Egypt Makes LNG Supply Deals With Aramco, Trafigura and Shell

(Bloomberg) -- Egypt agreed to buy liquefied natural gas over 2 1/2 years from suppliers including Saudi Aramco, Trafigura Group and Vitol Group, putting the country on course to be a long-term importer as local production slows.

Egyptian Natural Gas Holding Co. also struck agreements with Hartree Partners LP, BGN, Shell Plc and Azerbaijan’s Socar, according to people with knowledge of the matter. The deals will bring in as many as 290 cargoes over the period, starting next month, they said.

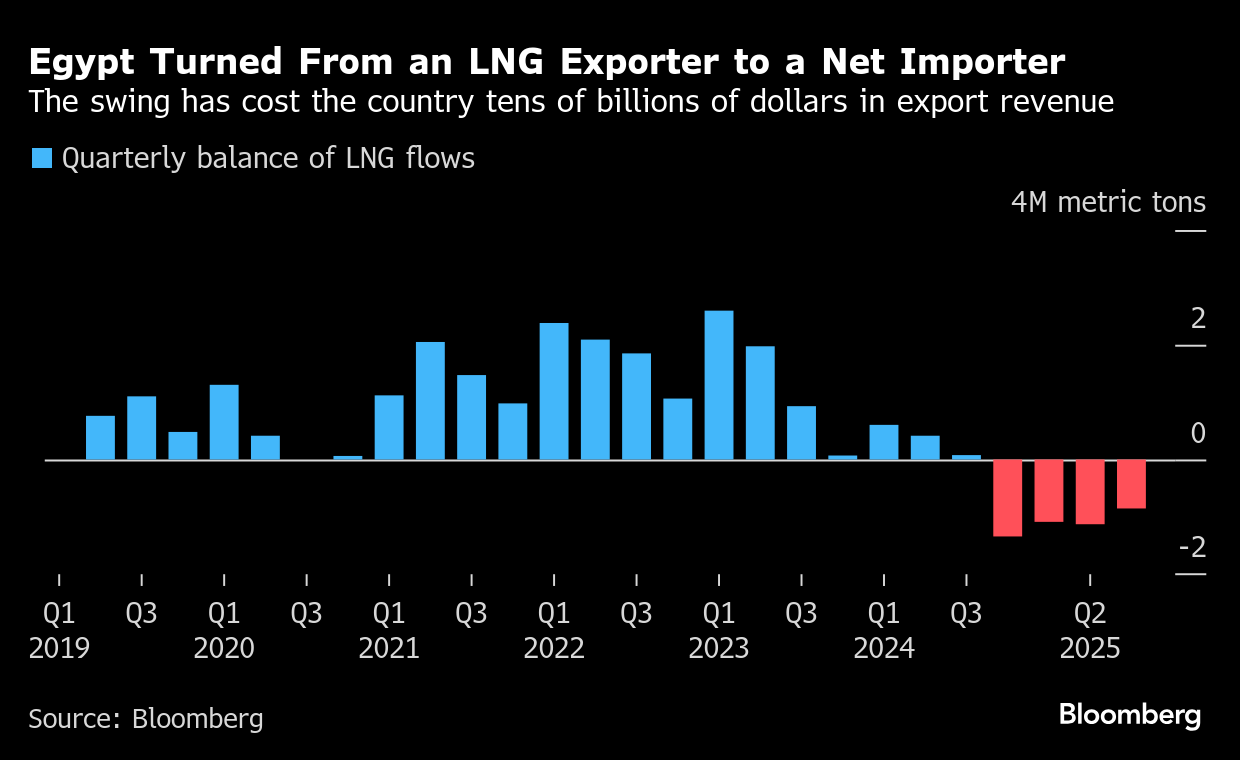

The move adds to import accords earlier this year and is aimed at cutting Egypt’s reliance on volatile spot markets. It’s a sharp turnaround for a country that until a year ago was exporting LNG. Declining gas output from domestic fields at a time of rising local demand has made Egypt a major importer and helped tighten global markets.

Hartree and BGN are expanding in an LNG market dominated by long-established traders. They were awarded more than 100 cargoes between them for 2 1/2 years, some of the people said, asking not to be identified discussing private information. Contract durations varied among the other supply agreements.

The cargoes are priced at a premium to the European gas benchmark of about 80 cents to 95 cents per million British thermal units, according to one person, who said payments can be deferred for as many as 180 days.

In total, EGAS received 14 offers to supply, ranging from 18 months to three years, Bloomberg reported last month. The eventual amount of LNG may still change as the shifting outlook for Egyptian demand could mean some future deliveries get rerouted, some of the people said.

Egypt is seeking to reboot its economy after emerging from a foreign-currency crisis. It has embarked on a plan to avoid the power shortages witnessed in previous summers when soaring demand led to nationwide blackouts. That includes adding several floating import units and a shift to medium-term LNG deals that will leave it less exposed to the volatility of the spot market.

Still, the increased consumption means Egypt’s summer energy bill is likely to rise to about $3 billion a month starting July, from about $2 billion last year, a person familiar with the matter said in May.

BGN, Hartree, Vitol and Trafigura declined to comment. The other awarded companies didn’t immediately respond to requests for comment.

(Updates number of cargoes in second paragraph, adds pricing in fifth.)

©2025 Bloomberg L.P.