World Gas Supply Shifts From Shortage to Glut With Demand Muted

(Bloomberg) -- The world is becoming awash with natural gas, pushing prices lower and creating an overabundance of the fuel in both Europe and Asia — at least for the next few weeks.

The trend has been a rare sight over the past year since the war in Ukraine upended energy markets and Europe rushed to secure as many alternative supply sources as possible.

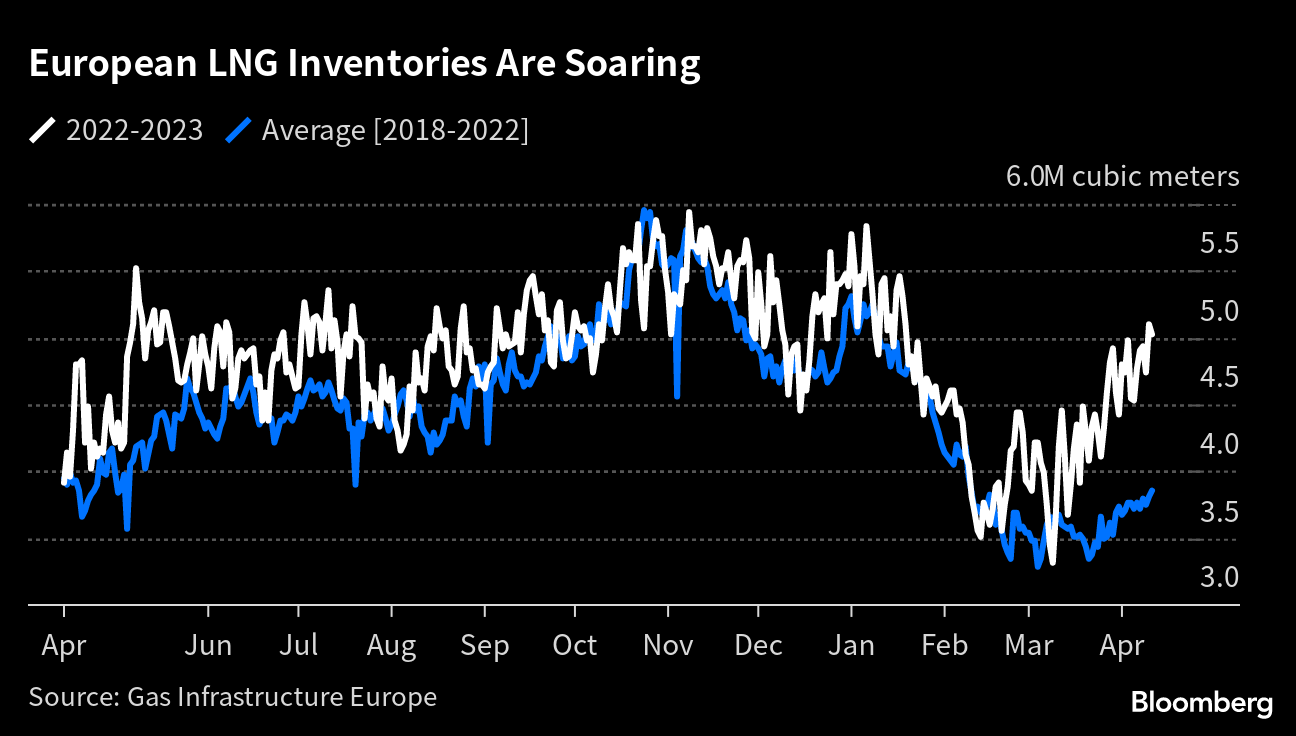

Now, inventories are filling up from South Korea to Spain, a result of mostly mild winter weather and efforts to reduce consumption. Tankers filled with liquefied natural gas — a stopgap in replacing lost Russian pipeline flows — now often struggle to find a home, spending weeks idling at sea.

