US Natural Gas Falls Below $2 for the First Time Since 2020

(Bloomberg) -- US natural gas futures fell below $2 for the first time since 2020, extending a massive selloff as traders give up on hopes of extreme cold boosting demand.

Gas for March delivery dropped to $1.987 per million British thermal units on the New York Mercantile Exchange, the lowest since September 2020. The slump in gas prices marks a major reversal in the bullishness that swept across the market last year, when shortage fears sent prices to the highest level in 14 years.

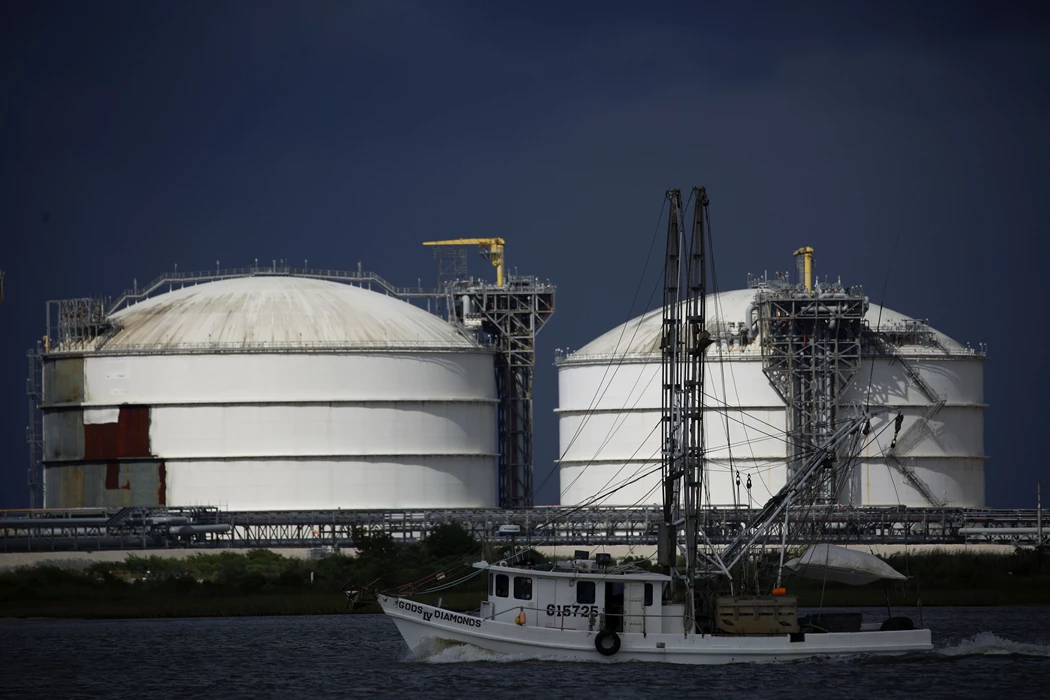

Abnormally mild temperatures this winter have eroded energy demand, causing inventories of the heating and power-generation fuel to swell above usual levels and prices to plunge more than 70% since November. A much-delayed restart of the Freeport LNG terminal in Texas has also weighed on prices as its shutdown after a June explosion curbed export demand.

“The market has been hit with the worst case scenario,” said Bloomberg Intelligence analyst Vincent Piazza. “Hard to imagine how things get worse from here.”

Across the contiguous 48 states, January was the sixth-warmest on record. The six New England states, as well as New Jersey, were warmer than ever recorded, according to the US National Centers for Environmental Information. New York, Pennsylvania and Indiana had their second-warmest January in data going back to 1895.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.