Europe Gas Swings as Strong Storage Weighed Against Spring Risks

(Bloomberg) -- European natural gas prices fluctuated as traders weigh continued disruptions to French energy networks against strong fuel supplies at the end of the heating season.

Benchmark futures swung between gains and losses on Wednesday. Europe is heading into spring having seen out an energy crisis that at one point threatened to overwhelm the economy. Yet mostly mild winter weather and strong flows of liquefied natural gas have helped to avoid major strains, with markets now looking at how reserves will fare into next winter.

“While tensions on the European gas market considerably moderated since the start of the year, we are not out of the woods yet,” said Gergely Molnar, gas analyst for the International Energy Agency, at the European Gas Conference in Vienna.

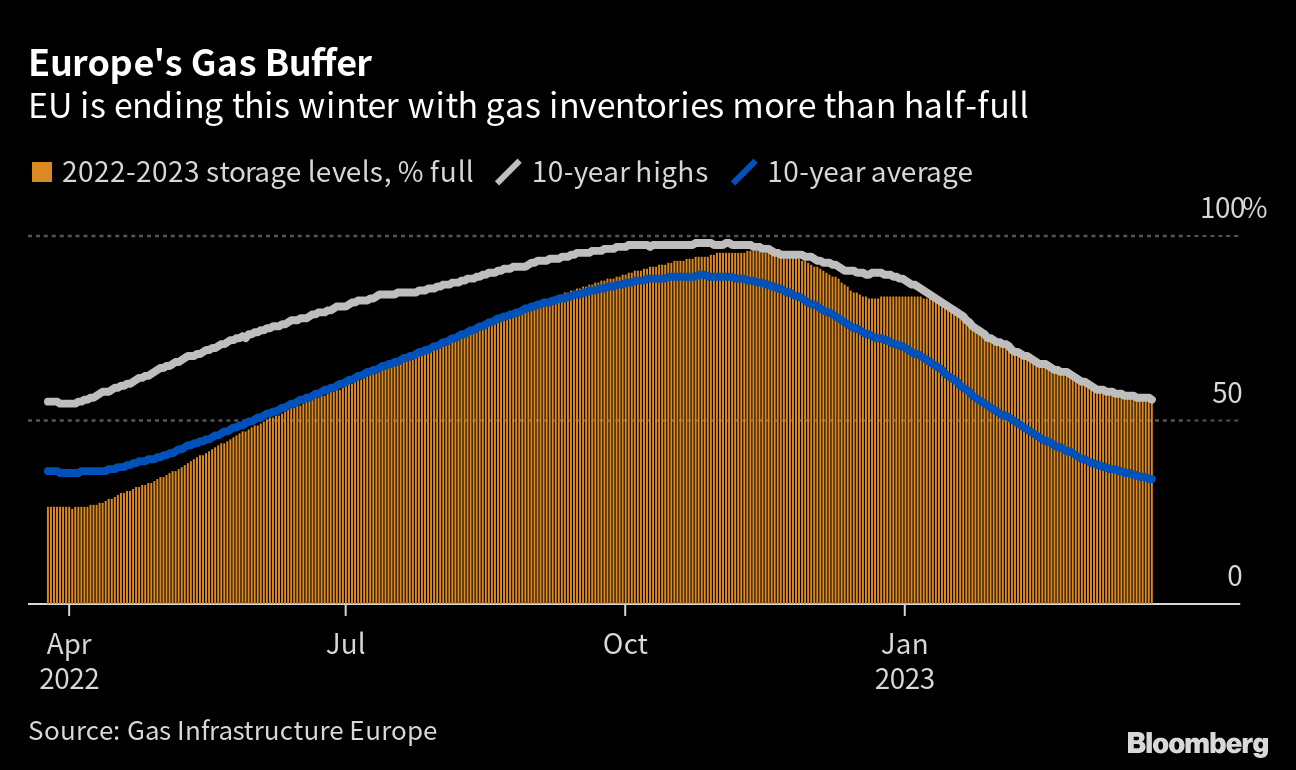

Stockpiles are far fuller than normal for the time of year, with BloombergNEF forecasting next winter’s storage targets will be met early. Still, officials are warning the squeeze may not yet be over as the critical period of replenishing those storage sites begins — this time without significant pipeline flows from Russia.

Frequent bouts of chilly weather have kept concerns about demand alive even though the winter has been mostly mild. A colder-than-normal start to April could prolong the heating season and add pressure to the market.

There’s also evidence that some gas demand is returning following the decline in prices from their peaks last year. European Union energy ministers this week agreed to extend a voluntary consumption cut as the bloc seeks to ensure there are no shortages.

Supply worries are also mounting with protests in France hitting nuclear power output, and blocking liquefied natural gas terminals and oil refineries. Strike action has kept some LNG facilities blocked for three weeks.

But issues in France “have not particularly impacted markets abroad,” said Alfa Energy Ltd in a note. Prices are “likely just a small reaction to panic-inducing headlines, capped by strong fundamentals as we approach the end of the winter season.”

Dutch front-month futures, the benchmark for Europe, were 0.8% higher at €43.11 per megawatt-hour at 3:09 p.m. in Amsterdam. The UK equivalent contract increased 0.1%.

©2023 Bloomberg L.P.