Santos Exploring Options to Unlock Value as Profits Fall 42

(Bloomberg) -- Santos Ltd., the Australian oil and gas producer that ended merger talks with a larger rival last month, said it continues to attract interest in its portfolio as full-year earnings slumped on lower prices.

Underlying profit fell 42% to $1.42 billion in 2023 from a year earlier as oil and liquefied natural gas prices retreated and on weaker output, the Adelaide-based company said Wednesday in a statement. That missed a $1.53 billion average estimate among analysts surveyed by Bloomberg.

Santos shares declined as much as 2% in Sydney trading, and were 0.8% lower as of 12:44 p.m. local time.

Woodside Energy Group Ltd. last month ended talks over a tie-up that would have created an Australian gas export powerhouse, prompting some Santos investors to press the company to consider asset sales or a plan to split out its LNG unit and domestic gas market-focused operations.

“We will continue to look at other opportunities that unlock or create shareholder value, whilst keeping our organization focused on delivering on a strategic plan,” Chief Executive Officer Kevin Gallagher said on a call with analysts. The producer’s portfolio has attracted significant interest, Santos said in a separate statement.

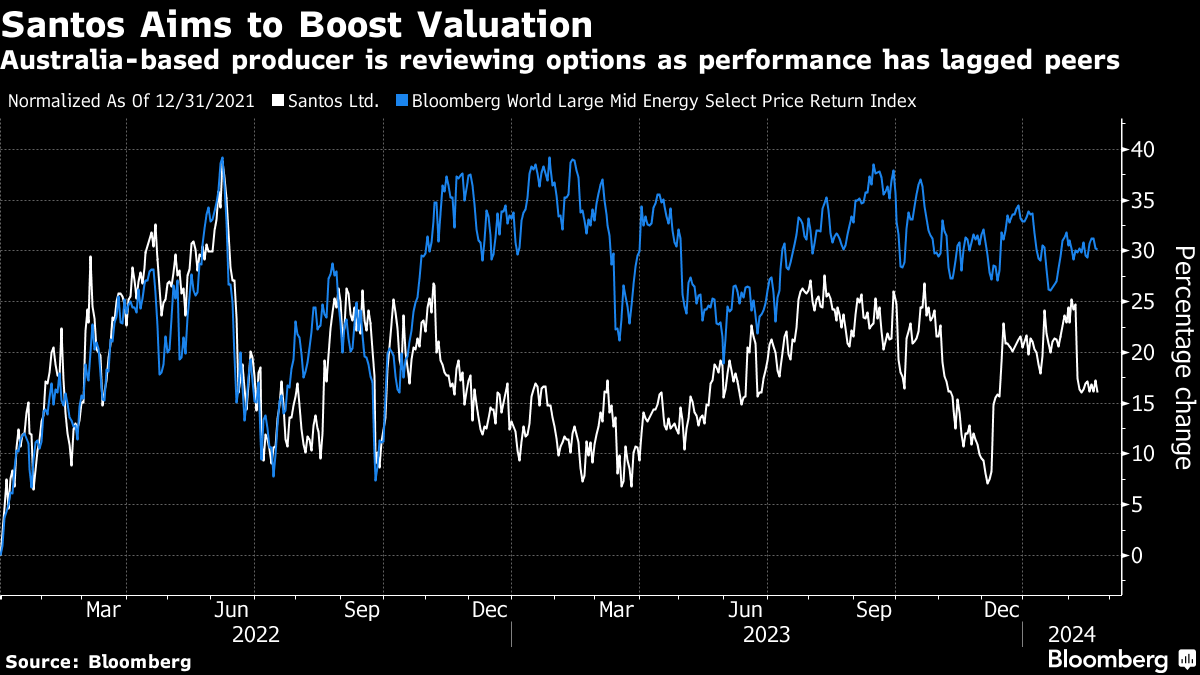

Santos had flagged in November it was working with advisers on potential changes to strategy after seeing its market valuation lag behind peers.

(Updates to add shares, CEO comment from third paragraph.)

©2024 Bloomberg L.P.