Qatar to Build New LNG Project as US Stalls on Export Push

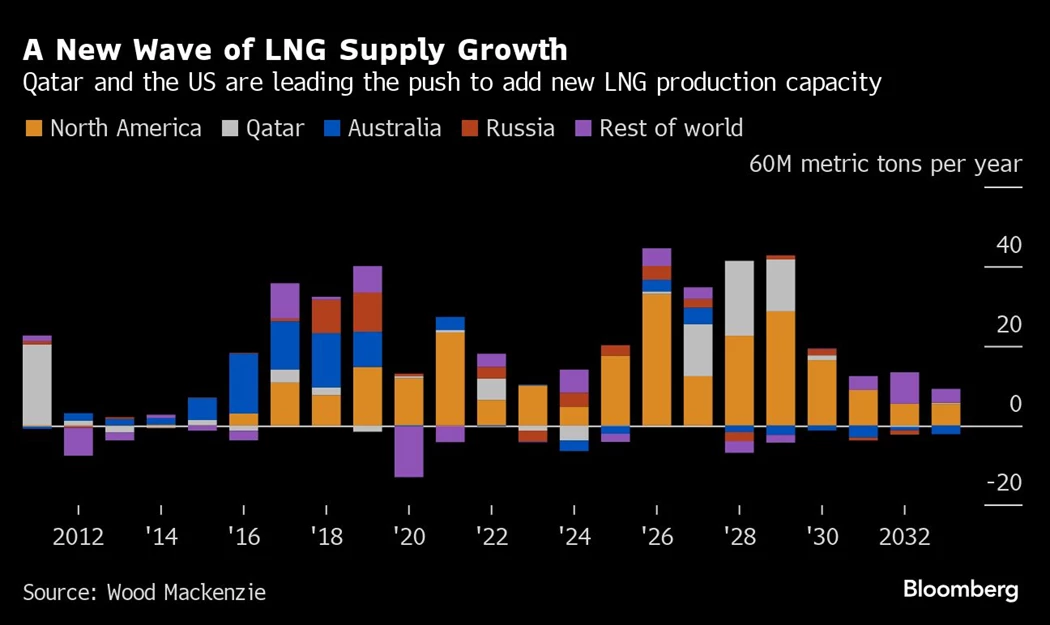

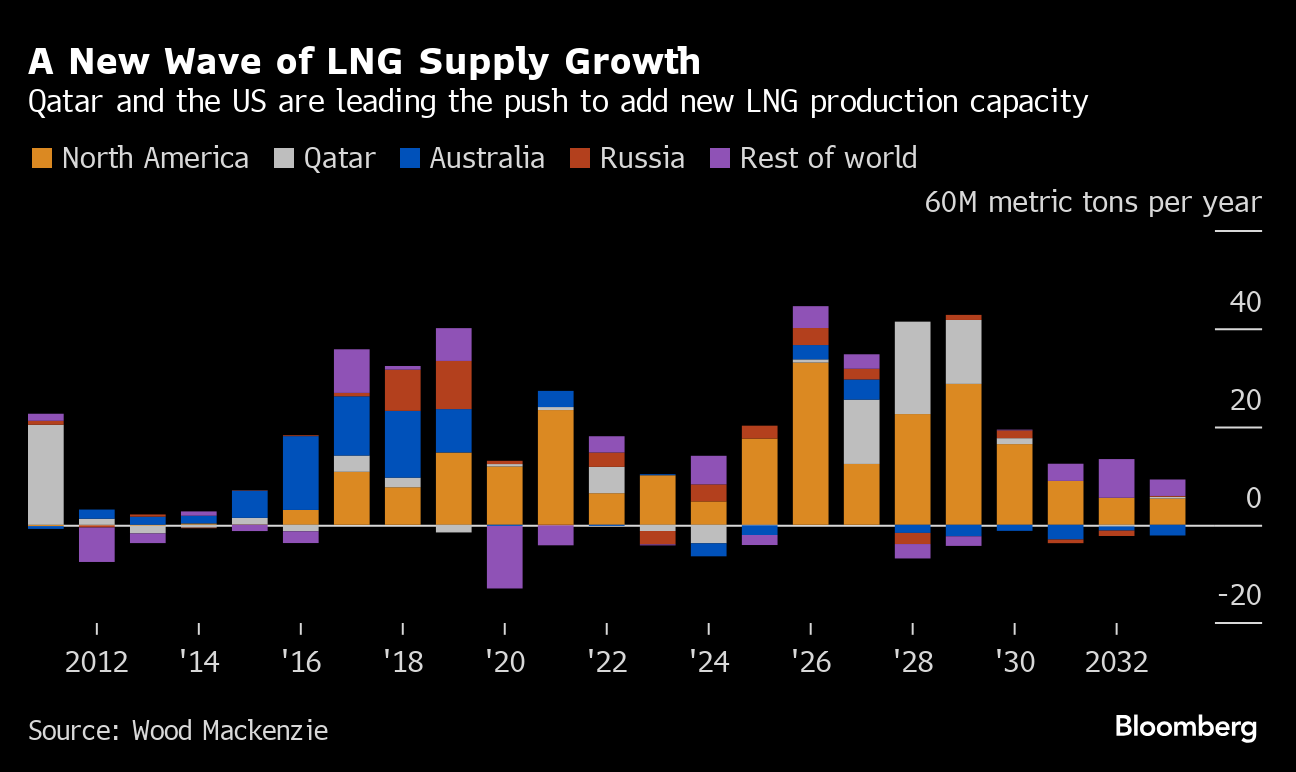

(Bloomberg) -- Qatar plans to expand exports of liquefied natural gas amid rising demand and a pause on growth projects in the US, a key rival supplier.

The nation, which vies with the US and Australia as the biggest shipper of the fuel, will develop a new 16 million tons a year project before the end of this decade, lifting annual production capacity to 142 million tons by 2030, the country’s Energy Minister Saad Al-Kaabi said Sunday.

The expansion opens the way for the Middle Eastern country to secure a dominant long-term role in global exports. It has already signed a succession of deals to sell supply from its current expansion to 126 million tons, including a 27-year pact with China Petroleum & Chemical Corp. and with European companies such as Eni SpA, TotalEnergies SE and Shell Plc. Demand for LNG is forecast to rise more than 50% by 2040, driven by rising consumption in Asia, according to Shell.

The expansion follows the discovery of 250 trillion cubic feet of new gas deposits in the North Field, taking overall reserves to about 2,000 trillion, Al-Kaabi said. The country is still appraising new wells in the field and will produce more if there are additional gas finds, he said.

Qatar hasn’t yet decided if it will bring in partners for the new project, Al-Kaabi said.

US Pause

The US imposed a temporary halt on new LNG export licenses in January while it studies the impact of higher shipments on climate change, the economy and national security. A pause on approvals could last as long as 14 months, according to White House energy adviser Amos Hochstein.

The American pause comes as producers and other advocates insist natural gas is a lower-emissions alternative to coal or oil and can complement rising adoption of renewable sources. Al-Kaabi expects a global shortage of gas despite new projects.

“The only thing that would stop us announcing more projects is if we don’t believe there is a market for gas,” he said.

Most of that demand is likely to come from Asia, with Europe also continuing to use gas for a long time even though the pace of growth will be slower, Al-Kaabi said.

(Updates with context from the third paragraph.)

©2024 Bloomberg L.P.