BP’s Urgent Search for a New CEO: Who’s on the List

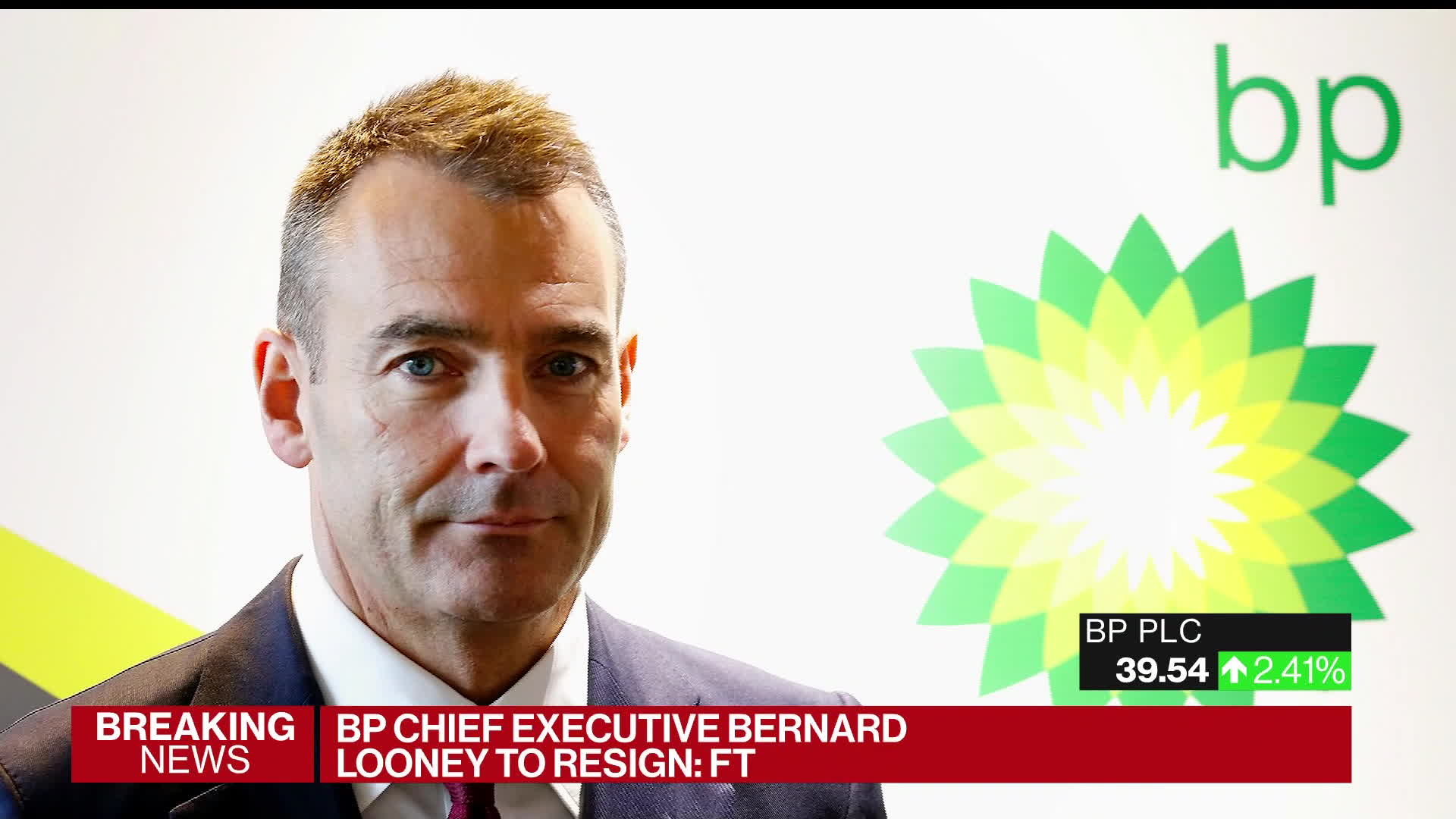

(Bloomberg) -- BP Plc’s board woke up on Wednesday facing an urgent search for a new boss, its fifth in 16 years. Outgoing Chief Executive Officer Bernard Looney shocked the industry a day earlier with his resignation after failing to fully disclose past relationships with colleagues.

The storied oil and gas producer has typically molded CEOs over decades-long careers within the company. But with Looney becoming the third of the last four chiefs to leave BP abruptly, an external hire can’t be ruled out. Here’s a look at some potential candidates:

The CFO

BP’s Chief Financial Officer, Murray Auchincloss, was named interim CEO on Tuesday after Looney stood down with immediate effect. The Canadian came into BP through its merger with Amoco in 1998. He started off there in his hometown of Calgary as a tax analyst, later taking on a number of roles in London, Texas and Aberdeen, Scotland.

Auchincloss often balanced Looney’s gregarious tone with a more reserved approach to investors. The Canadian gently admonished his CEO on a recent call with analysts for giving out too many operational details about oil wells.

As caretaker CEO, Auchincloss sought to reassure staff on Wednesday that the company can continue business as usual. “While the person in the CEO’s chair has changed, the fundamentals have not changed,” he said in an internal webcast, details of which were confirmed by a company spokesperson. The leadership team has “the full support of the board to continue to deliver the plan we have laid out.”

The Chairman

Norwegian Helge Lund’s career at BP is relatively short, having joined the board in 2018, but he comes with strong industry credentials. He worked at Equinor ASA, then known as Statoil, as president and CEO for 10 years from 2004. He briefly served as BG Group’s CEO from 2015, before the company agreed to sell itself to Shell Plc a year later.

The Long Timer

William Lin’s profile mirrors that of many BP CEOs in its longevity and breadth. Most recently, the 55 year-old American served on Looney’s leadership team as executive vice president for regions, corporates and solutions. This seat at the top table followed a career that was steeped in BP’s core businesses, with more than 20 years working on the operational side of oil and gas projects from Indonesia to Texas and Scotland to Egypt.

The Newcomer

Like most major oil and gas companies, BP has never had a woman at its helm. Since joining last year to lead the gas and low-carbon business, Anja-Isabel Dotzenrath had a high profile in Looney’s core mission of transitioning to cleaner energy. While elevating her further would be one way to reaffirm BP’s commitment to a low carbon future, her previous career at power producers RWE Renewables and E.ON SE gives her fewer of the oil and gas roots the company typically looks for in its leaders.

The Technician

Being the chief of BP’s upstream division has been a common stepping stone into the top job, just as it was for Looney. Scotland-born Gordon Birrell briefly took up that role when Looney became CEO, but it was soon dismantled in a companywide restructuring.

Birrell remained on BP’s leadership team as executive vice president for production and operations. His career has mostly been in operational and safety roles close to the core oil and gas business, including four years as president of Azerbaijan, Georgia and Turkey. That has given him less involvement in low-carbon ventures than some of his peers.

The Outsiders

BP hasn’t hired externally for the top job in its recent history, but with three abrupt CEO departures in less than two decades it could be time to reconsider.

There are several former BP executives now occupying high-profile roles in other industries, such as Rolls-Royce Holdings Plc’s CEO Tufan Erginbilgic, who turned around BP’s struggling downstream operations before leaving in 2020. Or Varo Energy BV’s boss Dev Sanyal, whose 32-year career at BP included the job of running gas and low-carbon energy.

A bolder choice still could be to poach an executive from a US oil company, most of which have surpassed the share-price performance of their European peers in recent years. Such a move could convince US investors of BP’s value, but could also raise questions about its commitment to the energy transition.

(Adds CFO comments in fifth paragraph.)

©2023 Bloomberg L.P.