Germany Hits Gas Storage Milestone After Sharp Price Drop

(Bloomberg) -- Traders have ramped up bookings at German natural gas storage sites, marking a sharp turnaround from earlier this year when the country exited winter with stockpiles at a three-year low and an unusual market structure made refills unprofitable.

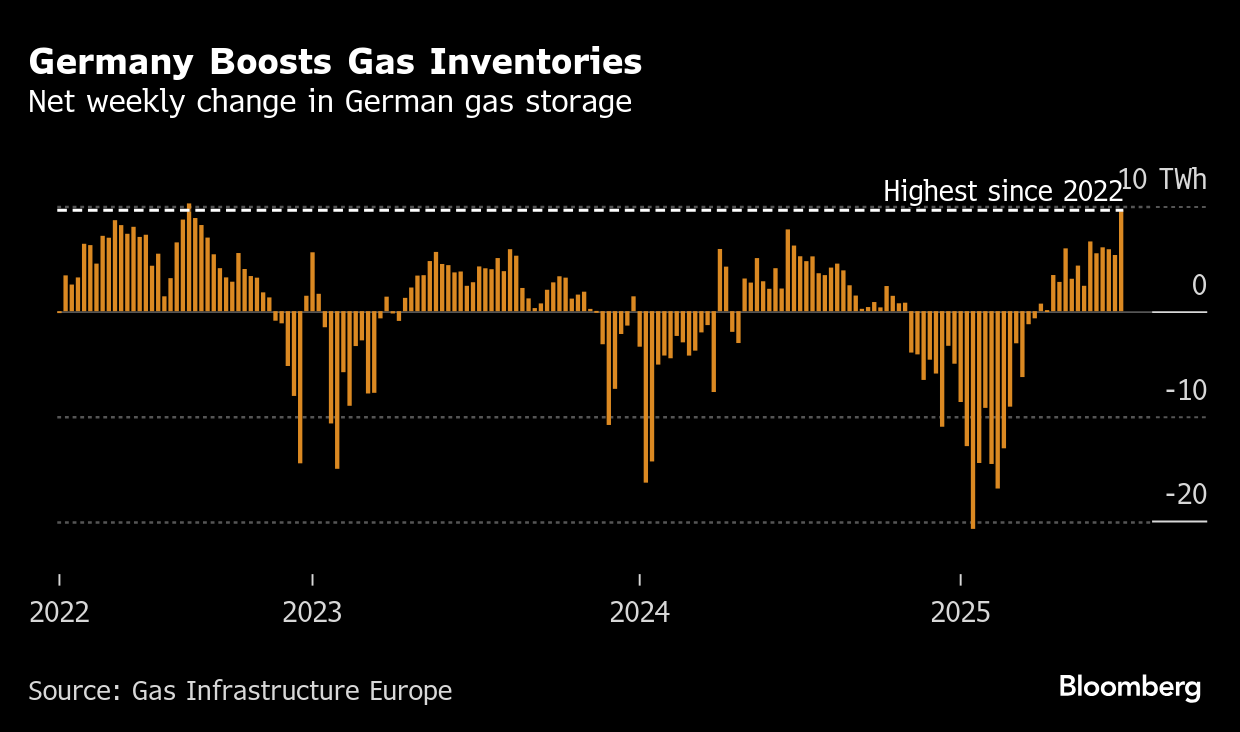

The nation’s available capacity in underground storage sites was more than 70% booked as of this week — marking an important threshold as it’s in line with Germany’s pre-winter storage-fill goal. A recent drop in summer gas prices helped make storing gas more profitable, and traders pumped nearly 10 terawatt-hours of the fuel into reserves last week — the biggest seven-day increase since 2022.

Ten traders, who spoke on condition of anonymity discussing trading strategies, see reduced risks for German stockpiling efforts, with six saying it’s likely German and European Union storage targets will be exceeded by Nov. 1.

The start of the year was marked by persistent worries about Germany’s gas inventories, with traders concerned at the time that the government may have to intervene in the market and cause substantial price disruptions, as was the case during Europe’s energy crisis. But summer gas prices plummeted in late June when Israel and Iran agreed to a ceasefire and have remained near their lowest levels this year, easing refilling efforts.

“People are more relaxed,” said Mirko Ivanda, co-head of power and gas at Onyx Commodities Switzerland AG, pointing to ample liquefied natural gas imports. Even if reserves end up remaining lower than in previous years, he doesn’t expect that to lead to a “catastrophe.”

Europe’s gas buffers — which have taken on a crucial role since Russia curbed pipeline flows in 2022 — were unusually depleted at the start of 2025 after a cold heating season with low wind generation. That raised concerns about a challenging stockpiling season ahead and potential price spikes during winter. Germany is still behind some of its neighbors in refilling storage sites, with France and Italy having measures in place to incentivize such efforts.

If Germany continues injections at the current pace, inventories will be 83% full by Nov. 1, according to estimates from BloombergNEF. Consultancy Energy Aspects Ltd. sees them around 80% to 85%. That’s up from a current level of 55% — with booked capacities yet to be filled.

A key factor that has changed is that summer gas prices widened their discount to winter contracts during the recent market slump. Europe’s benchmark futures for August delivery traded about €2.5 a megawatt-hour lower than February 2026 contracts by the end of last week — the widest spread this year.

It’s this price gap that normally makes stockpiling during summer interesting for traders. Most storage sites in Germany would likely be profitable with spreads of around €2 to €2.5, according to Erisa Pasko, a senior analyst at Energy Aspects.

German gas is also more expensive than the European benchmark, allowing the country to attract higher flows.

“The obvious expectation” is that more capacities will be reserved soon to accommodate further inventory injections, said Simone Turri, head of western European gas trading at Swiss energy trader MET Group. He still sees a chance that if Germany starts November with inventories below 80%, the upcoming winter “can be potentially bullish.”

The country’s largest site in Rehden remains stubbornly empty for now, but saw its biggest booking so far this year during an auction on Tuesday, before scheduling another one for the following day which saw no successful allocations.

While there are signs that stockpiling is getting easier, traders are likely to keep a close eye on developments amid summer heat wave risks and ongoing maintenance among top suppliers, such as Norway.

An early cold snap during the heating season could also spark jitters. Germany’s association of gas storage operators says a fill level of 70% wouldn’t be enough to ensure secure supply in very cold temperatures.

EWE AG — one of the country’s major operators — urged Berlin last week to keep the door open to intervening, despite signals from politicians that such a move is unlikely. The risk that inventories won’t be sufficiently filled is still “real,” EWE’s Chief Executive Officer Stefan Dohler said.

©2025 Bloomberg L.P.