PetroChina to Build Up Its LNG Fleet and Expand Global Trade

(Bloomberg) -- China National Petroleum Corp., the country’s biggest natural gas supplier, will build more ships to carry the fuel as it looks to enhance its role as a global gas trader.

CNPC’s trading arm, PetroChina International Co., plans to expand the number of its liquefied natural gas tankers to 25 by 2030, about four times the size of its current fleet, Wang Haiyan, the firm’s deputy general manager, said at a forum in Beijing on Tuesday.

The investment follows record annual profits at CNPC’s listed unit, PetroChina Co., which drew heavily on the state-owned company’s dominance of the domestic gas market. It also indicates an ambition to compete with some of the world’s biggest energy traders in supplying the cleaner-burning fuel beyond China’s borders.

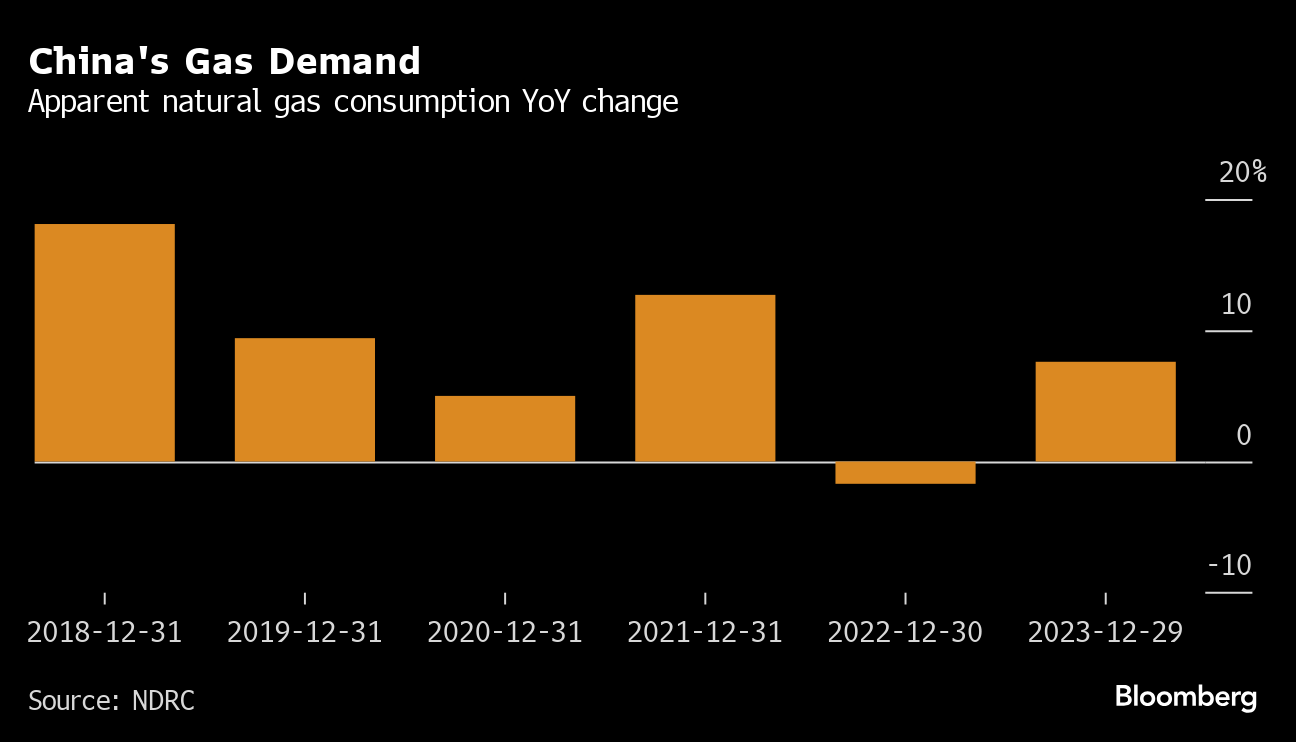

China is the world’s biggest LNG buyer, but a rare drop in domestic consumption at the height of the pandemic in 2022 forced importers to shift their focus to other markets. Last year, PetroChina resold 12 million tons of LNG to over 20 countries, a sizable chunk of the 30 million tons it bought from overseas, said Wang.

Even as Chinese demand rebounds, supply pressures are easing. Domestic production is at record levels, while Russian supplies, particularly via overland pipeline, are also growing apace. That’s creating more options for firms to trade gas.

“Supply isn’t a problem anymore,” and it’ll be even less of an issue as more global gas projects come online from 2026, Wang said.

Chinese importers have locked up more LNG on long-term contracts in recent years after Russia’s invasion of Ukraine caused gas prices to spike. Contracted volumes accounted for 63 million tons in 2023, from total shipments of about 71 million tons, and the figure is expected to rise to 106 million tons by 2030, according to Wang.

In the meantime, Wang said Russia will become China’s biggest supplier of gas this year, accounting for about 40 billion cubic meters, or 29 million tons. The Power of Siberia project is expected to deliver 30 bcm in 2024, from 22 bcm last year, before nameplate capacity of 38 bcm is reached in 2025. Another 10 bcm of Russian LNG should arrive this year by sea, he said.

On the Wire

China’s CPI inflation likely retreated in March from a holiday-driven bounce in February, according to Bloomberg Economics. Factory-gate prices probably extended their declining streak to an 18th month.

US Agriculture Secretary Tom Vilsack implied that China may be favoring Brazilian corn and soybeans partly in retaliation against recent restrictions on ownership of American farmland.

The European Union ramped up pressure on Chinese clean-tech investments potentially squeezing out its local suppliers amid EU efforts to transform the bloc into a green economy.

From Washington to New Delhi, politicians and executives are complaining that Beijing’s clean-energy manufacturing boom is damaging their own production efforts.

The Week’s Diary

Wednesday, April 10:

- China to release March aggregate financing & money supply by April 15

- CCTD’s weekly online briefing on Chinese coal, 15:00

- Global LNG & Hydrogen Conference & Exhibition in Beijing, day 3

Thursday, Thursday April 11:

- China inflation data for March, 09:30

- China’s monthly CASDE crop supply-demand report

Friday, April 12:

- China’s 1st batch of March trade data, including steel, aluminum & rare earth exports; steel, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gas & coal imports; oil products imports & exports. ~11:00

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2024 Bloomberg L.P.