Middle East Oil Flows Jump as Hormuz Security Concerns Ease

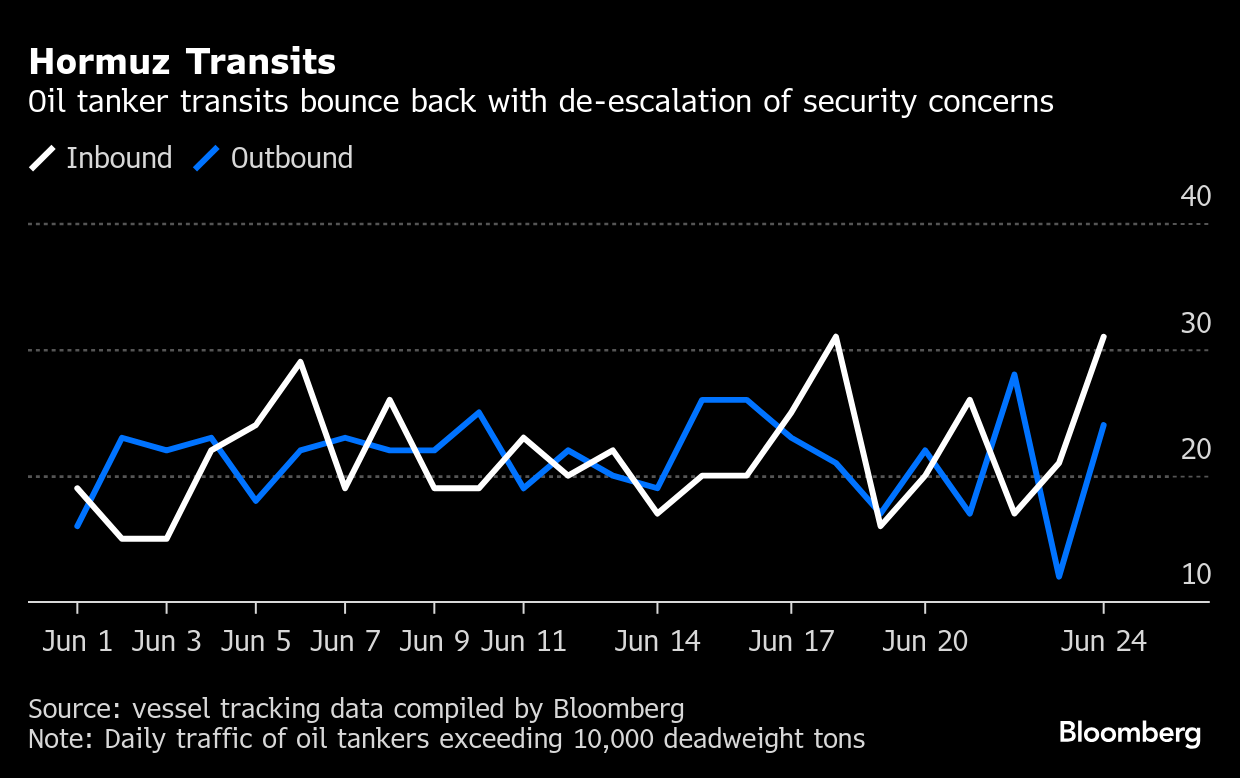

(Bloomberg) -- Oil tanker traffic through the Strait of Hormuz rebounded as concerns about security in the vital waterway eased following the US-brokered ceasefire between Iran and Israel.

The number of tankers leaving the Persian Gulf doubled on Tuesday compared with Monday, according to vessel tracking-data compiled by Bloomberg. Flows via the narrow strait between Iran and Oman — which handles more than a fifth of the world’s oil trade — had dropped after missile exchanges between Iran, Israel and the US.

