Fear Grips Global Gas Market Facing Winter Supply Threats

(Bloomberg) -- Mounting threats to gas supply are sending most global fuel prices higher as fear takes hold of the market just ahead of the first signs of winter.

Natural gas in Asia and Europe jumped this week, with the latter hitting the highest level in seven months, driven by the Israel-Hamas war, potential strikes at key export plants and infrastructure vulnerabilities, including a leak in a Baltic Sea pipeline where sabotage is suspected.

The US stands apart, and price swings there have been much more muted thanks to ample domestic production.

The multiple risks highlight the fragility of other markets, in particular Europe, which is starting its second winter without much of the pipeline gas flows from Russia that it once took for granted. The continent’s benchmark futures continued their rally Thursday, adding as much as 13%.

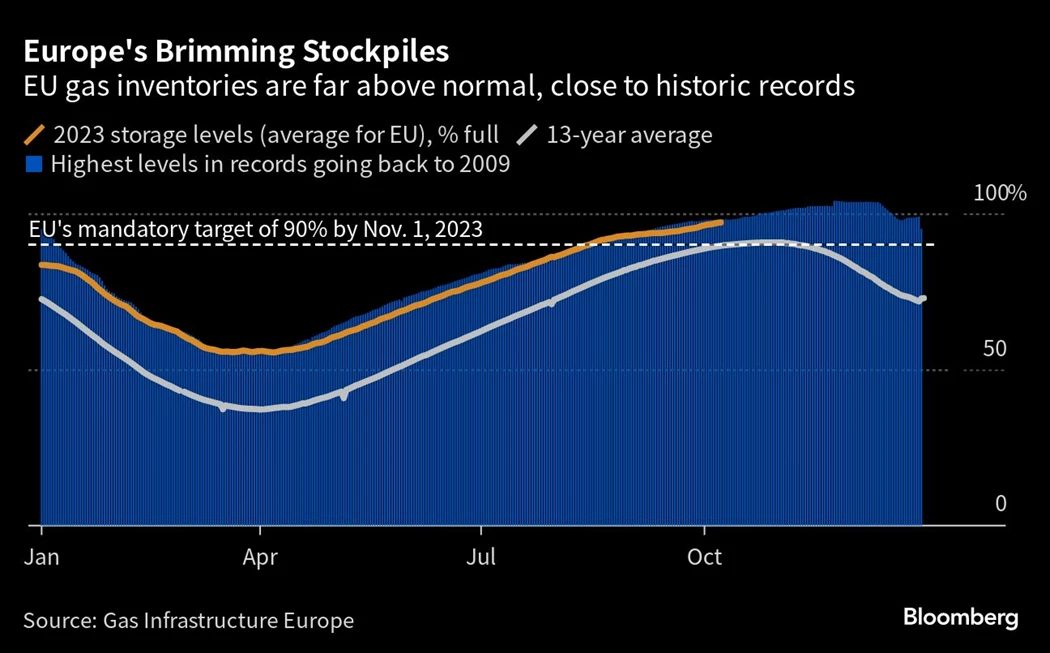

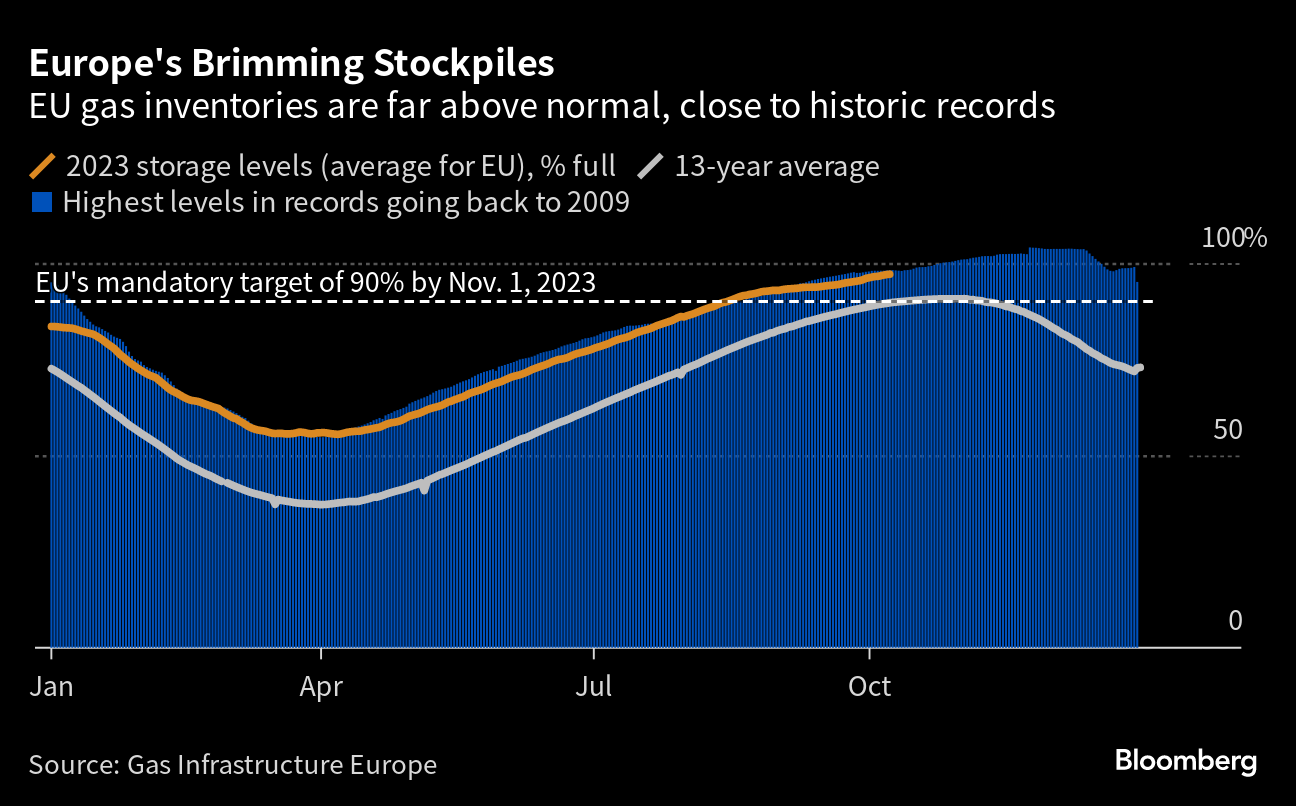

The good news is the gas market is in a much better place now than this time last year. Inventories are high, industrial demand is down, and several new import facilities have been added. In addition, some forecasts suggest Europe will have a relatively warm winter, which should reduce gas needs.

But the energy crisis is still far from over, and a cold snap is set to hit Europe in the coming days. Any hint of disruptions to global gas flows could send shockwaves through the market, particularly as households crank up the heat.

“Somehow the risk of something going wrong vastly outweighs the reality that everything has gone right,” said Ira Joseph, a global fellow at the Center on Global Energy Policy at Columbia University. “The fear of being short of supply and the potential for another price spike is overpowering, even if stocks are high and demand is weak.”

Markets on Edge

It’s true that global gas supply and demand is delicately balanced. Russia’s invasion of Ukraine last year upended the market, significantly cutting Moscow’s pipeline deliveries to Europe and forcing Europe to depend far more on liquefied natural gas.

Underpinning that new reliance, France this week signed a long-term agreement with Qatar for LNG, but deliveries aren’t expected to start until 2026. In the meantime, with so little spare capacity, any events that suggest a risk to supply can cause price spikes.

And over the last week, multiple incidents sparked fresh rallies:

- Australian workers unions gave notice that strikes at Chevron’s LNG export plants in Australia will begin next week.

- Then, a leak at an undersea pipeline linking Finland and Estonia was discovered. The nations, which border Russia, are on alert that this was a deliberate act. That’s fueled concern about the safety of Europe’s infrastructure, particularly after explosions last year on the Nord Stream pipelines from Russia to Germany.

