European Gas Surges on Australia LNG Talks and Norway Outages

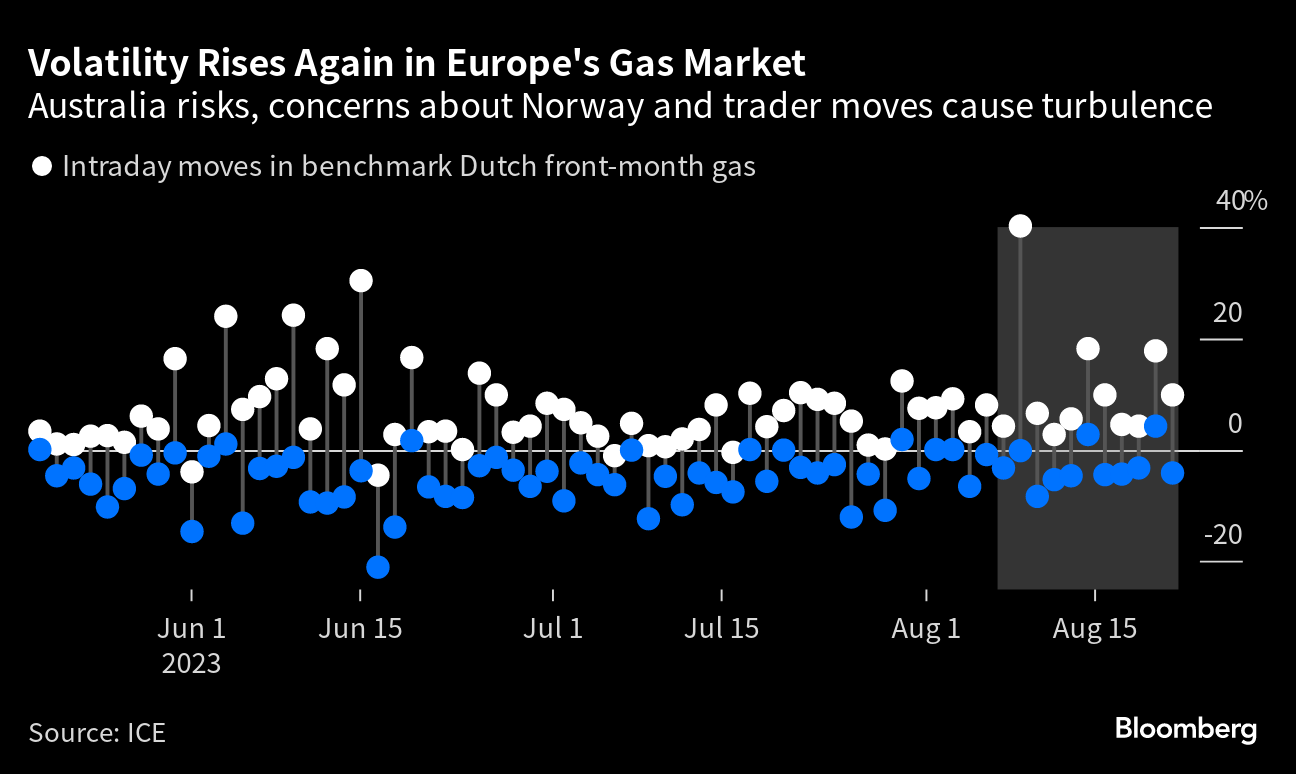

(Bloomberg) -- European natural gas extended gains as heavy maintenance in Norway adds to volatility in a market already spooked by the threat of strikes in Australia.

Benchmark futures rose as much as 9.9% after settling at a two-month high in the previous session as supply concerns intensify. Seasonal works at the giant Troll field, previously scheduled to continue past the summer season, were extended further to Oct. 16, according to Norwegian grid.

Meanwhile, workers serving a key liquefied natural gas plant of Woodside Energy Group Ltd. have threatened to strike as soon as Sept. 2 unless they reach an agreement during scheduled talks on Wednesday. Staff at some Chevron Corp. facilities are also considering walkouts.

The industrial action risks interrupting as much as 10% of global LNG supplies, while Asia and Europe prepare for the winter heating season. Both regions vie for a limited amount of the fuel worldwide.

“The overarching market concern is on Australian exports, and we should get some clarity on that tomorrow,” said James Waddell, head of European gas and global LNG at consultant Energy Aspects Ltd. Potential nuclear output curbs in France over the weekend, due to a heat wave and water restrictions, are lending additional support to gas, he added. Coal and carbon also gained.

