After Gasoline, China’s Oil Refiners Face a Jet Fuel Glut

(Bloomberg) -- China’s oil refiners are grappling with an oversupply of jet fuel, in yet another blow to the bottom line of a sector already dealing with ebbing demand for gasoline and diesel.

In the post-pandemic period, as flights returned to the skies, jet fuel was a boon for domestic refiners struggling with a sputtering economic recovery, the electrification of the car fleet and trucks turning to alternatives like liquefied natural gas. Refiners piled into aviation, using up feedstock that in the past would have gone into road-transport fuels.

Now, though, there may be too much of a good thing.

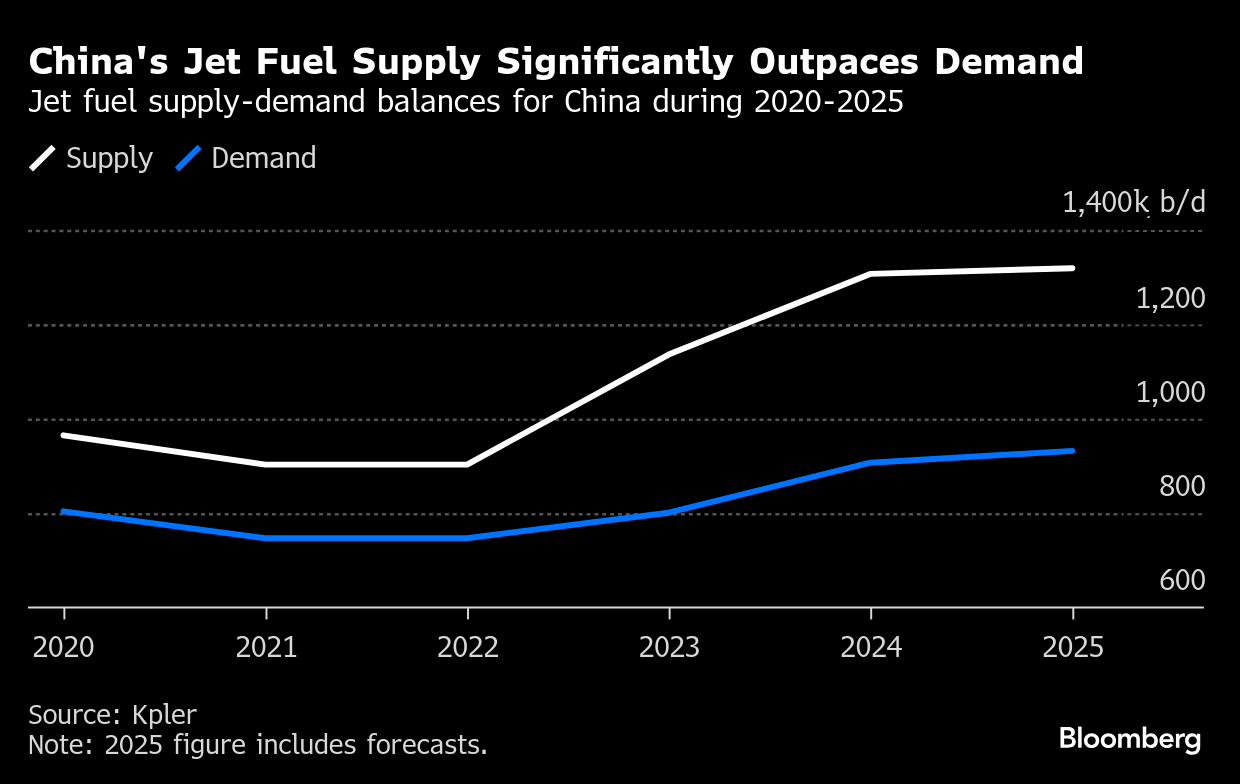

Supply this year is already running over 40% ahead of demand, according to data from analytics firm Kpler. In the long term, structural changes, like the build out of high-speed rail, stand to limit future growth.

“Jet was China‘s solution to demand destruction in gasoil and gasoline, but all it did was shift the problem elsewhere,” said Zameer Yusof, a middle distillates analyst at Kpler, who forecasts a surplus of 390,000 barrels per day in the country this year. “Chinese international travel looks weak, contributing to the glut we’re seeing.”

