Red Sea Disruptions Are Splitting Global LNG Trade Into Regions

(Bloomberg) -- It’s been four months since a liquefied natural gas tanker has passed through the narrow strait separating the Arabian Peninsula and Africa, testament to how violent attacks there have upended global energy trade.

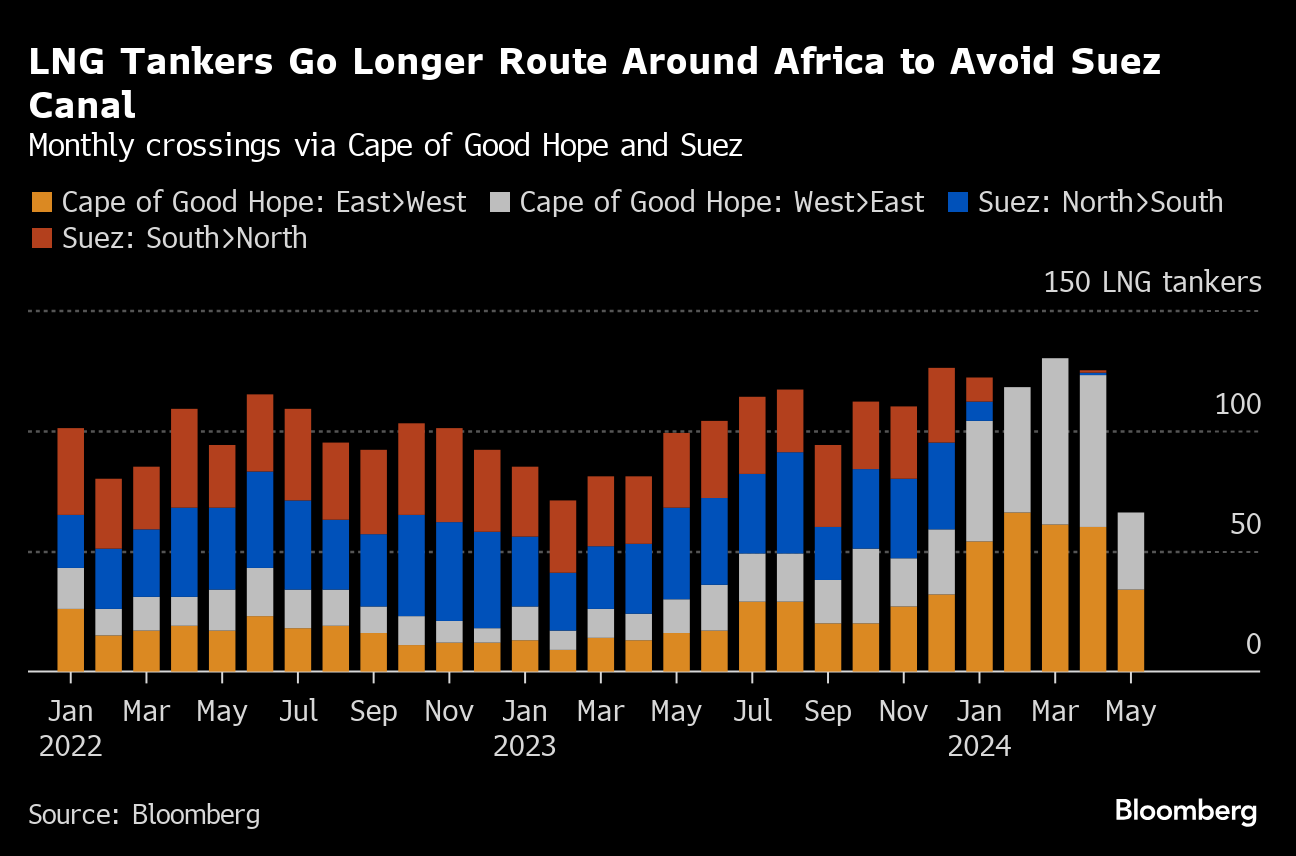

While dozens of such ships used to traverse the Bab al-Mandab Strait each month prior to the escalation of the Israel-Gaza war, attacks by Yemen’s Houthi rebels have brought that number down to zero since mid-January.

Vessels have been forced to reroute around Africa to transport fuel between the Atlantic and Pacific basins, leaving buyers with a limited pool of suppliers unless they’re willing to pay for higher shipping costs. The result is that the global market for LNG is growing increasingly fragmented.

“At the moment, more than ever, you have cargo segmentation of the two basins, and it will be more challenging economically to move a cargo from one basin to another,” said Patrick Dugas, head of LNG trading at TotalEnergies SE, at a conference last month.

Traders have had to find homes for shipments closer to where they are produced to save on transportation. Those efforts will likely intensify when fuel demand ramps up ahead of next winter, when shipping costs usually also rise.

Solutions involve swapping cargoes, for example by channeling US LNG to Europe and finding equivalent supplies in Asia to meet contractual obligations to a buyer there. In the first quarter of 2024, Qatari LNG volumes that ended up in Asia reached the highest level since at least 2017, while Russia poured even more of its super-chilled fuel into Europe, according to ship-tracking data on Bloomberg.

The Red Sea and its Suez Canal previously accounted for about a tenth of global seaborne trade, and provided Qatar with the shortest route to Europe, which has embraced LNG since it lost pipeline flows from Russia.

The longer distances ships have to travel now are tying up their availability, and adding about 4% to global demand for shipping of oil products and gas, according to Clarkson Research Services, a unit of the world’s largest shipbroker.

Thousands of miles away, crossings via the Panama Canal have also slumped after an unprecedented drought has led to reduced traffic there. With that, another shorter route for US LNG to Asia has effectively closed. TotalEnergies’ Dugas said the congestion will likely be structural as an anticipated increase in US LNG supply by the end of the decade will probably do little to alleviate the burden on the passage.

So far, the daily cost of chartering a tanker has been resilient and even declined since the Red Sea disruptions escalated in January. That reflects a comfortable supply situation in markets like Europe, which experienced a mild winter and muted industrial consumption of the fuel.

“It is, however, what we call the ‘shoulder month period’ in LNG, with low gas and ship demand,” said Per-Christian Willoch Fett, director and global head of LNG at shipbroker Fearnleys AS. “Let’s see how things go when we get towards the ramp up period towards the autumn.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project