European Gas Gains as Approaching Cold Snap Tests Winter Supply

(Bloomberg) -- European natural gas prices rose as colder weather was forecast for the end of next week, testing the region’s readiness for winter.

Benchmark futures gained 4.1% Friday, rebounding after a dramatic slide a day earlier. Bloomberg reported Thursday that Kyiv was in talks about supplying Azeri gas to Europe as a transit deal with Moscow nears expiry. Still, uncertainty persists over whether an agreement can be reached.

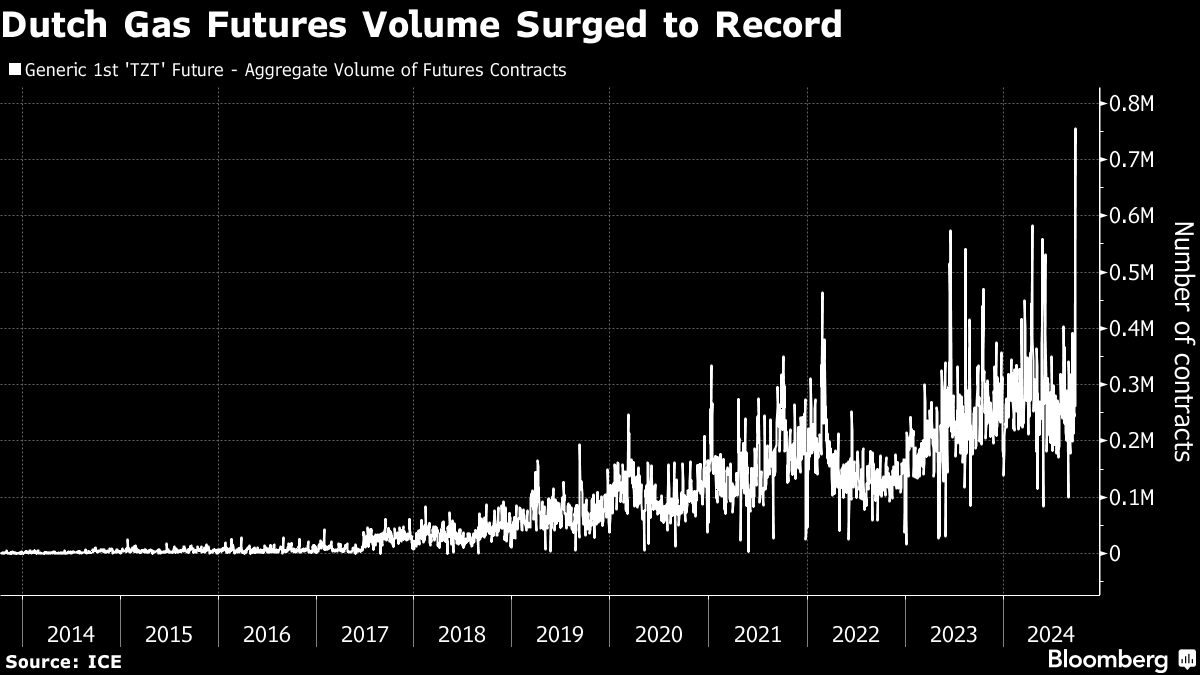

The developments around the future of Russian gas transit have been one of the main sources of price volatility this year. The aggregated volume of Dutch gas futures contracts reached the highest since at least the end of 2013 on Thursday.

A handful of European countries such as Slovakia and Austria continue to receive Russian gas via Ukraine. While an end to the transit accord in its current form is almost inevitable, the region’s stockpiles are brimming and efforts to source alternative supplies continue, including from Azerbaijan.

Prices “are likely to take direction from developments surrounding the potential transit agreement between Ukraine and Azerbaijan,” consulting firm Inspired Plc said in a note. “If an agreement is reached, markets could be exposed to more downside, though it may be limited by markets already dropping.”

Europe also receives deliveries of liquefied natural gas from around the world, but faces stiff competition for cargoes with Asia. The continent needs to attract 54% of the global flexible LNG supply pool this winter, down from 56% last winter, BloombergNEF said this week.

“In the event of an extremely cold winter for both north Asia and northwest Europe, Europe is likely to fully deplete its storage and would need to fiercely compete for spot LNG,” BloombergNEF analyst Lujia Cao said in a report.

At average temperatures, Europe will exit the winter with storage still 40% full, above the five-year average, BNEF said in a separate report this week.

Dutch front-month futures settled at € a megawatt-hour. Prices still posted a third weekly decline amid mounting confidence that Europe will have sufficient winter supplies.

©2024 Bloomberg L.P.