Europe Gas Traders See Signs Demand Set to Rise

(Bloomberg) -- Europe’s natural gas traders are starting to see early signs that demand may pick up this winter, adding to risks in a market that’s been laser-focused on supply shocks.

Consumption increased by 1% in October, marking the first year-on-year advance since Russia’s invasion of Ukraine caused a record surge in energy prices and forced companies and households to curb demand, said Gergely Molnar, an analyst at the International Energy Agency.

“We have seen some demand coming back” from the industrial sector, Gyorgy Vargha, Chief Executive Officer of Swiss trading firm MET International AG, said in an interview on the sidelines of a London conference last week, adding that he was watching to see if domestic consumption goes back to pre-crisis levels.

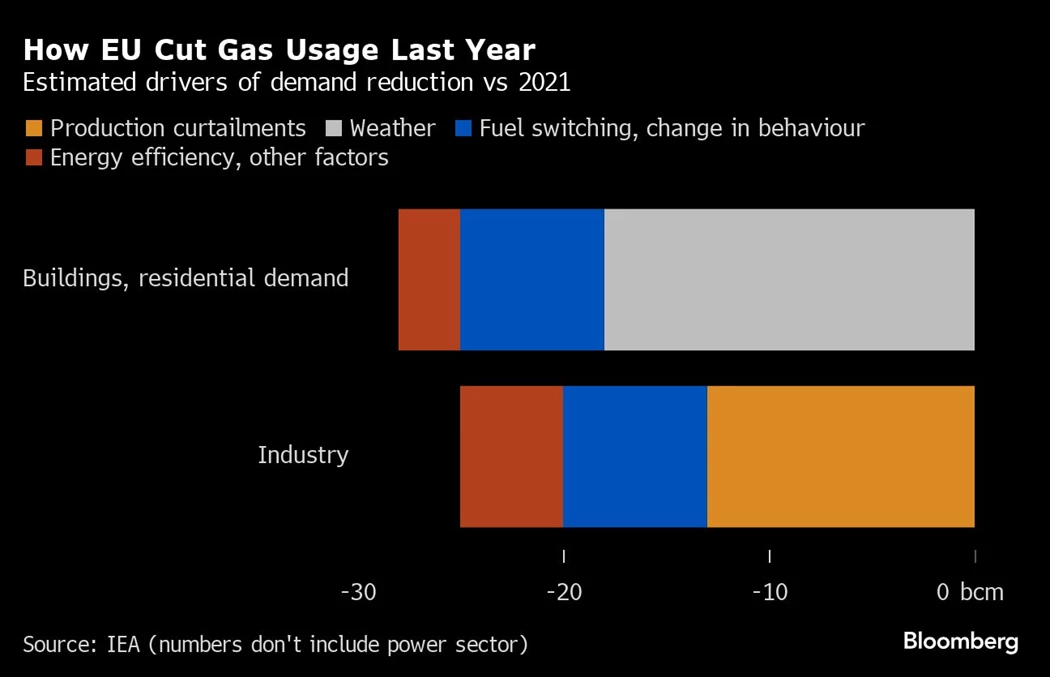

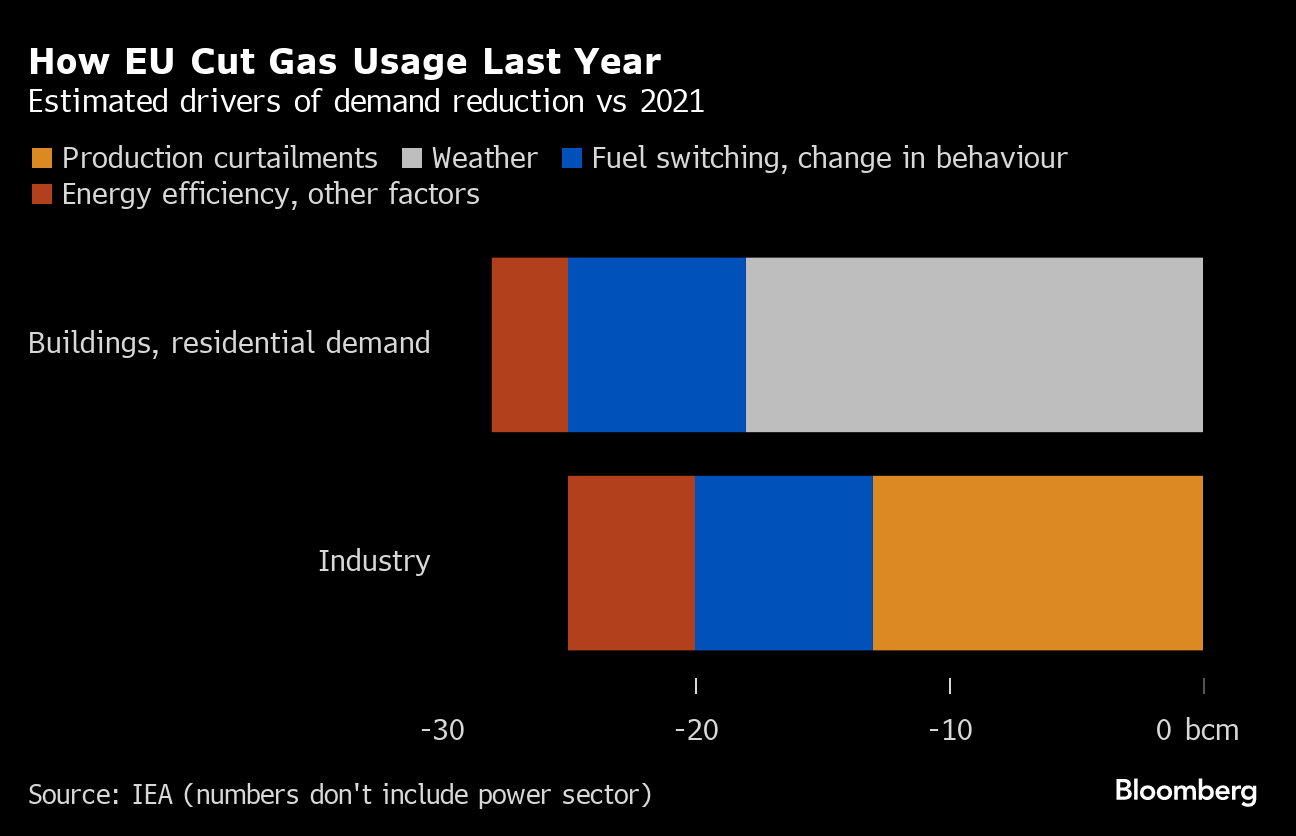

Europe survived last winter without blackouts despite a record cut in gas supplies from Russia. That was, in large part, due to the steepest gas demand reduction in its history — because of relatively mild weather, increased use of both coal and renewables, and energy-saving measures from households to businesses.

Now, electricity usage in key European markets could bounce back to pre-crisis levels by January, BloombergNEF expects. Also, declines in industrial production in the Eurozone are set to ease in the first quarter, according to a Bloomberg survey of economists.

Swiss trader Axpo Holding AG’s CEO Christoph Brand noted “signals” from some clients that they intend to recover gas consumption.

Those could all be warning signs for a market still trying to bolster its energy security after one difficult winter.

