Oil’s ‘Dead Cat Bounce’ Spares Energy Stocks From Greater Pain

(Bloomberg) -- Don’t be fooled by Friday’s sharp relief rally in oil and gas equities as the picture is still bleak for crude supply and demand.

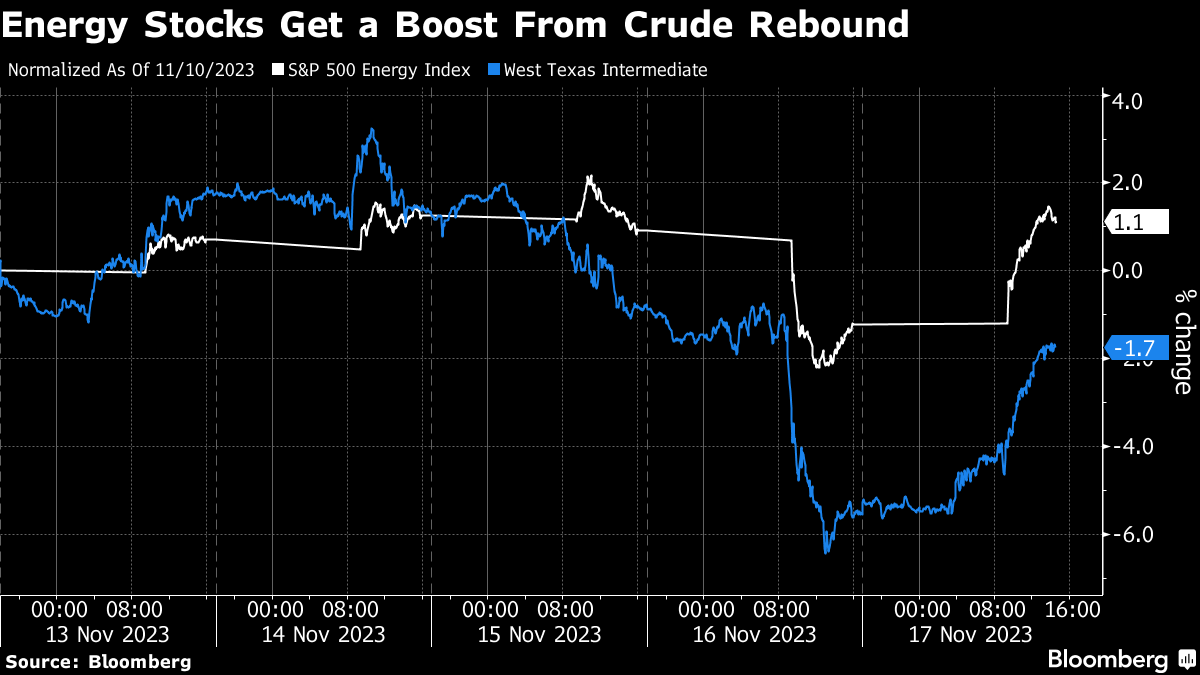

Energy stocks in the S&P 500 index followed oil higher with a benchmark-leading 2.5% intraday jump as the sector narrowly avoided notching its second straight weekly decline. But the move in crude supporting the stocks is nothing more than a “dead cat bounce” after speculators liquidated positions this week, according to Roth MKM analyst Leo Mariani.

Such rallies often prove fleeting. And other analysts pointed to financial hedging and technical factors rather than any real change in outlook. That leaves the energy sector trailing 9 of the 11 industry groups in the S&P 500 over the past week as both oil and natural gas prices have declined on a combination of storage data and surging supplies.

Drilling and fracking companies have fared the worst in the group over the past five sessions as Baker Hughes Co. dropped 1.7% while competitors Schlumberger Ltd. and Halliburton Co. slumped less than 1% each.

“The financial positions went a lot more bearish over the last two weeks,” Bloomberg Intelligence analyst Fernando Valle said by phone Friday, noting that economic data from both China and the US on oil demand were a disappointment. Growing output from OPEC members Iran, Venezuela and Iraq didn’t help, with “the supply side being stronger than people expected.”

Short covering may also be behind this week’s move Valle added, and thin holiday trading could distort further moves. “You want be a bit careful over the weekend,” he said. “Next week is going to be very low volumes.”

US oil supplies are contributing too. The West Texas Intermediate oil price is headed for its fourth straight weekly drop, declining 2.5% this week after oil storage data released by the The US Energy Information Administration released. The build in oil storage levels came despite lower net imports, higher refinery runs and flat US oil production in the week, JPMorgan analyst John Royall said.

The natural gas storage picture is also bearish, further weighing on the energy index as gas-weighted names declined. “The compound effect of skyrocketing production and El Niño has quickly muted earlier optimism for NYMEX natural gas prices, including from these quarters,” Desjardins analyst Chis MacCulloch wrote in a research note following the natural gas report.

Canadian gas producer Birchcliff Energy Ltd. tumbled more than 8% and was the worst performer on the S&P/TSX Composite Index this week. Its earnings report weighed on peers after showing the company was outspending its cash flows.

©2023 Bloomberg L.P.