Europe Gas Heads for Sharp Annual Drop as LNG Surge Calms Market

(Bloomberg) -- European natural gas prices are heading for a sharp annual drop despite unusually low inventories, a sign of how dramatically the market has changed since the energy crisis as a wave of LNG reshapes supply expectations.

Prices are on track to finish 2025 at roughly half the levels reached earlier this year, reversing concerns that Europe could face a tight winter with reserves well below recent norms. Instead of focusing on thinner buffers, traders have taken comfort in the sheer volume of gas available on the global market.

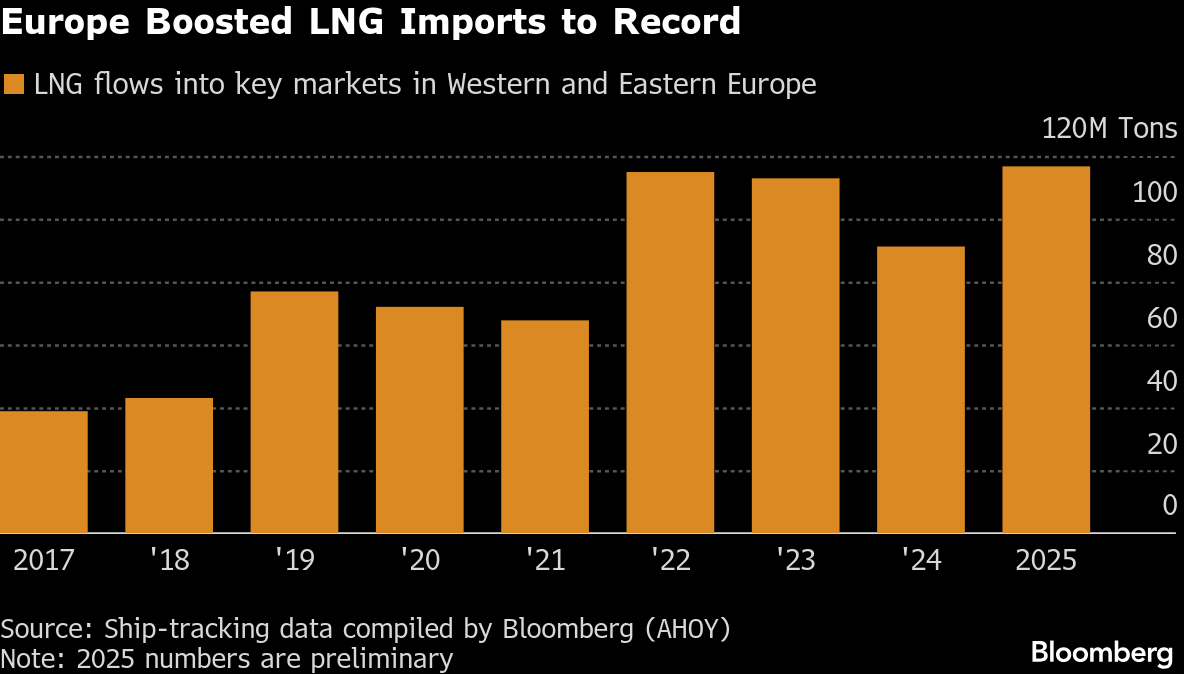

The shift reflects how Europe’s energy safety net has evolved since the crisis triggered by Russia’s full-scale invasion of Ukraine. Pipeline flows that once anchored the market gave way to an intense focus on building up stockpiles, but this year attention has increasingly turned to seaborne supplies. Europe’s liquefied natural gas imports are expected to have hit a record in 2025, according to the International Energy Agency.

As a result, storage levels — currently around 63%, compared with a five-year seasonal average of about 74% — have done little to unnerve the market this winter. Steady flows from the US and elsewhere are giving buyers flexibility that has barely existed in recent years, and a relatively mild start to the heating season and reliable pipeline supplies from Norway have further eased pressure.

The relaxation in energy markets is likely to be a welcome salve for an economy that has been battered by setbacks, though it may be coming too late. Years of elevated costs have hollowed out parts of Europe’s industrial core, and cheaper energy alone is unlikely to help shuttered factories reopen or solve the numerous challenges facing surviving businesses.

The shift to LNG also leaves Europe more exposed to global geopolitical events and production issues across the globe. In the European Union, LNG accounted for 45% of gas imports at the start of this year, compared with about 20% before the war.

Still, looking ahead, the supply picture points to even looser conditions. A wave of new LNG export capacity is due to come online globally over the next few years, raising the prospect of a prolonged glut that could allow Europe to secure cargoes even in periods of higher demand.

- Weather: Some forecasts turned cooler for mid-January, with a Bloomberg model showing below-normal temperatures persisting across northwest Europe.

- Outages: Power issues still impacting flows from Norway’s Troll field

- Prices: Dutch gas for February delivery, Europe’s gas benchmark, was up at € a megawatt-hour by 11:09 a.m. in Amsterdam, sticking near its recent band. Prices are set to end the year more than 40% lower.

©2025 Bloomberg L.P.