European Gas Prices Advance on Russian Pipeline Uncertainty

(Bloomberg) -- European natural gas prices rose for a fourth consecutive session, with little clarity on future flows via a major Russian pipeline.

While the Nord Stream pipeline is sending gas to Germany at a consistent rate of 40% of capacity following the end of maintenance on July 21, Russian President Vladimir Putin last week warned that this could decline to 20% if a turbine isn’t received in time to replace another that’s likely to need repairs. Benchmark European prices climbed as much as 6.7%.

The critical piece of equipment is still in Germany after missing a ferry sailing on Saturday to Helsinki amid paperwork delays, Russian newspaper Kommersant reported. If the documents are exchanged, it could be transported in the next few days, it said. The component was first stranded in Canada after routine repairs because of sanctions on Russia over its invasion of Ukraine.

The Kremlin tried to ease the market on Monday, saying the repaired component will be re-installed, but warned that any further sanctions on Russia may weigh on how much gas it can supply to Europe.

“The turbine will be installed after all the technological formalities have been completed, and the flows will be at the levels that are technologically possible,” Kremlin spokesman Dmitry Peskov said. The situation may change “if Europe continues its course of absolutely recklessly imposing sanctions and restrictions,” he said.

Uncertain about the future level of Russian flows, the European Union is on a mission to save as much gas is possible ahead of the peak winter demand season. The European Commission President Ursula von der Leyen called on all EU member states to participate in the effort to save gas, regardless of how dependent they are on Russia for the fuel.

German Companies Must Save More Gas, Network Agency Says

“Putin has suggested that if the turbine is not back early this week then gas flow may fall to 20% capacity even though originally this turbine wasn’t expected to be needed until September,” Deutsche Bank AG said in a research note. “So watch out for gas politics.”

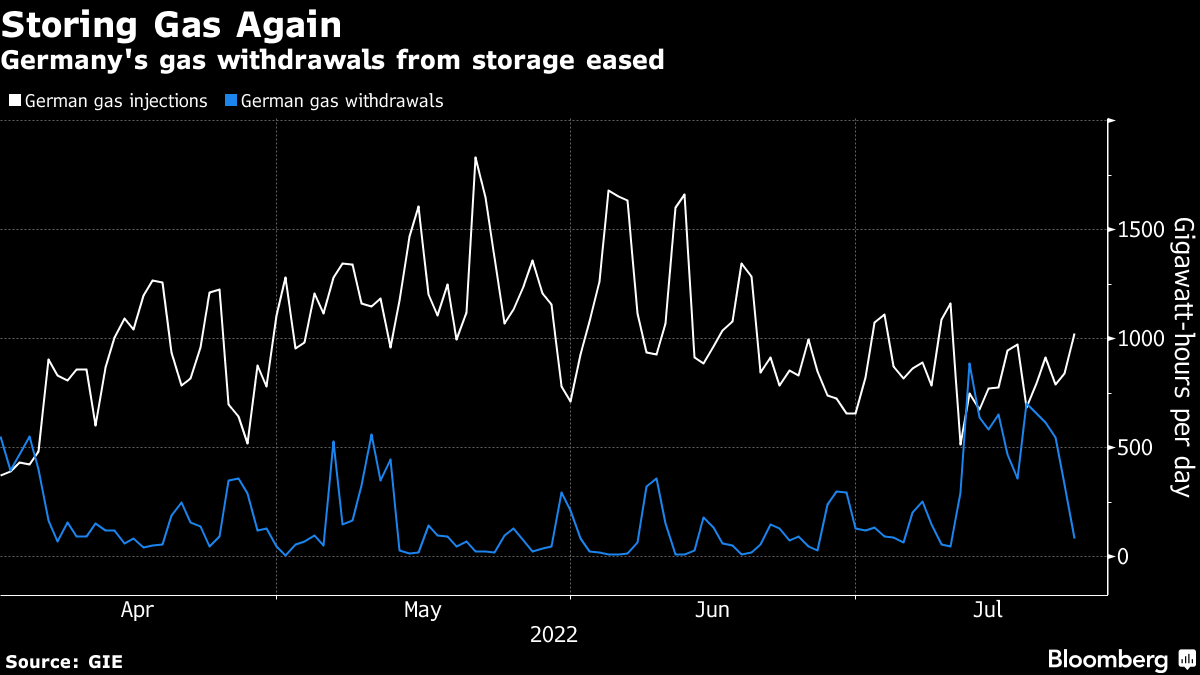

Still, even limited volumes via Nord Stream have helped Germany and its embattled utility Uniper SE stabilize gas storage levels.

Inventories are now at 65.9%, and the country’s storage is back on a “proper path,” according to federal network agency BNetzA. Germany’s next goal is to reach 75% by Sept. 1, in line with a government target announced last week, Klaus Mueller, head of the agency, said in a Twitter post on Monday.

Uniper, which was bailed out by the government last week, had to take gas from its storage sites in Germany when Russian flows dwindled. Its storage facilities in Germany resumed injections on Saturday and are now 53.1% full, data from Gas Infrastructure Europe show. A Uniper spokesman confirmed the company is filling its own booked storage capacities again.

Nord Stream flowing at only 40% of capacity “is not enough for Germany’s energy hunger and there is still great uncertainty on whether the Russian leadership will turn off the gas tap completely,” said Claus Niegsch, industry analyst at DZ Bank. “This is particularly worrying for industrial companies, because planning for the coming months is becoming increasingly difficult.”

Dutch front-month futures, the European benchmark, rose 4.7% to 167.42 euros per megawatt-hour by 12:13 p.m. in Amsterdam. UK front-month gas edged down 2.6%.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.