Saudi Arabia Set for $11.2 Billion Haul From Aramco Sale

(Bloomberg) -- Saudi Aramco’s mega stock offering will raise at least $11.2 billion for Riyadh, the biggest such deal globally in about three years that will help fund a multitrillion-dollar push to transform the economy.

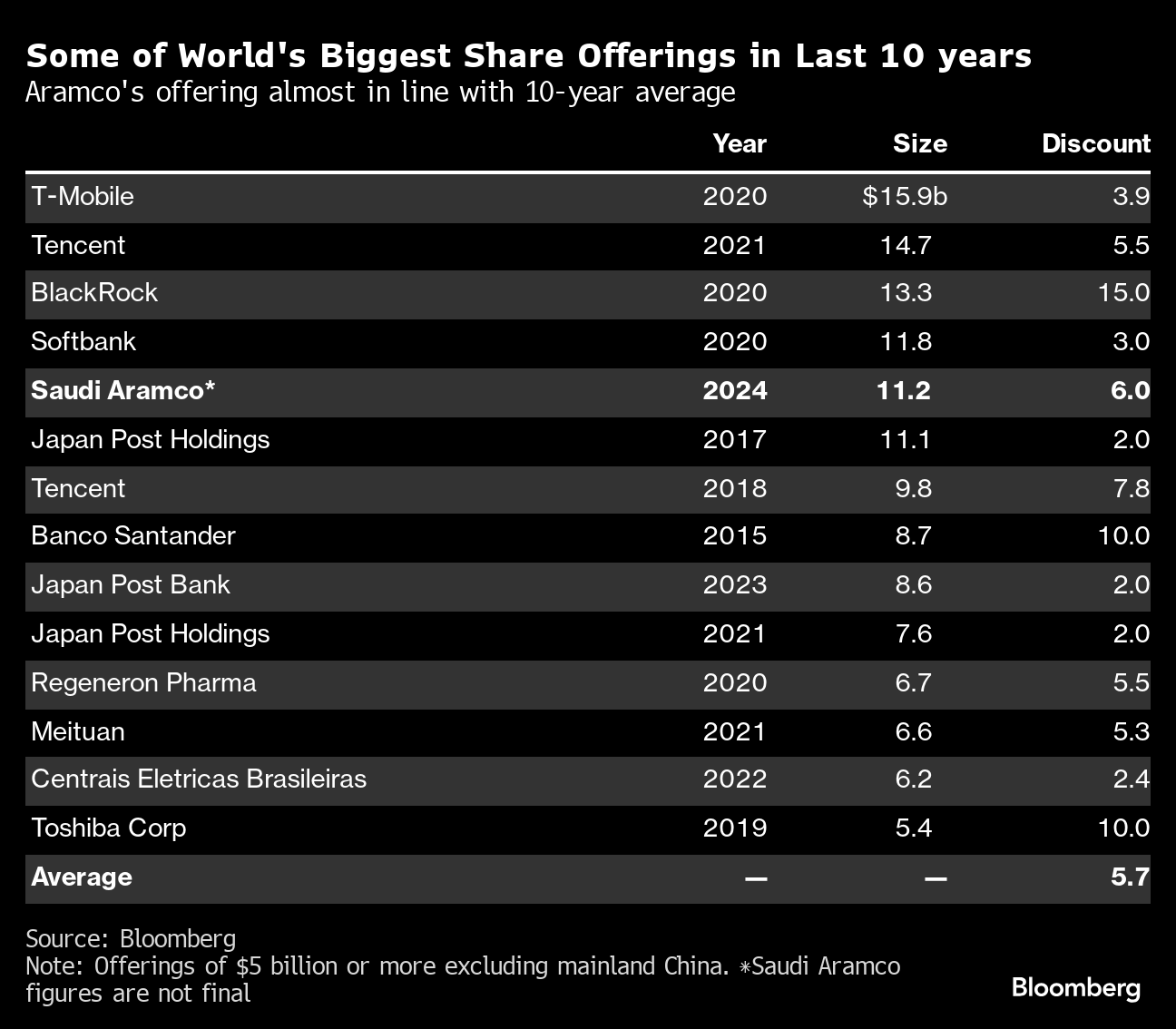

The government will sell almost 1.55 billion shares for 27.25 riyals ($7.27) apiece, according to a statement. That’s a 6% discount to the stock’s last close before the deal was announced, in line with the average for offers of a similar size over the past decade.

The final price is in the bottom half of a proposed range of 26.70 riyals to 29 riyals. Armaco shares have been under pressure recently, even dropping to their lowest levels in over a year in the days leading up to the massive offer that’s drained liquidity from the Saudi market.

The proceeds will help Crown Prince Mohammed Bin Salman’s ambitious plans to revamp the economy with investments including in sports, artificial intelligence, tourism and the desert project of Neom. The kingdom’s budget has been in a deficit for six quarters, and it has raised over $40 billion from local and international markets this year to fill the gap.

Saudi Arabia had demand for all shares on offer in a few hours after the books opened Sunday, with the Aramco’s $124 billion annual dividend emerging as a big draw. The oil giant has increased the payout by more than 60% since it listed. Still, the latest deal is priced well below the level of the initial public offering of 32 riyals apiece.

Secondary offerings are rare in the region. Prior deals include Saudi Telecom Co. and Tadawul Group Holding, which operates Riyadh’s stock exchange — both priced at a roughly 10% discount.

The deal attracted significant interest from foreign investors, Bloomberg News reported Thursday. It wasn’t immediately clear exactly how much demand came from overseas, but those investors put in enough bids to more than fully cover the offering, people familiar with the matter said.

That’s a turnaround from the firm’s IPO in 2019, when global funds had largely stayed away and left the government reliant on local investors. It had put the spotlight on foreign participation in the current sale, even as the oil market outlook darkens amid strong supply and demand concerns in China.

And while Aramco boasts the world’s biggest dividend, its stock is expensive compared with major Western oil companies.

The sale comes just as oil prices in London slid below $80 a barrel for the first time since February. That’s below the near $100 that Saudi Arabia needs to balance its budget, according to data from the International Monetary Fund.

The Saudi government owns about 82% of Aramco, while the Public Investment Fund holds a further 16% stake. The kingdom will continue to be the main shareholder after the offering.

SNB Capital is lead manager of the share sale, according to a previous statement. It is also serving as a joint global coordinator along with Citigroup Inc., Goldman Sachs Group Inc., HSBC Holdings Plc, JPMorgan Chase & Co., Bank of America Corp. and Morgan Stanley. M. Klein & Co. and Moelis & Co. are independent financial advisers on the offering, according to the statement.

(Updates with confirmation of offer price.)

©2024 Bloomberg L.P.