- The conflict in Israel and the Gaza Strip forced Chevron Corp. to shut an offshore gas field which supplies Egypt, a move that may affect that nation’s LNG exports to Europe.

The combined effect sent European gas prices up about 40% since late last week. Dutch front-month futures, the region’s benchmark, traded 12% higher at €51.55 a megawatt-hour by 4:26 p.m. Amsterdam on Thursday.

“Military conflicts spook markets,” said Toby Copson, head of energy APAC at Marex. “Market participants are taking positions now as the potential for supply disruptions in the Middle East could affect flows both in shipping and volume.”

For more on the Israel-Hamas war, click here.

Part of the issue is that more and more financial players are entering the European gas futures market, lured by its extreme volatility, and the region has for the last year dictated global prices. Derivatives traders might be piling into purchase contracts before unexpected further price rises, said Copson.

To be sure, there are factors that will help to keep prices in check. Apart from brimming inventories in Europe and forecasts for a warm winter, China’s gas demand has been slow to fully rebound. Europe will add even more floating LNG import terminals this winter.

Meanwhile, the region’s desire for fuel is proving a boon for gas exporters vying to take a slice of the market once held by Russian giant Gazprom PJSC.

France’s LNG deal with Qatar runs beyond 2050, past the country’s net zero targets, showing how high energy security is on the political agenda.

Big Deals

The US is also lining up deals to finance its expanding production. It’s been the top global LNG exporter this year, outpacing Australia, Qatar and Russia, according to BloombergNEF data, and has accounted for a majority of supply to Europe since the invasion of Ukraine in early 2022.

Read more from Bloomberg Intelligence: Israeli-War Gas Curbs Won’t Affect EU Yet, But Supply Risk Looms

Companies pushing to expand or build new US LNG projects saw a surge in interest for longterm contracts in the wake of the war in Ukraine and have raced with other countries to sign up buyers from Europe.

The renewed threat to European gas infrastructure could see global importers double down on the need to secure supply, delivering more business for the US and other suppliers.

And as for Russian supply, traders are on alert and monitoring remaining gas flows via a pipeline across Ukraine to Europe, and LNG deliveries. Some politicians have said Europe must restrict LNG imports, though finding enough alternative supply would be an issue, at least for now.

“Europe’s energy landscape is fraught with challenges,” said Leslie Palti-Guzman, head of market intelligence at SynMax, a satellite data analytics company in Houston. “The geopolitical undercurrents are intensifying, amplifying Europe’s supply security vulnerabilities.”

(Updates prices in Europe and US starting in 2nd paragraph)

©2023 Bloomberg L.P.