Mercuria Joins Trader Push Into Japan’s Spot Electricity Market

(Bloomberg) -- Mercuria Energy Group Ltd. is preparing to begin trading in Japan’s physical power market, the latest global commodities firm seeking to capitalize on the sector’s rising volatility.

Mercuria hired Masayuki Kato, formerly one of Itochu Corp.’s top electricity traders, as it gears up to join the country’s spot market, according to people with knowledge of the plans. That follows moves by other European energy companies, including BP Plc and Engie SA, to expand in one of the biggest power-consuming nations.

Firms with a history of trading oil and gas are pushing into physical power markets, attracted by recent volatility and the opportunity to supply major utilities and manufacturers with coal, gas and carbon credits.

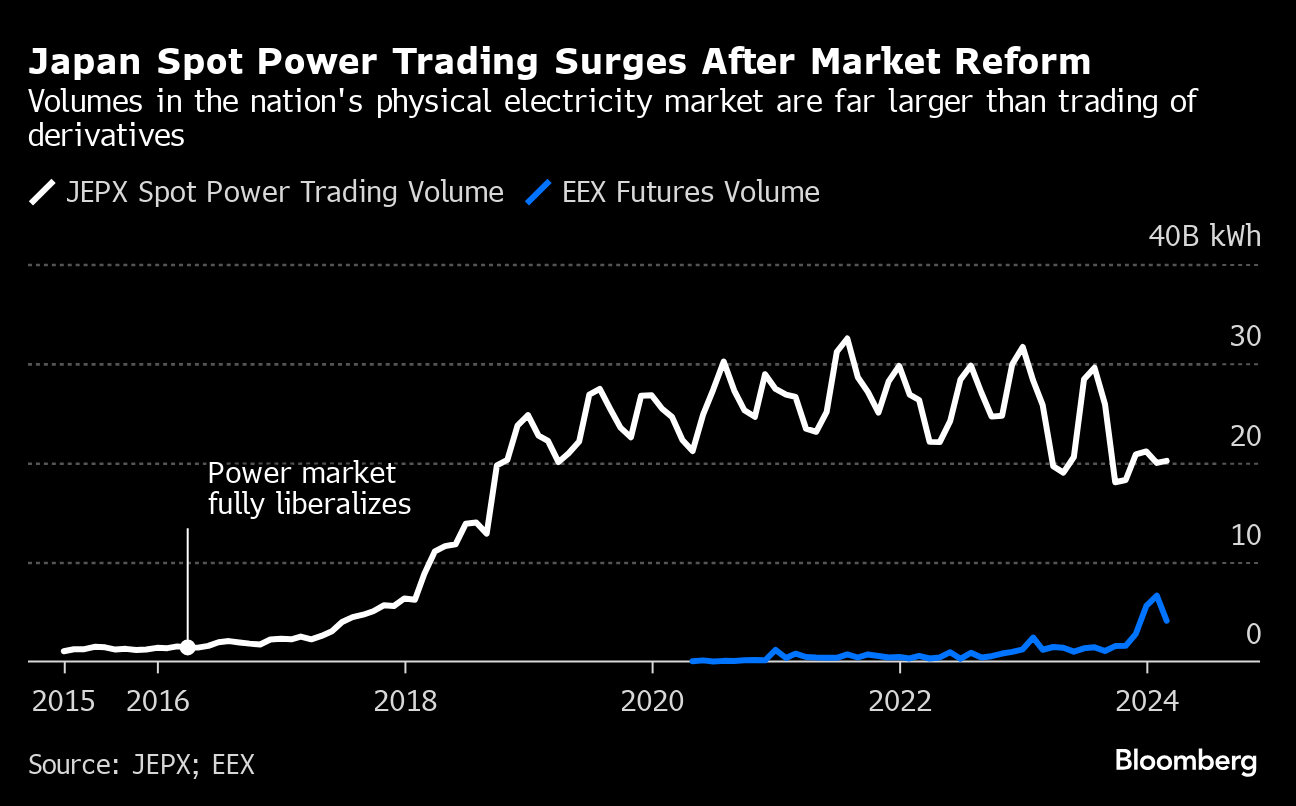

Foreign players joining the Japanese market, liberalized in 2016, have typically started by trading derivatives — a business that can be conducted overseas and doesn’t require a specific government license.

Taking additional steps to begin physical trading offers access to what’s currently a larger market, where volatility is being stoked by fluctuating prices for liquefied natural gas — among Japan’s mainstay fuels — and moves to add more renewables.

About 60,000 gigawatt-hours of electricity were traded in the spot market during the first quarter, almost 15 times more than during the same period pre-2016, according to the Japan Electric Power Exchange.

“Japan being an island makes it a very interesting market, because power is connected to LNG and other imported commodities,” said Roland Rechtsteiner, a Zurich-based partner at McKinsey & Co. who leads its commodity risk and trading practice. “You have a lot of requirements to balance within the country.”

Policy changes in 2022 have exposed clean-electricity generators to potential costs if their production misses forecasts. That’s creating more opportunities in the spot market, said Jesper Johanson, chief executive officer of InCommodities A/S, a Goldman Sachs Group Inc.-backed firm that’s in the process of getting a license for physical trading.

“Our interest in entering Japan’s physical power-market space, rather than solely focusing on derivatives, is directly linked to our expertise in managing risks on behalf of renewables asset owners,” Johanson said.

While derivatives volumes are currently just a fraction of spot trades, the futures market is likely to become larger eventually, as is the case in more mature power sectors in Europe, according to Bob Takai, Japan representative at EEX Group, the bourse with the most popular offering.

“We have a lot of potential to grow in the coming months and years,” he said. More than 16,000 gigawatt-hours of futures contracts were traded with EEX from January through March, more than triple the amount a year earlier.

©2024 Bloomberg L.P.