Europe’s gas contracts, just a fraction of record prices last year, have slumped about 40% since the start of 2023. Yet, volatility appears to be here to stay. Heavier-than-expected maintenance in Norway this summer, strikes at export facilities in Australia in September and the conflict between Israel and Hamas prompted sharp intraday price swings.

Last year, the European Union cut its gas usage by 55 billion cubic meters, or 13%, according to the IEA. Demand in the industrial sector dropped around 25%, IEA data show.

To be sure, demand recovery is still fragile and “highly dependent on the future evolution of gas prices,” IEA’s Molnar said.

And some changes in consumption may be here to stay.

Germany, the continent’s largest economy, is expected to consume the lowest amount of energy in more than three decades this year, even lower than in 2022, when it was especially hard-hit by the crisis.

However, traders are watching for signs of change in the demand picture. Together with supply risks, it is something the market is also wary of in the longer term. Gas prices in winter 2024-25 are expected to be higher than this year.

Some gas-supply contracts for both industrial and residential sectors start in October and in January, which would further determine consumption levels, MET’s Vargha said.

The weather will remain a big issue, according to Colin Parfitt, vice president for midstream at Chevron Corp. Europe looks very well supplied for now, with record fuel inventories, but if it gets really cold, with low wind generation and high demand for liquefied natural gas in Asia, withdrawals from storage could speed up and prices can spike again.

“We’re not home free yet. There is a risk of volatility,” Parfitt said.

©2023 Bloomberg L.P.