An Australian Oil Giant Will Be Paid to Bury Its Own Emissions

(Bloomberg) -- Australian taxpayers will soon be helping to foot the bill for the emissions reduction efforts of one of the nation’s largest fossil fuel companies.

Santos Ltd. on Monday sanctioned the first carbon capture and storage project eligible for funding under a controversial change to a government program that pays companies to lower emissions. The move is another sign of the continued support for fossil fuels by Prime Minister Scott Morrison, who later spoke at the COP26 climate summit in Glasgow, Scotland, and whose proposals to reach net zero by 2050 have been widely criticized.

“It’s Australian taxpayers subsidizing the fossil fuel industry as opposed to the fossil fuel industry being made to pay even remotely a small share of their cost of doing business,” said Tim Buckley, a director at the Institute for Energy Economics and Financial Analysis. “The absolute core priority of the government -- the gas-led recovery -- is all about supporting more fossil fuel production.”

Adelaide, South Australia-based Santos declined to comment on taxpayer funding of the facility. The company’s A$220 million ($165 million) Moomba project, which will also receive a federal grant, plans to store 1.7 million tons of greenhouse gases annually in underground reservoirs from 2024 after capturing it from a nearby plant that processes the region’s natural gas.

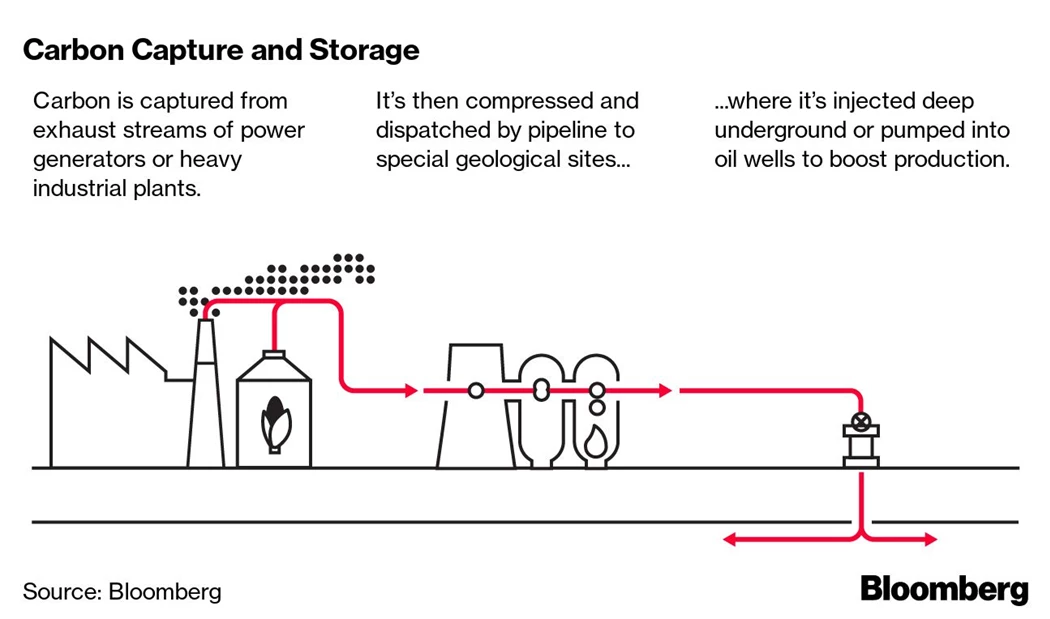

CCS is one of the key technologies being promoted by the government as part of its roadmap to reaching net-zero greenhouse gas emissions by 2050, yet critics argue that it helps prolong the use of fossil fuels.

Moomba will qualify for carbon credits for a 25-year period, at a likely cost to the taxpayer of at least A$720 million, according to Buckley. His calculations are based on the current prices the government pays for Australia carbon credits of around A$17 per ton, a level which he said was likely to rise in the years ahead as the demand for offsets increases. Prices on the voluntary market, where companies can buy the allowances to help offset their own emissions, are normally higher.

“This is the first time a national government will award tradable, high-integrity carbon credits to large-scale projects that capture and permanently store carbon underground,” Energy Minister Angus Taylor said in a statement on Tuesday.

The government’s Emissions Reduction fund was established in 2015 to purchase abatement in the form of carbon credits from eligible projects. Up to now those have primarily been in the agriculture sector. Santos’s Managing Director and Chief Executive Officer Kevin Gallagher had previously said that enabling it to generate credits was essential for the project to stack up economically.

Moomba CCS was an “important milestone” on the company’s path to hitting net-zero emissions from its operations by 2040, Gallagher said in a statement on Monday, while the International Energy Agency has said that it will be almost impossible for the world to reach net-zero without CCS. Still, the technology has had only mixed success. Chevron Corp.’s multibillion dollar project at its Gorgon liquefied natural gas facility in Western Australia went over time and budget, missing targets set by the state government.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.