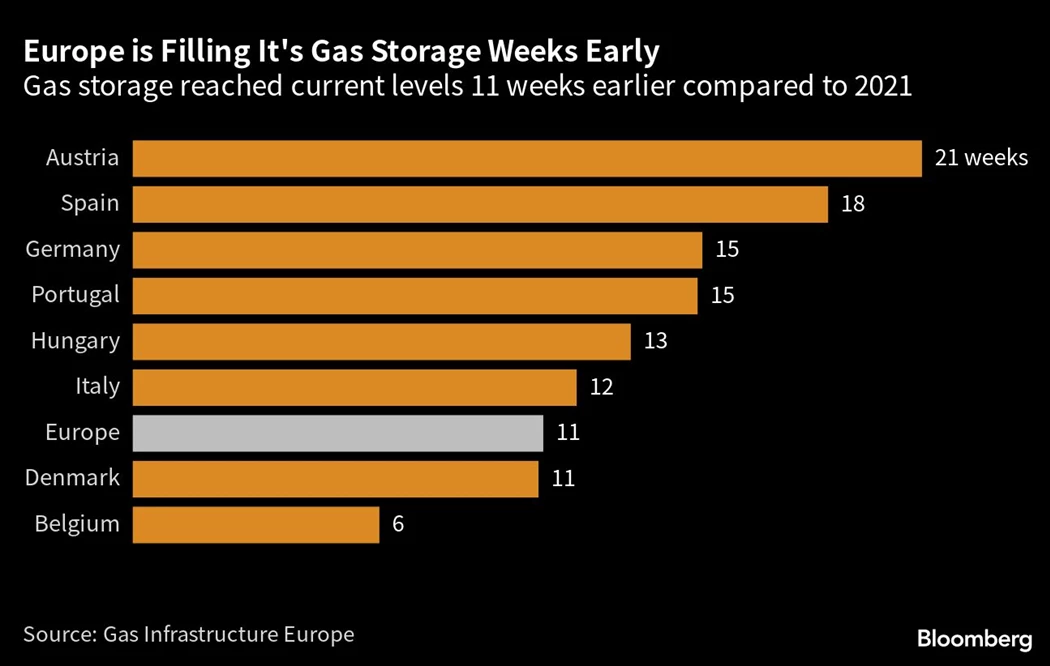

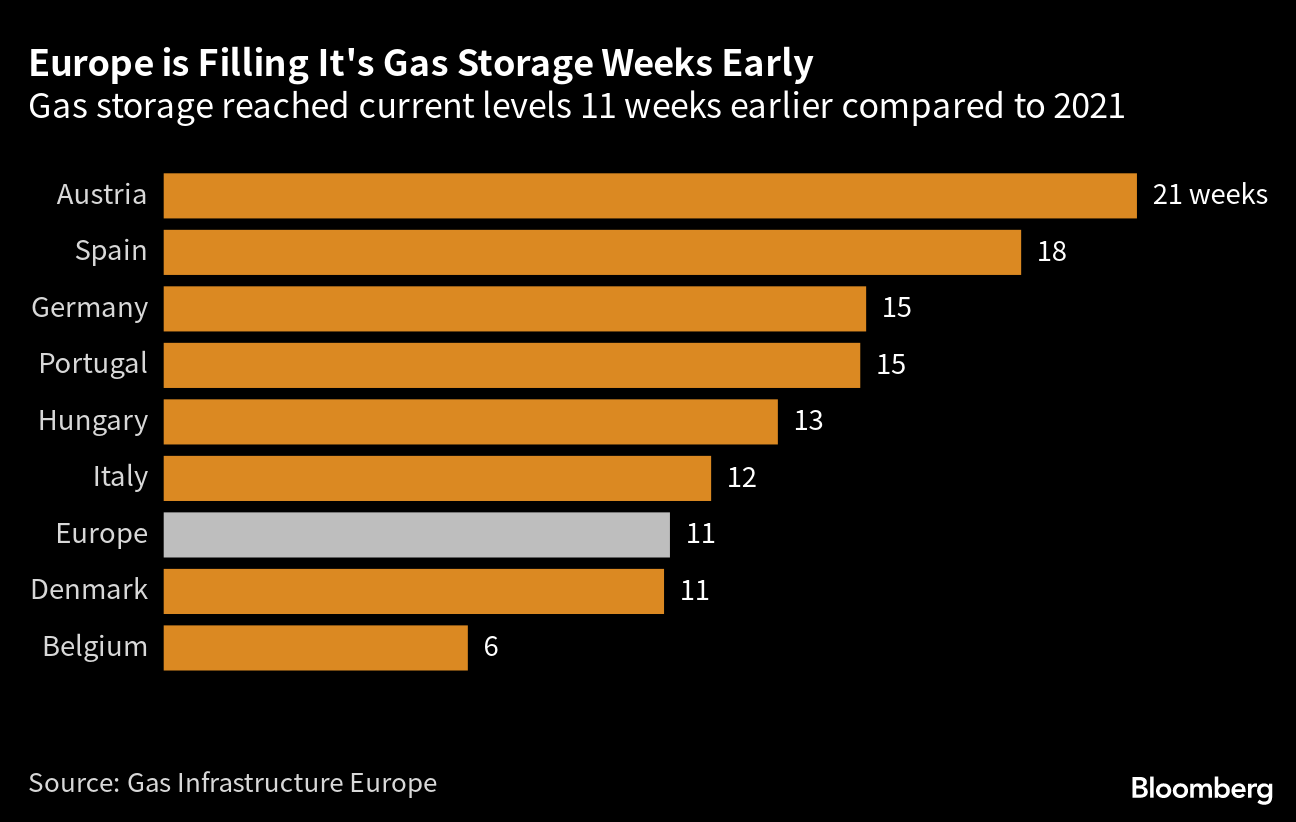

Demand for gas typically slides as the heating season ends, before hotter weather lifts cooling needs later in the summer. The fuel then mainly goes into storage sites to prepare for the next season, but this year, refilling efforts in Europe may be completed as early as late August, Morgan Stanley said.

“There does appear to be a brief gas glut that should sustain pressure on LNG prices in the next few weeks, potentially nudging benchmarks slightly lower,” said Talon Custer, a Bloomberg Intelligence energy analyst.

While gas prices in Europe and Asia have plummeted from last year’s highs, they’re still well above the average of the last ten years, signaling possible concern that the current glut could disappear. Custer says prices “may be close to a floor” as cheaper gas costs could spur additional demand.

All eyes are on the summer weather, as any extreme heat and droughts could boost consumption. By the beginning of the third quarter, importers will start to prepare for the winter, heating up competition for LNG cargoes, Custer said.

But for now, the glut is spreading.

From Spain to China

In Spain, home to the most LNG terminals in Europe, gas storage is already 85% full, meaning the nation’s market could quickly turn to overcapacity and weigh on spot prices, RBC Capital Markets said.

In Finland, LNG import slots for the summer period were reduced to 10 from 14, in part due to an expected reduction in demand. Europe rapidly installed mobile LNG import terminals as it cut dependency on Russian pipeline gas, and more will be added this year and next.