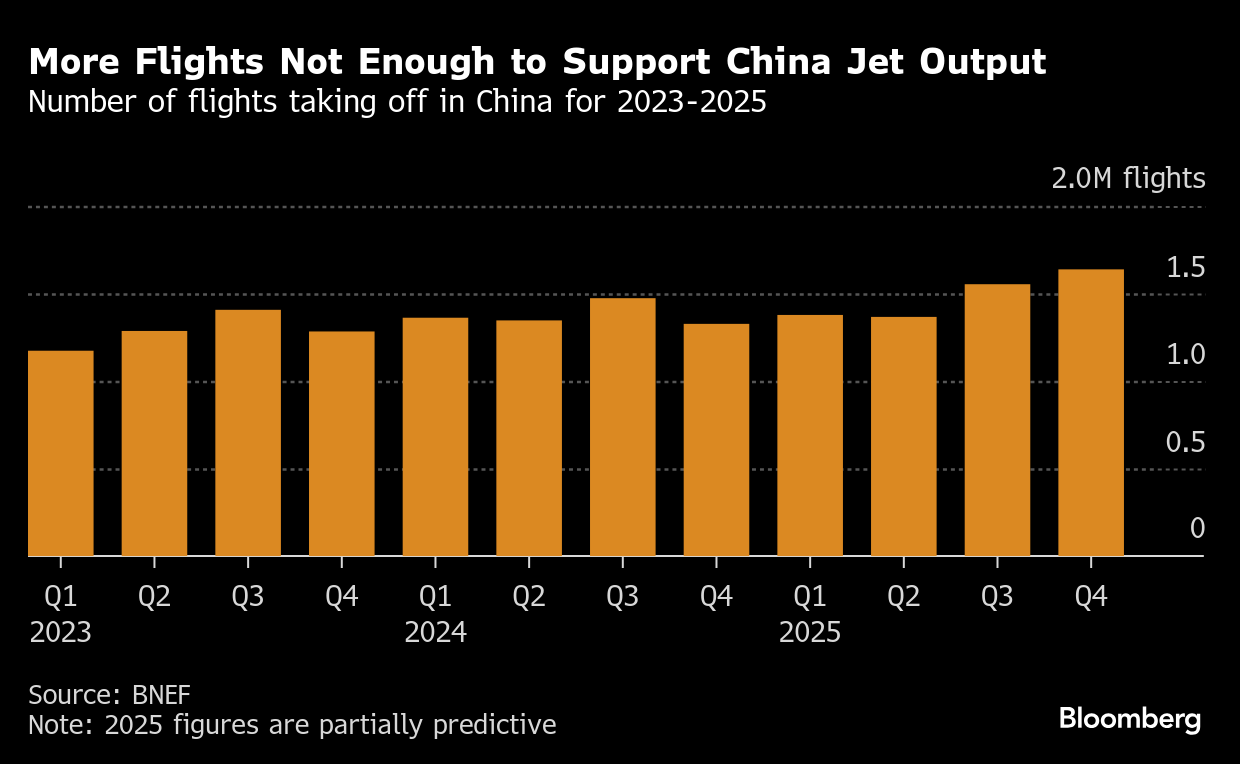

Granted, consumption is set to keep climbing in 2025 as more aircraft take flight and a larger proportion of the population travels — but it’s still short of the growth that the refining system needs to absorb the extra production.

A pivot toward domestic travel in recent years, at the expense of international routes, hasn’t helped, slowing the growth trajectory further. Other headwinds include an uncertain outlook for consumer spending, plus newer, more fuel-efficient aircraft and better management by airlines eager to trim the consumption necessary for each flight.

With “limited options for relief,” Chinese refinery margins will remain under pressure, Yusof said.

Export Trouble

As with much of China’s excess capacity, much of this may turn into a headache beyond its borders. Last month, Kpler forecast the nation’s June exports would reach a record 2.6 million tons, potentially displacing flows into the region from the Middle East and India.

China’s refineries have been struggling with paper-thin margins for years. China’s diesel demand likely peaked in 2019, while the nation’s electric-vehicle boom means gasoline consumption may have crested in 2023, the chairman of top refiner Sinopec Group said in March.

Beijing has urged a shift toward making more petrochemical products — including ethylene, a key building block for many plastics — but that has done little to ease the financial pain.

“There is already too much ethylene-producing capacity in China,” said Manish Sejwal, a natural gas liquids analyst at Rystad Energy. “This is all happening at a time when demand for ethylene remains clouded by a slowing global economy.”

The country plans to add 6 million tons of ethylene production capacity in 2025, and a further 20 million tons over the next three years, according to Rystad, taking total capacity to 70 million tons.

On the Wire

BRICS countries once again failed to make significant strides in the cross-border payments system for trade and investment they’ve been discussing for a decade.

Xiaomi Corp. is succeeding where Apple Inc. failed, burnishing founder and chairman Lei Jun’s reputation, making his company one of the most valuable in China and shakingg up both the tech and automobile industries.

China will impose some reciprocal curbs on medical-device procurement for companies based in the European Union, adding tensions between the two major trading partners just as Beijing seeks to shore up ties while it fights a trade war with the US.

This Week’s Diary

(All times Beijing)

Monday, July 7:

- China foreign reserves for June, including gold

- Shanghai Platinum Week, day 1

Tuesday, July 8:

- Shanghai Platinum Week, day 2

Wednesday, July 9:

- China inflation data for June, 09:30

- China to release June aggregate finance & money supply data by July 15

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

- Shanghai Platinum Week, day 3

- Forum on aluminum packaging and new applications in Shanghai

Thursday, July 10:

- China aluminum fabrication forum in Shanghai

- Shanghai Platinum Week, day 4

- CSIA’s weekly solar wafer price assessment

Friday, July 11:

- Mysteel mid-year steel forum in Beijing, day 1

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, July 12:

- Mysteel mid-year steel forum in Beijing, day 2

©2025 Bloomberg L.P.