European Gas Extends Slide on News of US-Russia Truce Plan

(Bloomberg) -- European natural gas extended its slide after Bloomberg reported that US and Russia are drafting a deal to halt the war in Ukraine, easing worries about the threat of further sanctions on Moscow and its energy trade.

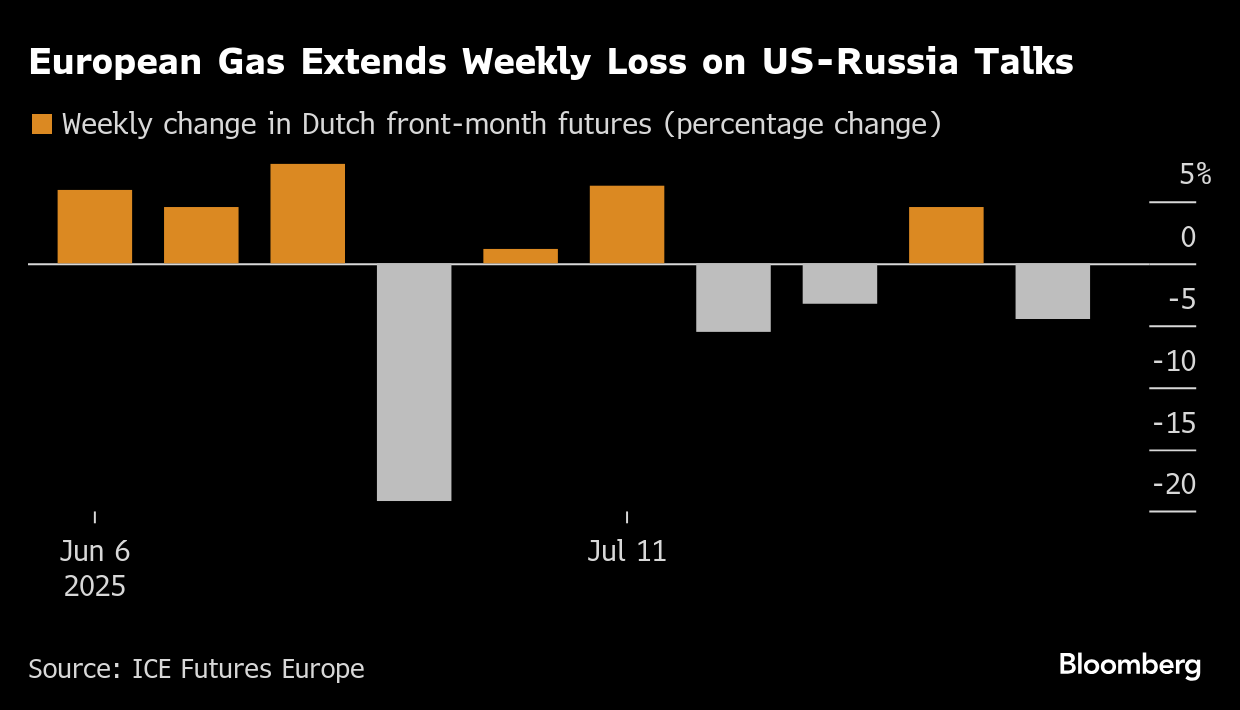

Benchmark futures settled 1.5% lower, erasing an earlier gain, and ended the week with a 4.5% loss.

Washington and Moscow are working toward an agreement that would lock in Russia’s occupation of territory seized during its military invasion, for a planned meeting between Presidents Donald Trump and Vladimir Putin as early as next week, according to people familiar with the matter. The deal is far from certain and the US is still working to get buy-in from Ukraine and its European allies, they said.

Traders are closely watching Trump’s recent attempts to establish a ceasefire in Ukraine — something he has pledged do to since returning to the White House. While a truce wouldn’t necessarily lead to any imminent return of Russian gas flows to Europe, it’s seen as reducing risks to global energy flows, with Trump recently threatening to impose penalties on India over its purchases of Russian oil. Europe sources gas from a number of global suppliers and competes with other countries for flows.

For now, the continent has attracted enough gas to progress with stockpiling the vital fuel for the next winter, even though the recent drop in prices appears to have led to several cargo diversions.

Yet, the market is expected to tighten soon as higher temperatures could drive cooling demand. In addition, Electricite de France SA said Friday it may be forced to curb nuclear output next week due to high river temperatures, which caused a brief uptick in gas prices.

“Geopolitics will overshadow fundamental data in the next few days,” said Florence Schmit, an energy strategist at Rabobank in London. But higher fuel usage from the power sector could provide “some baseline support to prices.”

Dutch front-month futures, Europe’s gas benchmark, closed down at € a megawatt-hour, the lowest in two weeks.

©2025 Bloomberg L.P.