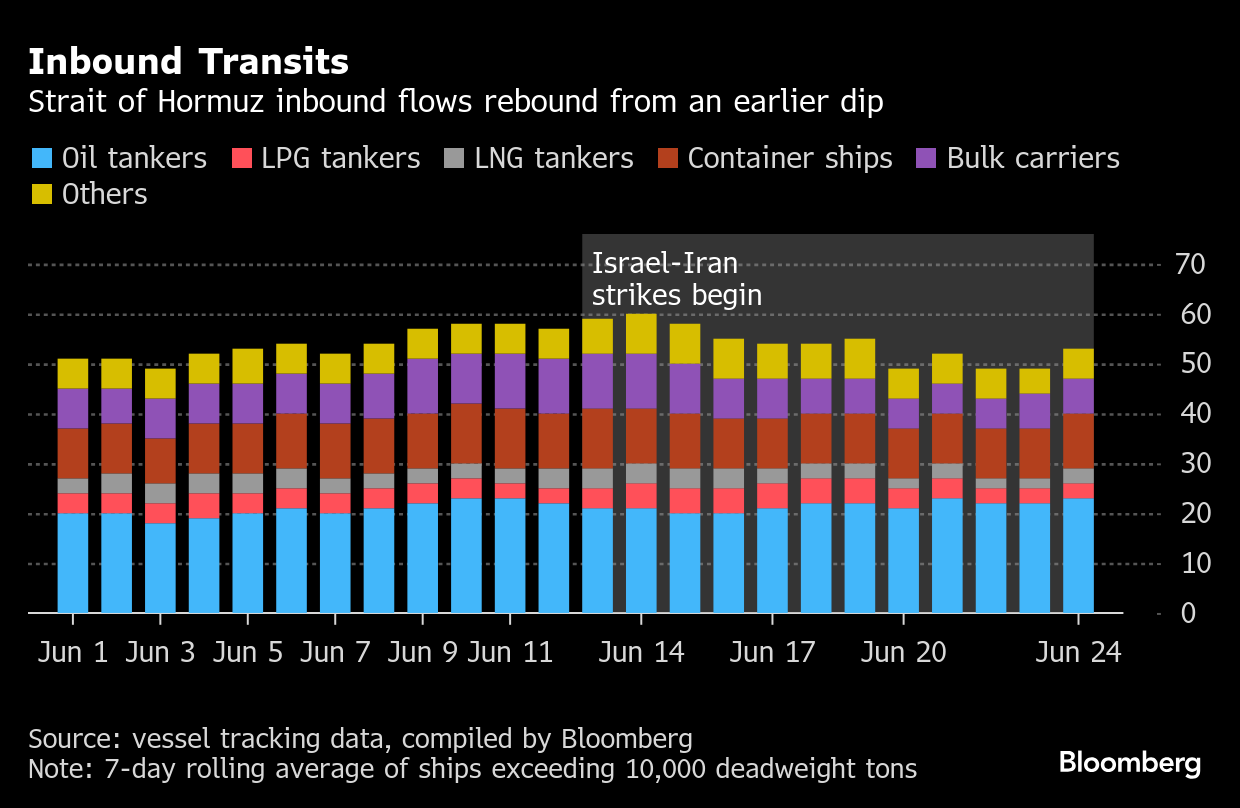

Inbound flows also rebounded, gaining by 48% from the previous day.

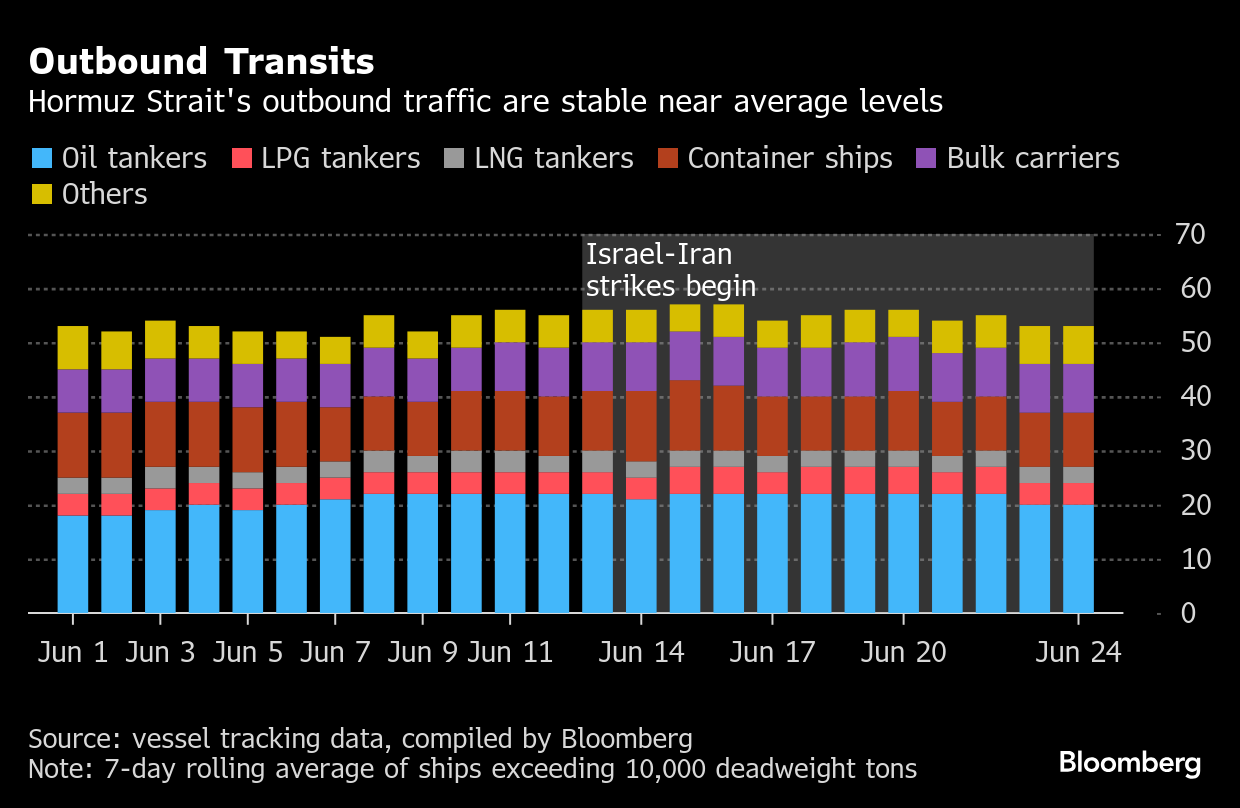

The seven-day rolling average of oil tankers departing the Persian Gulf was about 20, while inbound flows averaged 23. Transits by liquefied petroleum gas tankers and liquefied natural gas carriers also rebounded to about eight ships each on Tuesday.

While short-term data from Monday indicated reduced transits, commercial traffic through the strait on Tuesday totaled about 106 on a seven-day rolling average basis — consistent with the overall average for this month.

NOTE: Bloomberg News is discontinuing the publication of this story but will continue to monitor the flow of cargo.

For terminal-based data, which are derived from a smaller-Hormuz search area than the one applied to this story and therefore create slightly different outputs, click on:

DSET CHOKE 51O45GSYF1PD for crude oil tankers going east to west

DSET CHOKE 51O45DSYF1QL for crude oil tankers going west to east

DSET CHOKE 51O45DSYF1RL for oil products tankers going east to west

DSET CHOKE 51O45ESYF1S7 for oil products tankers going west to east

DSET CHOKE for all Bloomberg tracking through chokepoints

©2025 Bloomberg L.P.