US Oil Exports to China Dwindle as Demand Wanes, Buying Shifts

(Bloomberg) -- US crude exports to China plunged by almost half this year as shifts in the nation’s economy weighed on demand and it bought more barrels from other countries including Russia and Iran.

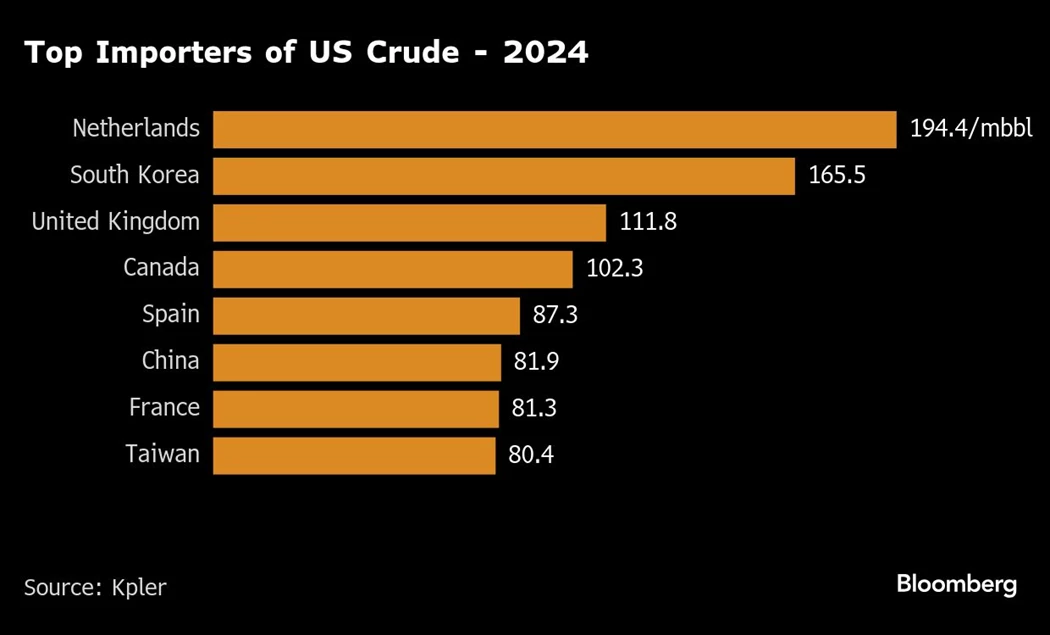

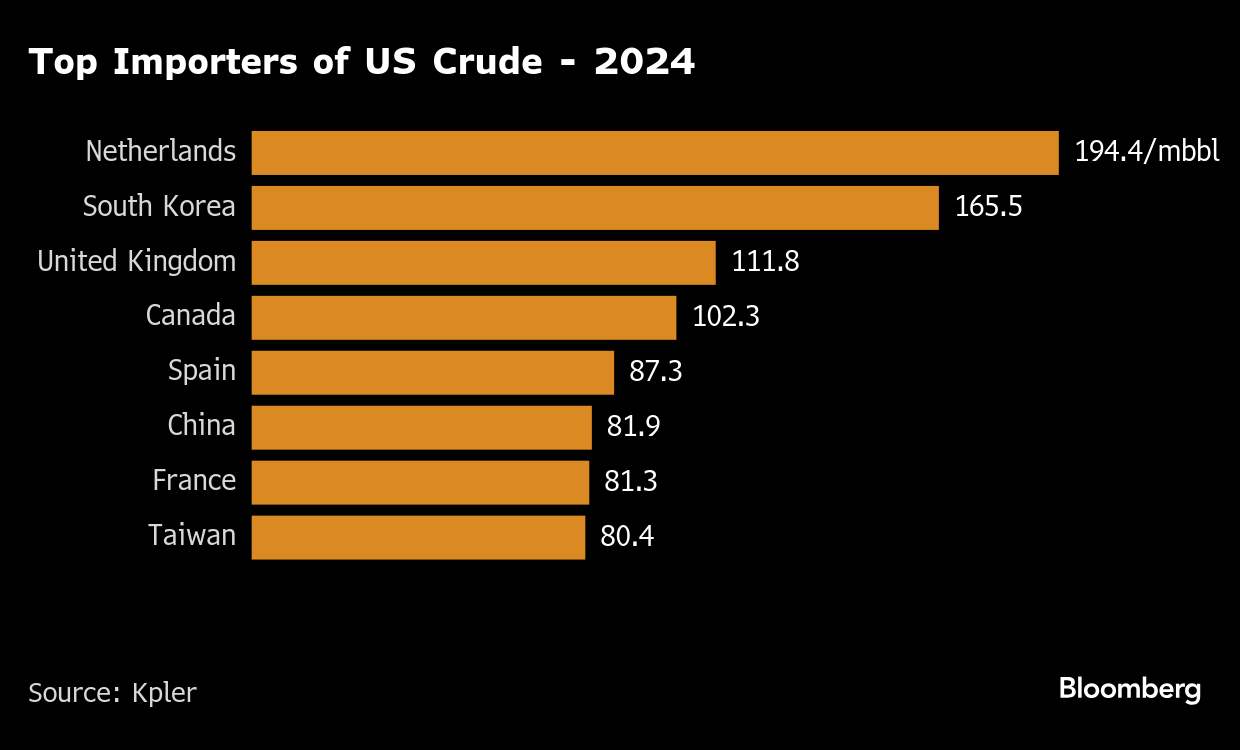

Exports of US oil to China plunged to 81.9 million barrels over the course of the year, down 46% from 150.6 million barrels last year, according to data from Kpler. That knocked China down to the sixth-largest buyer of US crude, from second last year.

China’s slowing economic growth and its increasing use of electric vehicles and energy sources such as liquefied natural gas are reducing the country’s appetite for crude, with its imports from all nations sliding 7.2% from a year earlier. That softening demand in China has helped drive global oil prices lower this year, and the outlook for 2025 is a top focus for the market.

China also is shifting its sources of oil and imported about 26% of its seaborne crude from Russia, Iran and Venezuela this year, up from 24% a year earlier, the Kpler data show. Overall, the country still relies primarily on the Middle East, accounting for about 60% of seaborne oil imports.

Meanwhile, Europe has become an increasingly important destination for US crude, driven partly by the inclusion of West Texas Intermediate oil in dated Brent, a European benchmark. The continent has been the top destination for US crude for three years since supplanting Asia as the biggest buyer after the onset of Russia’s war in Ukraine.

The Netherlands continues to import the most crude from the US, taking in 194 million barrels in 2024, a 12% increase from last year, the Kpler data show. South Korea was the second-largest importer of US oil in 2024, buying around 166 million barrels. South Korea is working to make up for the loss of some crude from Kazakhstan after the nation began shipping more oil to Italy.

©2024 Bloomberg L.P.