Weak European Industry Is Keeping Gas Demand Depressed

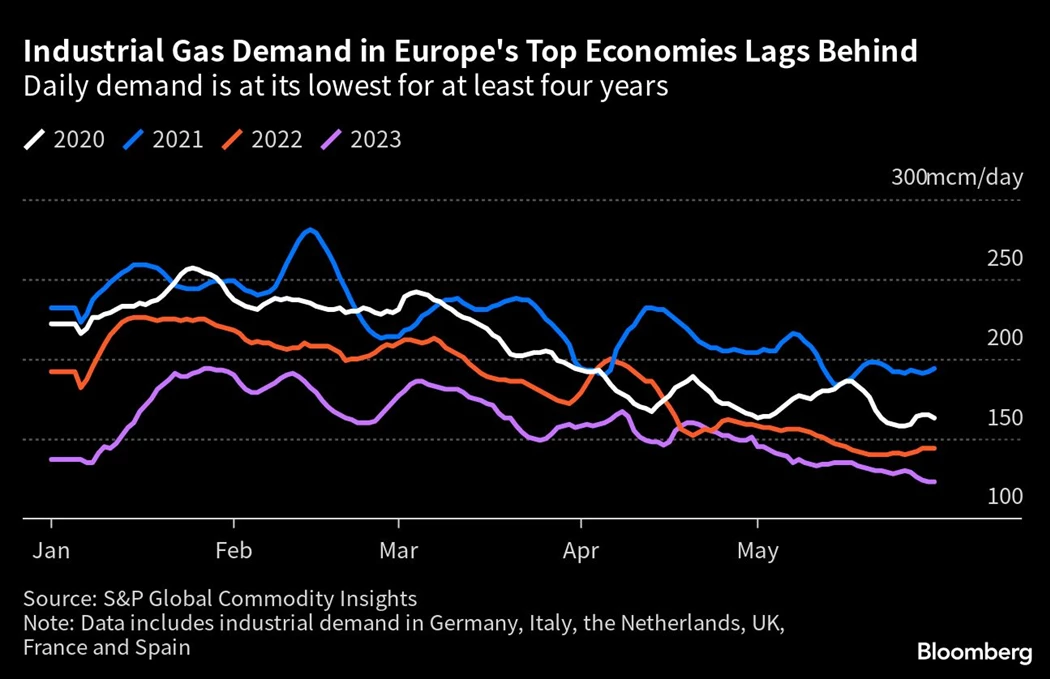

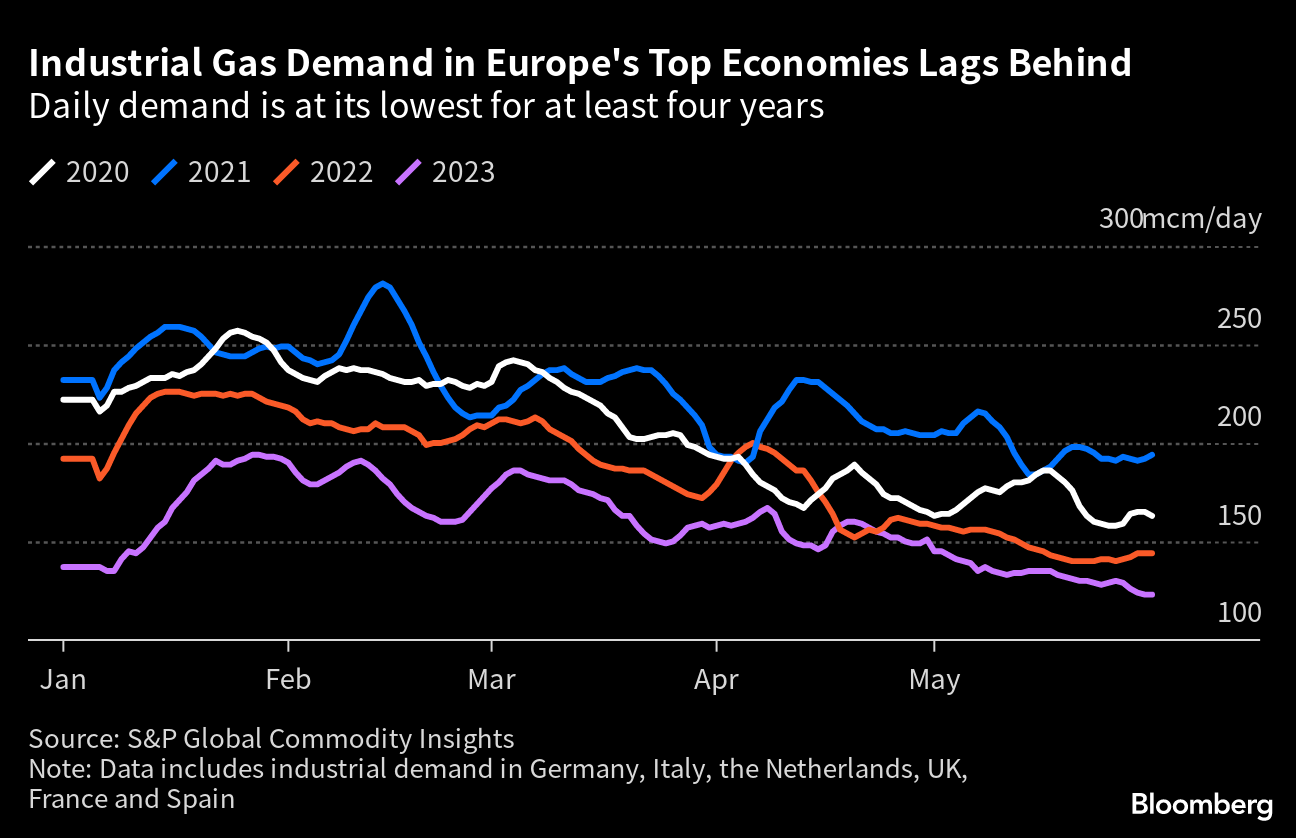

(Bloomberg) -- Industrial demand for gas in Europe’s largest nations remains depressed despite lower prices, as an economic slowdown weighs on consumption and customers pivot toward renewable energy.

Demand for the fuel in Germany, Italy, the Netherlands, France, Spain and the UK fell 9.7% in May from a year earlier, according to data from S&P Global Commodity Insights. That means consumption is lower than levels last year, when the European Union was trying to conserve gas ahead of the winter.

While that’s the smallest decline of any month this year, it underlines that European industries are struggling to bounce back from the energy crisis that followed Russia’s invasion of Ukraine. Industrial activity in the euro area is shrinking, and there are fears that some demand destruction could be permanent.

S&P said there are also specific factors weighing on demand from some of Europe’s most dynamic sectors. In chemicals, an ammonia price collapse has spurred continued imports from the US and Trinidad & Tobago, while seasonal maintenance by refiners lowered gas consumption in May.

The drop in industrial gas demand in May was also particularly acute in recession-hit Germany, with a 15% decline.

Key consumers — from chemical companies to steelmakers — have been reluctant to restore demand after a record surge in energy prices last year prompted them to curb production. That’s contributed to a 60% collapse in benchmark European gas prices this year.

Buyers are also pivoting toward alternative sources — like wind and solar — to power their factories.

EU nations met voluntary targets to reduce gas consumption by 15% between August 2022 and March this year, but that was in part due to a mild winter and higher prices depressing demand. The bloc is seeking to drastically reduce its reliance on Russian fossil fuels.

©2023 Bloomberg L.P.