Pressure Mounts to Fix Key US Grid as Costs Hit New Highs

(Bloomberg) -- Calls are mounting for the largest US grid operator to make electricity more affordable after power costs again surged to a new high.

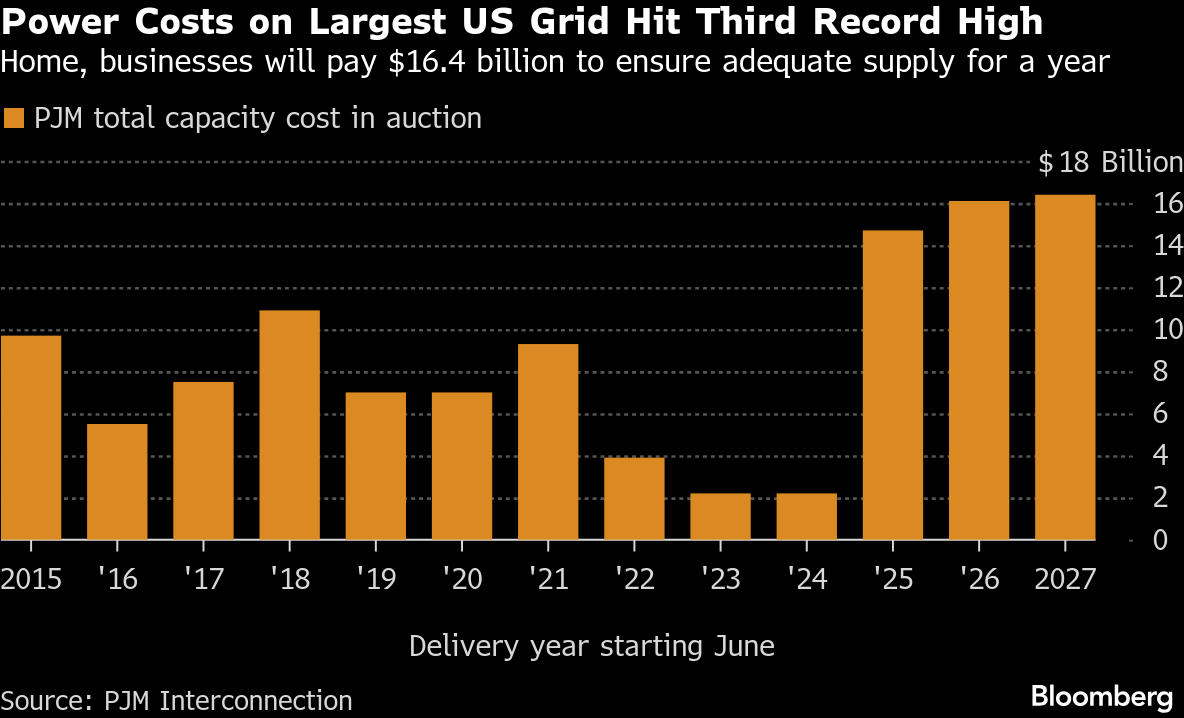

Households and businesses from New Jersey to Chicago will pay a record of $16.4 billion to secure electricity starting in the year starting June 2027, according to PJM Interconnection LLC, which operates the 13-state grid that serves nearly one-fifth of Americans. That fee will come on top of what consumers pay for the power they actually use, plus other line items on their bills such as charges for maintaining and expanding the power lines.

PJM’s so-called capacity auction determines how much generators will get paid for being available to the grid. The results released Wednesday show the daily cost of those payouts rose to $333.44 per megawatt from $329.17, which will show up in users’ monthly utility bills. Prices were as low as $29 a megawatt in 2023.

“The amount of pressure on PJM is enormous,” said Daniel Palken, director of infrastructure for energy and permitting at philanthropy Arnold Ventures. “The people’s hackles are up.”

It’s the third consecutive record-breaking auction held by PJM, a process that has emerged as a focus of the national debate on affordability. Democrats campaigning on lower energy prices won victories in Virginia and New Jersey — two states within the grid’s territory. Meanwhile, governors across the region have called on PJM to make changes to lower the cost of electricity amid a massive build-out of AI data centers that has fueled record demand and prices.

