Europe’s Natural Gas Glut Is About to Vanish as a Key Price Spread Flips

(Bloomberg) -- The threat of a natural gas supply squeeze in Europe is growing after a key price spread reversed, signaling that the region’s current glut will disappear as more cargoes head to Asia.

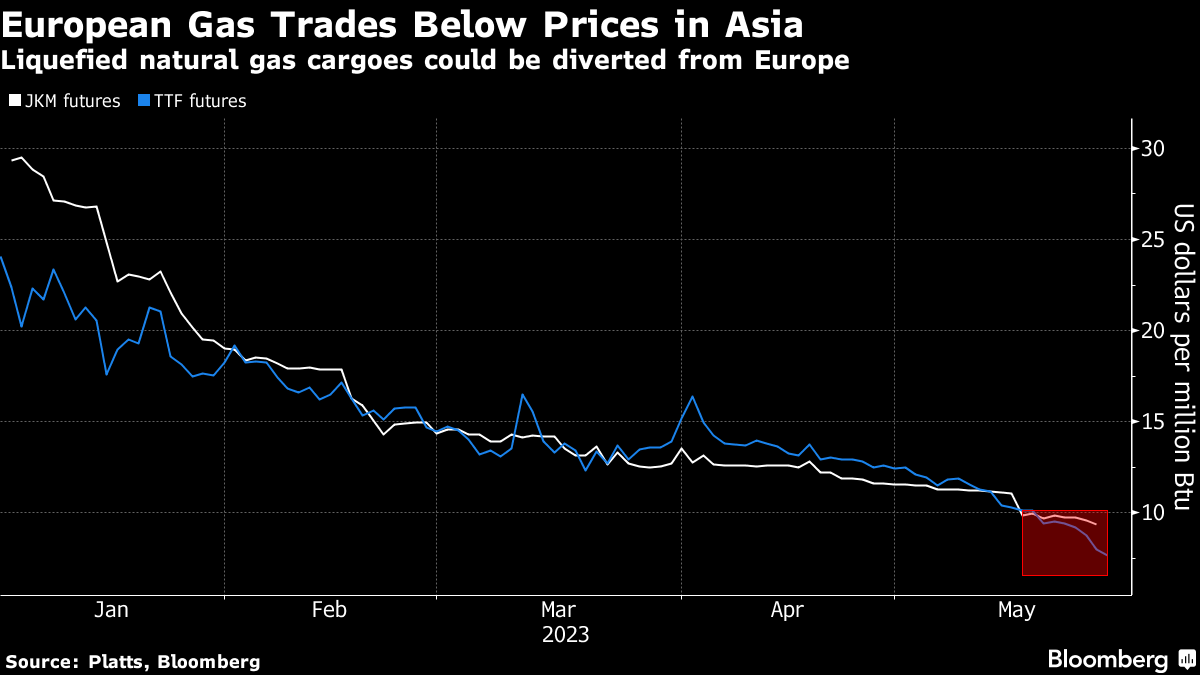

Liquefied natural gas futures in Asia are trading at the highest premium to European prices since January after the spread went positive last week for the first time in almost three months. Though Europe averted a severe gas shortage last winter, the discount to Asia for its cargoes could worsen the region’s still-fragile supply situation in the wake of Russia’s invasion of Ukraine.

JKM futures, the benchmark for prices in Asia, are trading about $1.75 per million British thermal units above the European benchmark TTF. SparkNWE LNG basis — another key indicator that shows the difference between the price of physical cargoes delivered to certain European terminals and TTF — narrowed to minus $1 per million Btu, the lowest since January 5.

The spread is narrowing “based on less demand for European terminal slots as Asia starts to attract more cargoes,” said Tim Mendelssohn, chief executive officer of Spark Commodities, which provides the SparkNWE assessment price.

©2023 Bloomberg L.P.