Barclays and UBS See Start to Colombia Rate Hikes

(Bloomberg) -- Economists are split over whether Colombia will raise interest rates on Friday for the first time since 2023, as out-of-control government borrowing stokes inflationary pressure.

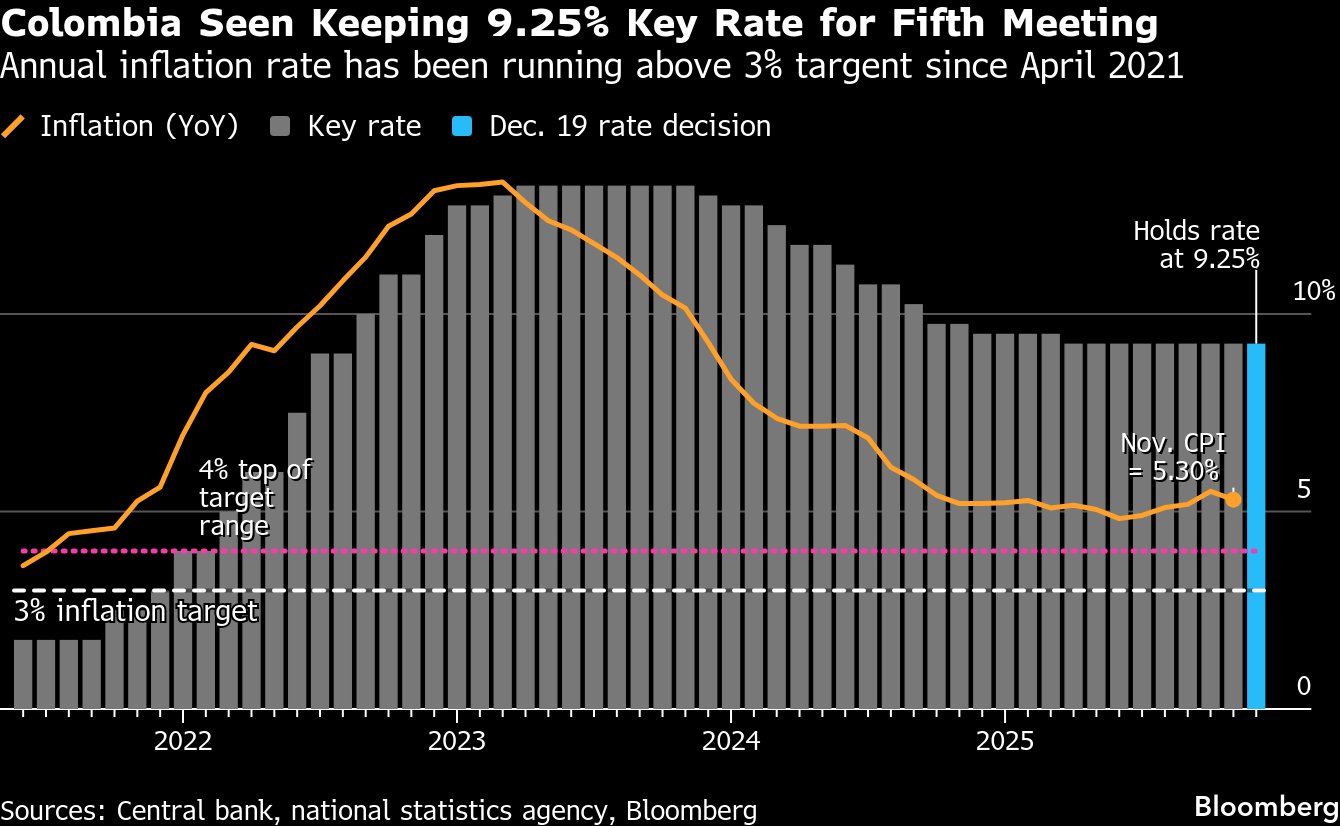

A majority of analysts — 25 of 29 — predict that the central bank will hold its benchmark rate at 9.25%, while a minority, including Barclays and UBS, forecast an earlier-than-expected start to monetary tightening.

Central bank Governor Leonardo Villar warned last month that higher interest rates may at some point be warranted to rein in inflation pressure. A large increase in the fiscal deficit, strong internal demand growth and last year’s “enormous” increase in the minimum wage all contributed to preventing inflation from slowing toward its target this year, Villar said.

Central bank co-director Mauricio Villamizar said that policymakers are monitoring a series of potential inflation risks, including a large increase in the minimum wage for 2026, a reversal of the peso’s recent strength, a jump in natural gas prices, and a further widening of the fiscal deficit. If two or more of these were to materialize simultaneously, the bank might be forced to act, he said.

Fitch Ratings downgraded Colombia one notch deeper into junk on Tuesday, citing persistently large budget deficits. Congress last week rejected a tax bill that sought to raise 16 trillion pesos ($4.2 billion) in revenue for next year.

At the same time, some board members, including Finance Minister Germán Ávila, have continued to argue for interest rate cuts at recent meetings, to boost economic growth.

Annual inflation slowed more than expected, to 5.3%, in November. Economists surveyed by the central bank now estimate that inflation will end 2026 at 4.59%, up from a previous forecast of 4.4%, in which case it would have overshot its target for a sixth consecutive year. The bank seeks annual consumer price rises of 3%, plus or minus one percentage point.

President Gustavo Petro has repeatedly urged the board to lower interest rates, arguing that the economy requires additional stimulus. Market pricing, however, points in the opposite direction as traders in the interest-rate swap market expect the policy rate to rise to around 11% within the next year.

What Bloomberg Economics says

Colombia’s central bank is expected to hold the policy rate at 9.25% for a fifth straight meeting on Dec. 19, with another split decision likely as some board members continue to argue for a cut. Forward guidance may turn more cautious, underscoring a widening divide within the board as several policymakers grow increasingly vocal about inflation risks that could ultimately warrant rate hikes.

— Felipe Hernández, Latin America economist

Click here for the full note

Attention is now in the 2026 minimum wage decision. Labor unions are pushing for a 16% increase, while employers have proposed 7.2%. With negotiations having passed their deadline, the final decision is likely to fall to the government via decree. Labor Minister Antonio Sanguino has said Colombians can expect a generous “Christmas gift” in the form of a hefty increase.

©2025 Bloomberg L.P.