China Shuns Costly LNG Imports Even as Summer Power Demand Rises

(Bloomberg) -- Sweltering temperatures are pushing up appetite for electricity in China — just not yet enough to revive the country’s spot purchases of costly liquefied natural gas.

Traders hoping for a recovery in spot LNG deals had been watching for a surge in summer demand along China’s eastern seaboard. Scorching heat has indeed created those spikes, except that cheap coal, higher-than-usual inventories of power-station fuels and a continued increase in renewable capacity have filled the gap and limited the risk of seasonal blackouts.

Ample supplies of piped natural gas — where prices are linked to oil, flagging under the weight of a supply glut — and sputtering industrial demand overall are also limiting the impact of a surge, the research arm of the ENN Group, one of China’s leading importers, said in a note.

China has already seen LNG imports falling steadily since the end of last year, as spot purchases became uneconomic for importers, denting the more optimistic consumption forecasts. Analysts at BloombergNEF estimate Chinese LNG imports at around 5.6 million tons in July, higher than last month but still lower year-on-year.

“We expect that China’s LNG imports will remain weak in the second half of the year, amid subdued demand, higher piped gas imports and an uncertain macroeconomic outlook,” said Gergely Molnar, a gas analyst at the International Energy Agency. Russian piped deliveries to China are expected to increase by around 25% in 2025, he added.

Imports are expected to decline less steeply than in the first half of the year, though, as the supply picture improves and storage is refilled ahead of the winter, Molnar said.

The growing frequency of extreme weather is making it tougher to predict the scale and duration of heat waves everywhere, and therefore the direct impact on power demand. High temperatures are coming earlier and can still occur late into the season.

While China’s summer temperatures have broken records, heavier-than-usual rains around the north, and the typhoon season should provide some relief to eastern cities, according to the China Meteorological Administration’s latest forecast for July.

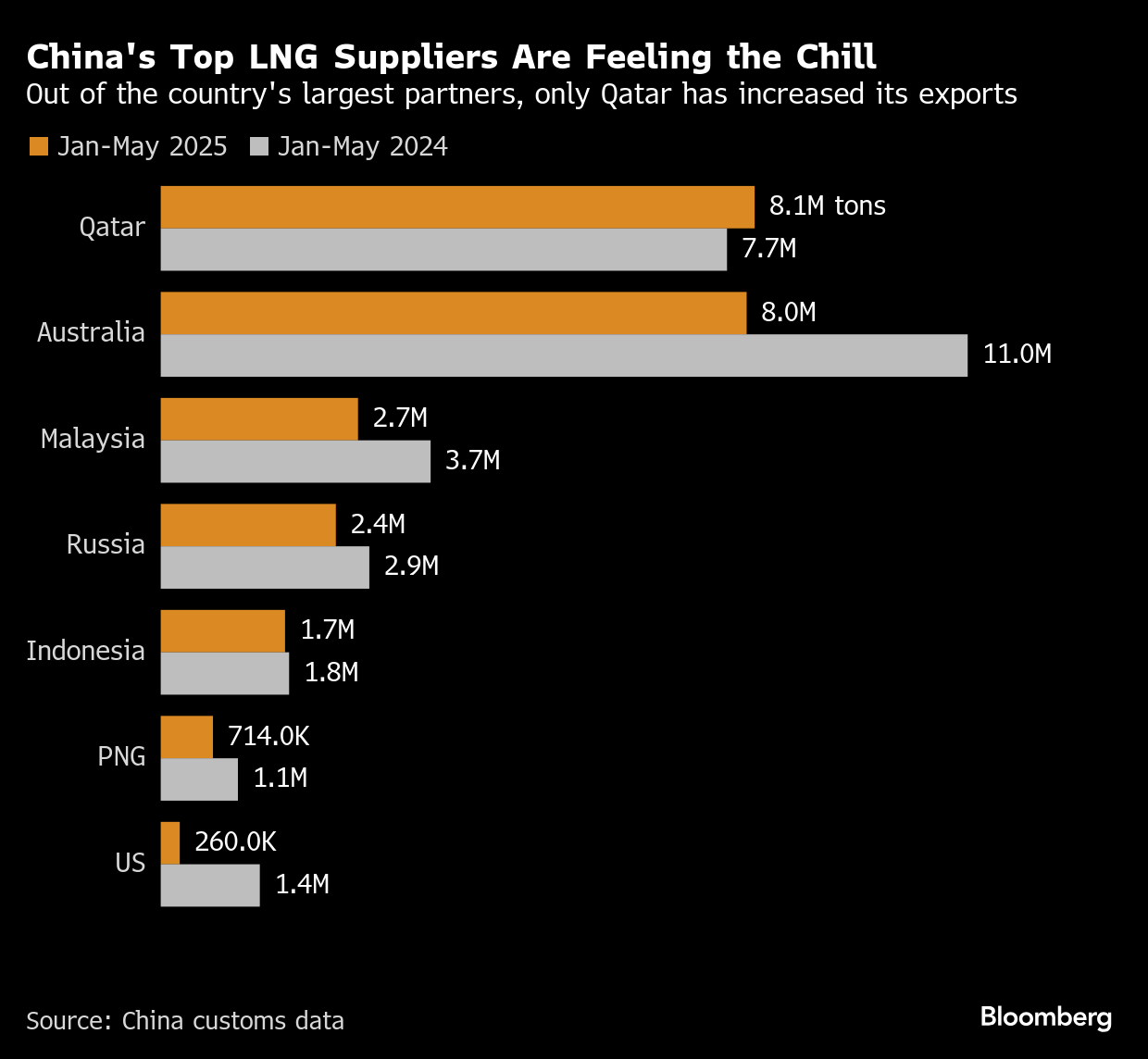

The other catch for the LNG trade is that China continues to diversify its energy purchases. That means changes in flows away from suppliers perceived to be less reliable — Chinese customs data show US purchases in the first five months of 2025 dropped more than 80% on the same period a year ago. Qatar ticked 5% higher.

But it also means developing other options. Beijing has recently built up a new cross-regional pipeline to increase imports from Central Asia. A connection to Russia’s Far East gas project for 10 billion cubic meters per year of imports is expected to be completed by the end of 2025.

On the wire

US Treasury Secretary Scott Bessent expects to meet with his Chinese counterpart in the coming weeks to advance discussions on trade and other issues between the world’s two largest economies.

The first cargo of copper has arrived at Hong Kong warehouses that will be officially added to the London Metal Exchange’s global storage network later this month.

China is considering doubling an investment channel local investors use to buy bonds overseas, according to people familiar with the matter, a major step in its efforts to loosen restrictions on financial flows.

This Week’s Diary

(All times Beijing)

Tuesday, July 8:

- Shanghai Platinum Week, day 2

Wednesday, July 9:

- China inflation data for June, 09:30

- China to release June aggregate finance & money supply data by July 15

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

- Shanghai Platinum Week, day 3

- Forum on aluminum packaging and new applications in Shanghai

Thursday, July 10:

- China aluminum fabrication forum in Shanghai

- Shanghai Platinum Week, day 4

- CSIA’s weekly solar wafer price assessment

Friday, July 11:

- Mysteel mid-year steel forum in Beijing, day 1

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, July 12:

- Mysteel mid-year steel forum in Beijing, day 2

©2025 Bloomberg L.P.