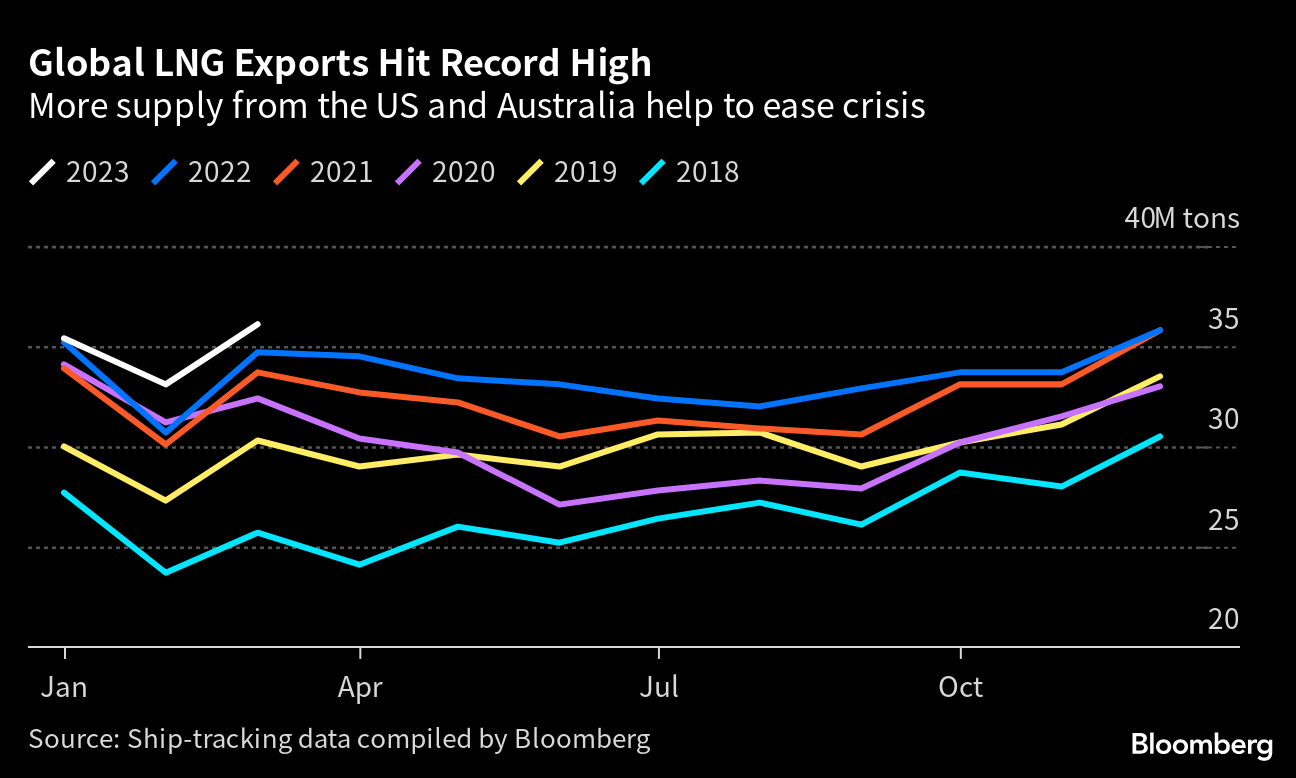

Meanwhile, global LNG exports rebounded in March to an all-time high due in part to a recovery in US production. The additional supply is contributing to lower prices as traders struggle to find a home for shipments.

The UK’s exports of gas to the continent are surging as the nation lacks large storage sites, and LNG keeps flowing at record rates for the time of the year. In addition, China saw record re-exports of LNG amid a slow recovery after pandemic restrictions were lifted, and some vessels are diverting from another major LNG importer, South Korea. Japan, a big buyer, is also offering to sell shipments to stave off an oversupply at home.

In South America, demand remains weak until Argentina deploys its second floating import terminal in May, in time for colder weather in the Southern Hemisphere, said Leo Kabouche, an analyst at Energy Aspects Ltd.

Still, planned annual maintenance at gas facilities from late April through the summer could put a lid on excessive supply. Other risks remain, too, from further cuts to Russian deliveries or unexpected outages. Global LNG supply is largely expected to remain limited for another two years.

That’s reflected in forward prices, which are seen higher in the coming months and in particular in the winter, and remain elevated through the start of 2025.

“For 2023, the European gas balance is much more fragile” than last year, the French Institute of International Relations said in a note last week. “Any slight disruptions in supplies can have major impacts.”

©2023 Bloomberg L.P.