The biggest beneficiaries of the auction will be independent power generators. Vistra Corp., which rose as much as 2.7% in early trading Thursday, earned $1.29 billion in the auction. Talen Energy Corp. cleared $1.07 billion and saw shares jump 5.6%. Constellation Energy Corp. earned $2.19 billion, with shares up 2.7%.

“This auction remains a wealth transfer from our struggling rate-payers to incumbent generators who would continue operating regardless of the auction prices,” Maryland lawmaker Lorig Charkoudian said in an email. “I’m angry. it didn’t have to be this way.”

Constellation is responding to high prices by investing billions in adding capacity, spokesman Paul Adams said in an email. The firm has also proposed adding 5,800 megawatts of supplies, including storage, in Maryland and increasing output from its existing nuclear fleet by about 1,000 megawatts.

“The increased demand necessitated by America’s national security imperative of winning the AI race is challenging PJM’s system reserve requirement in this most recent auction,” Adams said.

Vistra and Talen didn’t immediately respond to requests for comment.

While capacity is just one component of total electricity costs to consumers, it’s among the fastest growing due to the AI boom. Data center electricity consumption accounted for 45% of the price tag in the last auction, according to Monitoring Analytics LLC, PJM’s official independent watchdog. And in the latest auction, it comprised the majority of new demand, Stu Bresler, PJM’s executive vice president of market services and strategy, said on a call with reporters Wednesday.

“The energy market is not capable of meeting unlimited growth in a short amount of time without having massive price increases accompany that,” said Ben Inskeep, program director of Citizens Action Coalition, a consumer and environmental advocacy in Indiana.

In spite of the skyrocketing costs, the auction for a second year didn’t manage to secure enough supply to meet projected demand. While the grid needs a 20% reserve margin to ensure reliability, the auction only cleared 14.8%.

That means the grid will be 6.6 gigawatts short — the equivalent of six big nuclear reactors — versus about 200 megawatts in the previous auction. PJM will need to procure more supplies through incremental follow-up auctions, Bresler said.

Costs would be even higher if not for a price cap negotiated last year. But PJM hasn’t decided whether to extend that price ceiling to further auctions. With Wednesday’s results hitting the limit, the grid operator will be more likely to move forward with an extension, according to ClearView Energy Partners.

“I think this price cap is in place indefinitely for the time being,” said Jefferies analyst Julien Dumoulin-Smith.

Preserving the cap is controversial, though. While it would limit consumer costs, developers argue it would prevent them from covering their own soaring costs with energy-hungry data centers spreading across PJM’s territory. While six governors have asked for an extension, Citigroup analyst Ryan Levine said it’s unlikely.

Pennsylvania consumers will pay about $126 for the 12-month period starting June 2027, according to a statement. In the next auction, the price cap — typically based on the cost of building new gas plants — is set to more than double to $776, but PJM is seeking approval from the Federal Energy Regulatory Commission to adjust how it prices supplies, which could cut that cap to about $550. Either option points to much higher capacity cost given the projected demand from data centers.

PJM’s board is working on a proposal to integrate data centers to help them connect to the grid faster and potentially mitigate the impact on consumers. A dozen proposals failed to pass last month. FERC could provide guidance as early as Thursday on how to divvy up transmission charges for certain data center projects co-located with power plants.

The tech giants building those facilities – Amazon.com Inc., Alphabet Inc.’s Google and Microsoft Corp. – will closely be watched to see if they step up to help alleviate that pressure.

In the meantime, the impact of the rising auction prices will be felt most in states like New Jersey and Maryland where utilities rely heavily on the capacity market, said Mark Christie, former Federal Energy Regulatory Commission chairman. But even Virginia, which can pay for power plants through utility rates, is seeing its own “generation deficit grow rapidly” as data center growth accelerates there, he said.

Data centers are also adding costs to the high-voltage transmission system that moves the electrons to consumers. PJM is in the processing of finalizing an $11.6 billion plan to build out the wires, substations and other related infrastructure largely to meet soaring demand from data centers, which would be paid for by consumers.

“PJM needs real reform and they are running out of time to protect consumers from their inaction,” Pennsylvania Governor Josh Shapiro said in a statement after the auction.

(Story updates with shares in sixth paragraph.)

©2025 Bloomberg L.P.