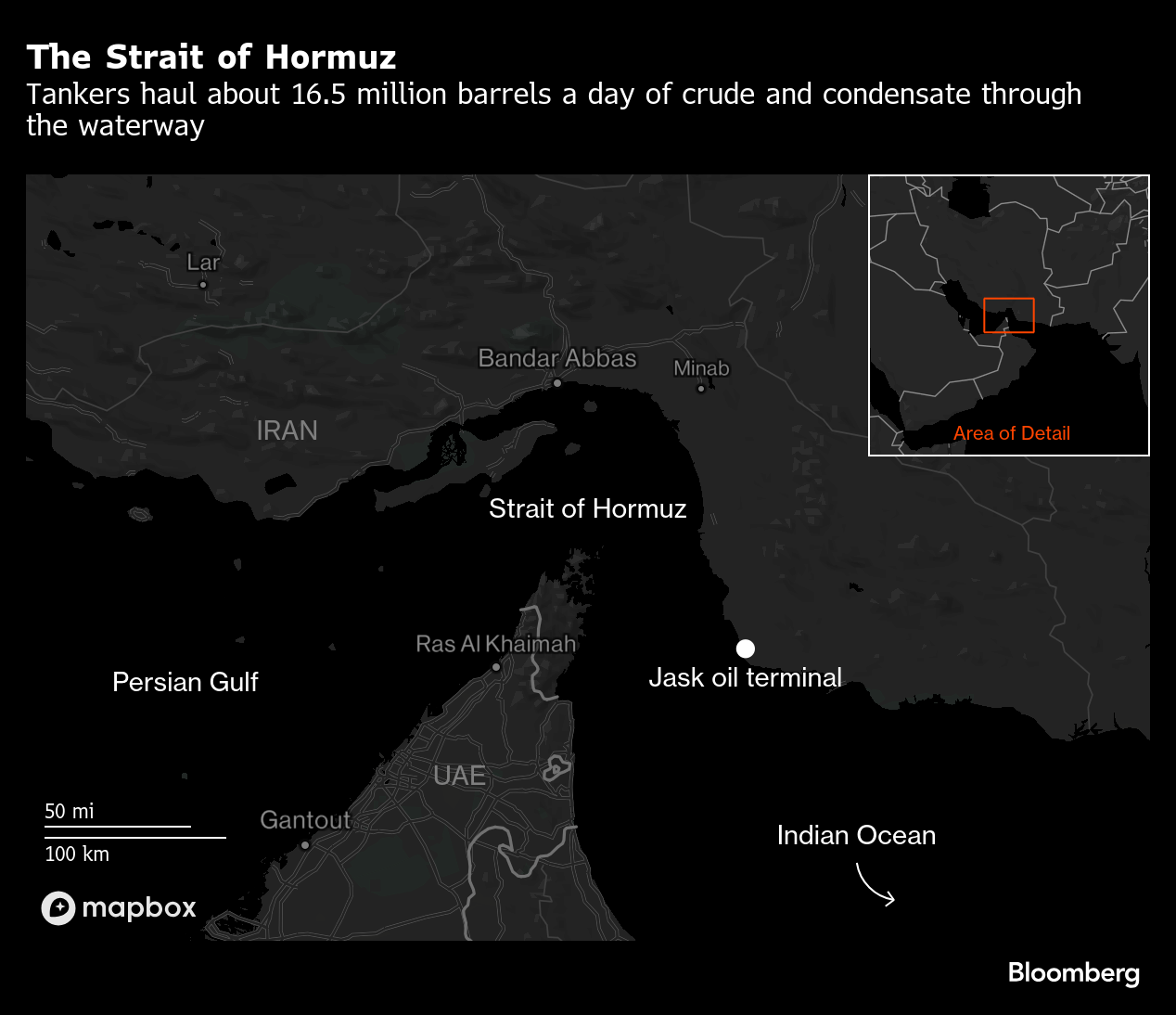

Oil prices advanced as much as 13% in the aftermath of the attack. JPMorgan has previously warned prices could spike to $130 a barrel in the “severe outcome” of a blockade to flows via the Strait of Hormuz or a broader conflagration in the Middle East.

“It comes really at an unfortunate time for the global economy given the already heightened uncertainty and chaotic nature we are dealing with coming out of the US protectionist stance,” Katrina Ell, Moody’s Analytics head of Asia Pacific economics, said on Bloomberg Television.

For the US, a substantial and sustained increase in oil prices would add to the inflationary impulse from President Donald Trump’s tariffs, Bloomberg Economics analysts Jennifer Welch, Adam Farrar and economist Tom Orlik wrote in a note.

“Coming hard on the heels of the post-pandemic surge in inflation, and with concern that inflation expectations are not firmly anchored, that would be difficult for Fed Chair Jerome Powell & Co. to look through,” they said.

In a separate note, Orlik and Chief US Economist Anna Wong ran the numbers on what a surge in the price of oil would mean for the US economy. They found a jump in the price of Brent to $100 a barrel would result in a 17% increase in all grades of gasoline prices in the US, corresponding to a rise to $4.2 a gallon from $3.25 a gallon. They estimate that would add 0.6 percentage point to headline CPI, boosting the year-over-year change to the CPI to 3.2% in June.

The Federal Reserve meets next week to set interest rates, as do monetary authorities in the UK, Sweden, Switzerland, and Japan.

Central banks will likely acknowledge the growing uncertainties but will be inclined to look through the impact of higher oil prices from today’s attack, said Diana Mousina, Sydney-based deputy chief economist at AMP Ltd.

“I don’t think that any oil price dislocation is going to change the trajectory for interest rates,” she said. “It’s just another layer of volatility in the market.”

In the event of a prolonged conflict, disruptions to shipping through the Strait of Hormuz would have a significant impact on the global liquefied natural gas market too. Qatar, which makes up around 20% of the global LNG trade, uses this route for exports and there’s no alternative passage. That would leave the global LNG market extremely tight, pushing European gas prices significantly higher, Bloomberg Economics noted.

“The risk of further escalation is elevated,” said Prashant Newnaha, APAC strategist at TD Securities. “Markets are likely to demand a higher geopolitical risk premium from here which should imply higher volatility, weaker equities and a firmer dollar.”

While investors may be concerned that supplies could be interrupted if hostilities escalate, OPEC+ members, including de facto group leader Saudi Arabia, still have abundant spare capacity that could be activated. In addition, the International Energy Agency may choose to coordinate the release of emergency stockpiles to try and calm prices.

Supply Shock

In the event of a prolonged price increase, the most vulnerable oil-importing emerging markets in Asia include India, the Philippines, Thailand and Vietnam given their large trade deficits relative to GDP. Japan, Italy, France, Germany and the UK are among those in advanced economies that run high trade shortfalls, according to a December 2024 report from S&P Global Ratings.

Central banks will likely treat the oil spike as a supply-side shock unless it becomes prolonged or starts affecting inflation expectations, according to Luci Ellis, chief economist at Westpac Banking Corp. who previously worked at the Reserve Bank of Australia. The strongest pass-through comes via inflation and business and consumer sentiment, rather than any direct hit to global growth given the relatively small size of both the Israeli and Iranian economies.

“Today’s strike highlights that geopolitical uncertainty remains high even though the worst-case scenarios for outcomes on tariffs have faded,” Ellis said. “Central banks are likely to want to wait and see how the latest events play out rather than draw hasty conclusions.”

©2025 Bloomberg L.P.