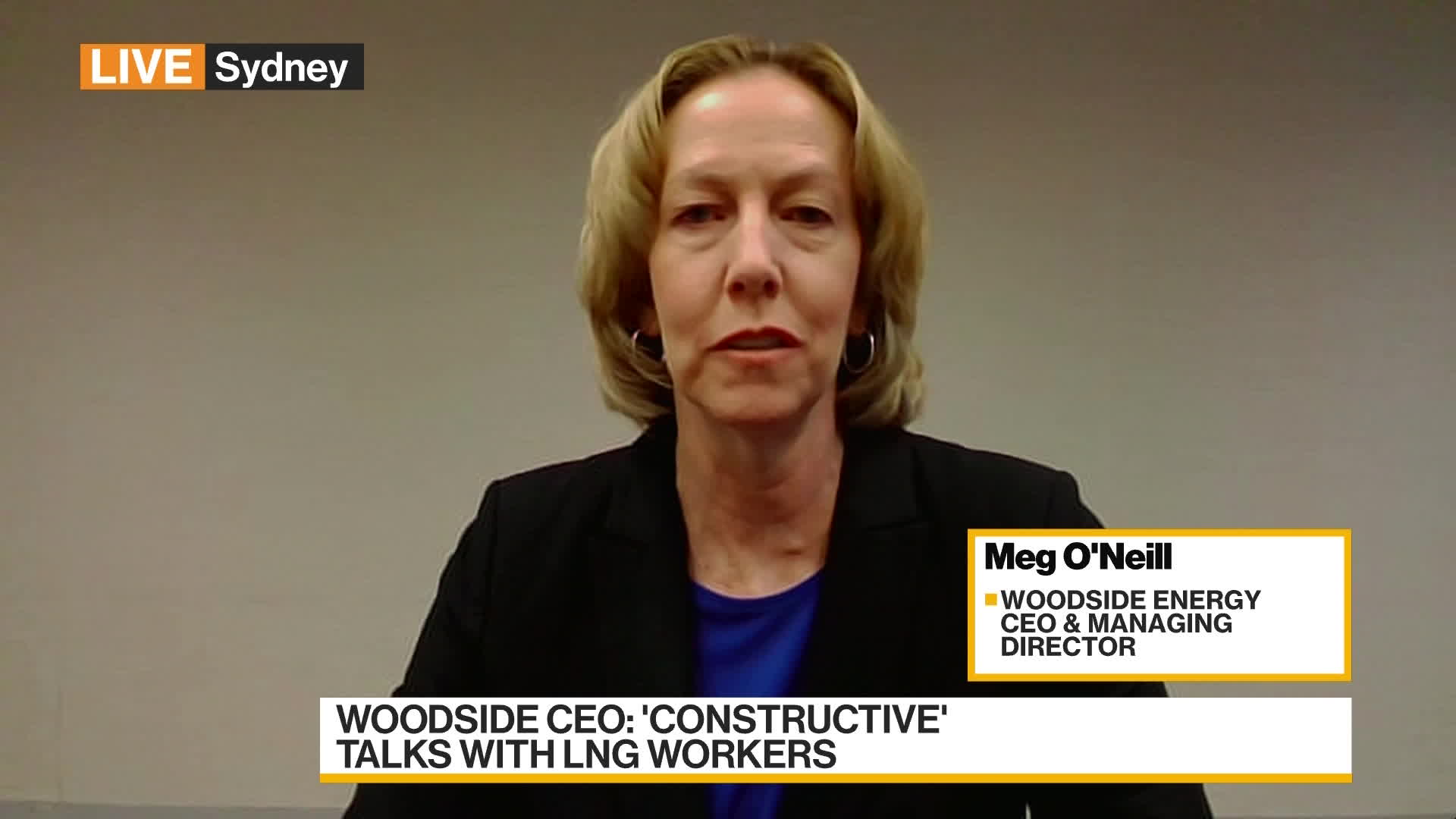

Woodside has said the labor negotiations have been constructive. “Our objective with workers is to come to an enterprise agreement,” Chief Executive Officer Meg O’Neill said in a Bloomberg TV interview.

While the possibility of industrial action has lifted futures in recent days, the impact of any such event depends largely on its duration. The avoidance of walkouts could also trigger volatility.

“If the labor strike is not decided or if production is not disrupted, the market would be so significantly oversupplied with gas and LNG that prices would have to fall ahead of November,” Citigroup Inc. analysts wrote in a note.

Prices are still far below the highs of last year’s energy crisis, and Europe’s gas inventories are at record levels for the season, providing a buffer in the early months of the heating season, which begins in October.

Dutch front-month futures, Europe’s gas benchmark, traded 5.2% higher at €42.90 a megawatt-hour by 4:22 p.m. in Amsterdam. The UK equivalent advanced 4.3%

©2023 Bloomberg L.P.