Chinese Thermal Coal Hits 5-Month High on Heat and Disruptions

(Bloomberg) -- Power plant coal prices in China have risen to the highest level since March, as downpours in mining areas disrupt output and scorching heat in cities boosts cooling demand for the fuel.

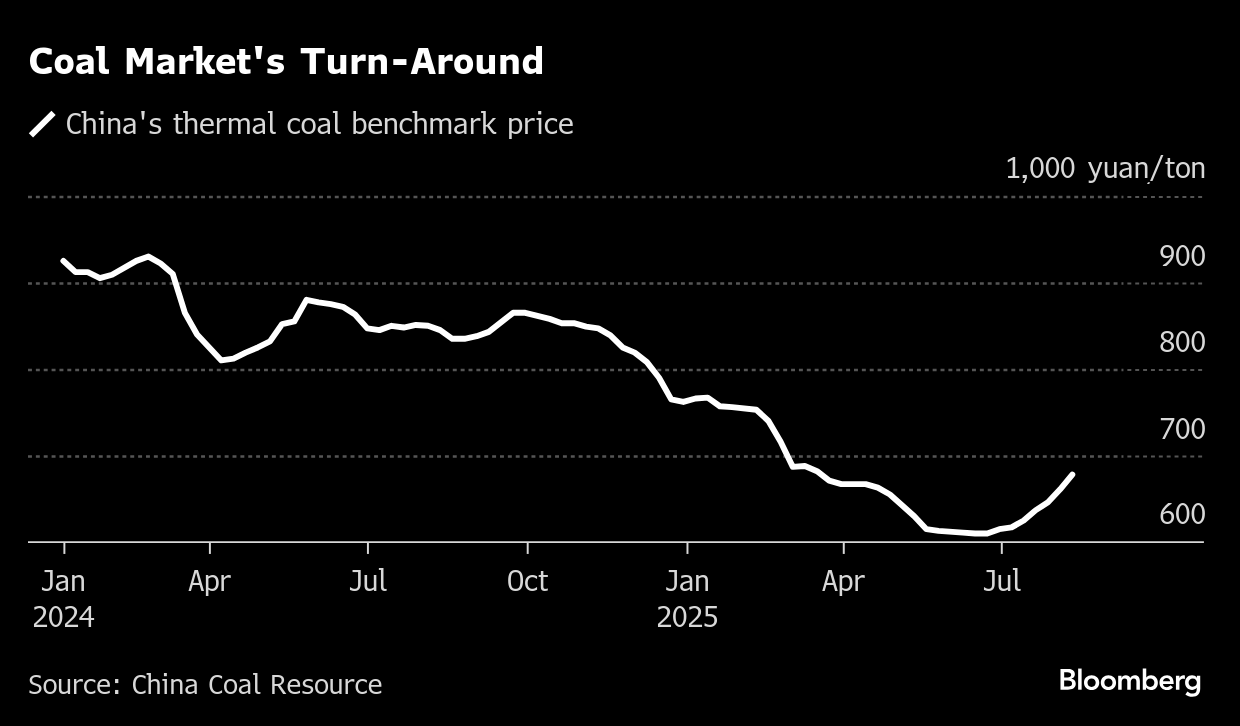

Spot prices in Qinhuangdao, the country’s benchmark, rose to 678 yuan ($94) a ton this week, the highest since March 17, according to China Coal Resource. Prices are up 11% since their four-year trough in June, which was hit after record output in the first half of the year lifted inventories, and the expanded use of renewables caused generators to burn less coal.

The market’s gains follow heavy rains and inspections targeting excess production in mining regions, which have suppressed output. Meanwhile, power demand has soared as people crank up the air conditioning. Thermal coal consumption across 25 provinces rose to the highest in at least five years on Aug. 6, Morgan Stanley analysts including Hannah Yang said in a research note on Monday.

But the turnaround could be brief. “We expect the coal price to continue this upward trend in the near-term but likely start to correct in late August,” Yang said.

Still, the seasonal boost to prices may be helpful for the government, which is seeking to curb deflationary pressures in the economy. Once temperatures start to cool, though, coal demand is likely to come under pressure again after record wind and solar installations in the first half.

Focus will then turn to whether Beijing has the appetite for stricter supply-side reforms, such as capacity cuts for state-owned firms and tougher enforcement of environmental, labor and quality standards in private industry. In that vein, the National Mine Safety Administration will conduct a briefing later Wednesday to discuss revisions to coal mine safety regulations.

On the Wire

China will implement more levies on Canadian rapeseed after an anti-dumping probe, escalating a trade spat that’s disrupted crop flows.

Chinese refiners are asking for less oil from Saudi Arabia, with the drop possibly pointing to a reshuffle of global flows as more Russian crude becomes available. A cargo of Indian diesel is heading to China, in what would be first such shipment since 2021.

India’s cabinet has approved the construction of a 700-megawatt hydropower plant in the northeastern state of Arunachal Pradesh, a region also claimed by China.

CK Infrastructure Holdings Ltd. has pulled out of the bidding for a UK liquefied natural gas terminal valued at about £2 billion.

Adverse weather from heat waves to excessive rains have disrupted crop growth in key production regions in China, the country’s agriculture ministry said.

This Week’s Diary

(All times Beijing)

Wednesday, Aug. 13

- MMG earnings call, 09:00

- National Mine Safety Administration briefing in Beijing on revisions to coal mining regulations, 10:00

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

- China to release July aggregate finance & money supply data by Aug. 15

- China Petroleum and Chemical Industry Federation forum in Nantong, Jiangsu, day 2

- EARNINGS: Power Assets. CK Infrastructure

Thursday, Aug. 14

- CSIA’s weekly solar wafer price assessment

- China Petroleum and Chemical Industry Federation forum in Nantong, Jiangsu, day 3

Friday, Aug. 15

- China home prices for July, 09:30

- China industrial output for July, including steel & aluminum; coal, gas & power generation; and crude oil & refining, 10:00

- Retail sales, fixed assets investment, property investment, residential sales, jobless rate

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Hongqiao

©2025 Bloomberg L.P.