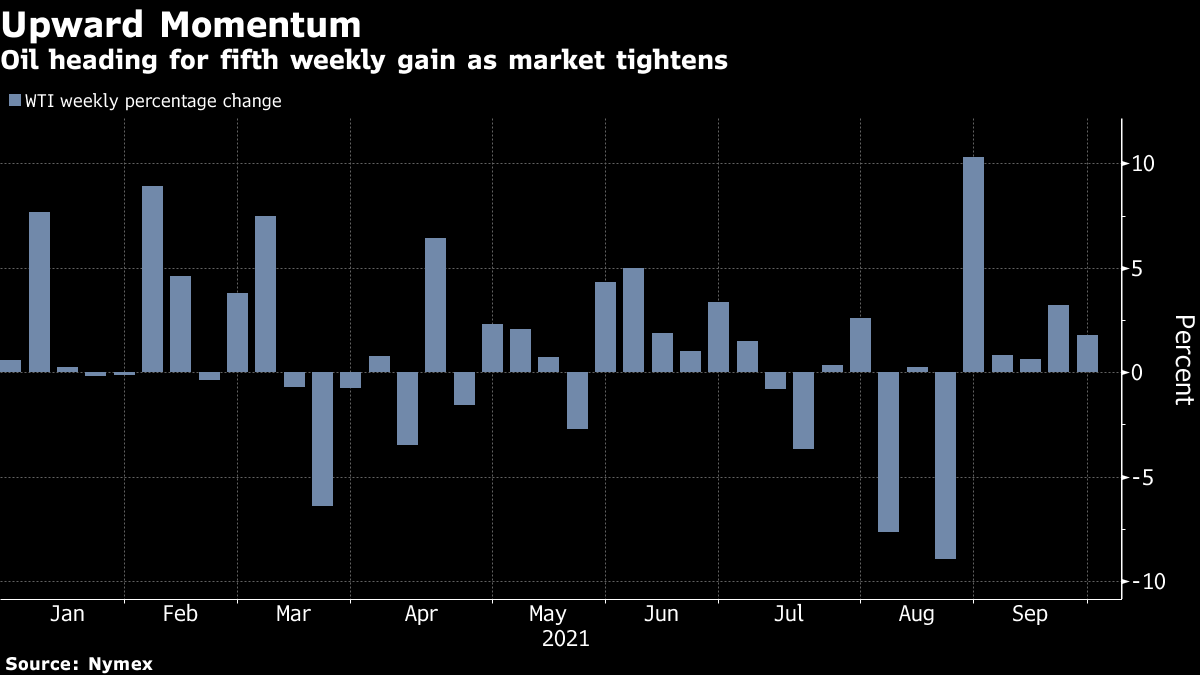

Oil Heads for Fifth Weekly Gain on Global Market Tightening

(Bloomberg) -- Oil was poised for a fifth weekly gain as the market tightened amid a global energy crunch that’s set to increase demand for crude.

Futures in New York held above $73 a barrel, while global benchmark Brent traded near its highest settlement since 2018. Crude inventories have shrunk from Europe to the U.S., even as OPEC+ adds more supply, with demand for oil products in power generation expected to climb following a surge in natural gas prices ahead of the northern hemisphere winter.

China, meanwhile, sold oil to Hengli Petrochemical Co. and a unit of PetroChina Co. in the first auction of crude from its strategic reserves, said traders with knowledge of the matter. Grades sold included Oman, Upper Zakum and Forties.

Oil has rallied recently after a period of demand uncertainty due to the rapid spread of the delta variant of the coronavirus, with some of the world’s largest traders and banks predicting that prices could climb even further on the energy crunch. Global crude consumption could rise by an additional 370,000 barrels a day if natural gas remains elevated for an extended time, OPEC said.

“The oil market will tighten at a quicker-than-expected pace in the coming months, which should prove supportive for prices,” said Warren Patterson, head of commodities strategy at ING Groep NV. “Tightness in the gas market has spilled over into oil, with demand set to benefit from substitution.”

Brent has firmed in a bullish structure as the market has tightened. The prompt timespread was 80 cents in backwardation -- where near-term contracts are more expensive than later-dated ones. That compares with 56 cents at the start of the month.

Oil is most likely headed above $80 a barrel, partly as higher natural gas prices boost demand, Vitol Group Chief Executive Officer Russell Hardy said in an interview on Thursday. Goldman Sachs Group Inc. is predicting that crude could surge to $90 if winter is colder than normal.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.