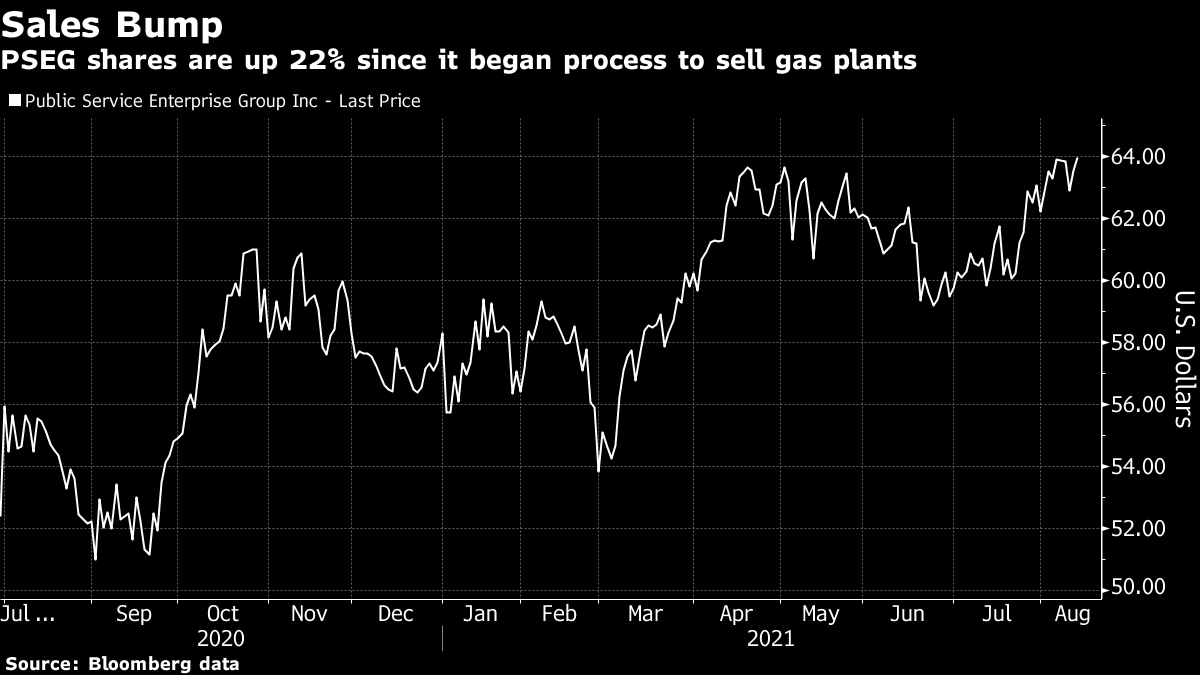

New Jersey Utility PSEG to Sell Fossil Fuels Plants for $1.92 Billion

(Bloomberg) -- Public Service Enterprise Group, New Jersey’s largest utility owner, reached a deal to sell a portfolio of natural gas-fired power plants for about $1.92 billion as part of its effort to reorient the company and curb its carbon emissions.

The sale to a fund controlled by ArcLight Capital Partners is scheduled to close by the first quarter of 2022, according to a statement Thursday. The shares gained 0.7% to $64.05 at 10:26 a.m. in New York.

The move is part of a plan announced in July 2020 to exit the wholesale power business to become a mainly regulated power and gas utility. It closed its last coal power plant at the end of May, a few weeks after striking a deal to sell most of its solar farms. In June, PSEG announced an ambitious effort to eliminate greenhouse gases by 2030, two decades ahead of its earlier target.

“This transaction continues our evolution toward a clean energy infrastructure-focused company that will enable our increasingly low-carbon economy,” PSEG Chairman, President and CEO Ralph Izzo said in the statement. “PSEG is on track to realize a more predictable earnings profile.”

While the company is pushing to shed its fossil-fuel plants, the New Jersey region will continue to require the around-the-clock power that gas plants provide. So the assets it’s selling to ArcLight’s fund are likely to remain in use for years to come.

If gas remains cheap and the U.S. doesn’t begin regulating carbon emissions more aggressively, “there’s definitely a role for nat gas, at least over the next decade,” Ethan Zindler, head of Americas research at BloombergNEF, said by email.

ArcLight, a private-equity firm, has been among the more active buyers of power plants, including coal and other U.S. gas assets. Such deals are expected to pick up as U.S. utilities face pressure from shareholders to reduce their greenhouse gas emissions.

In March, an affiliate of ArcLight agreed to buy 4,850 megawatts of generation from NRG Energy Inc., an independent power producer and retailer, in a $760 million deal. The firm previously teamed up with Blackstone Group to buy four power plants from American Electric Power Co. for $2.17 billion. The Boston-based firm has spent more than $23 billion on energy infrastructure since it was founded in 2001, including hydropower, renewables, gas pipelines, oil refineries and asphalt distribution.

Gas Is the New Coal With Risk of $100 Billion in Stranded Assets

PSEG is part of a growing wave of U.S. utilities that are selling or closing merchant-power assets, especially those that are significant drivers of climate change, to focus on less-volatile assets.

After deregulation in the 1990s, many U.S. utilities continue to own power generation even while operating in competitive power markets as a natural hedge for meeting customer needs. They have become more of a burden in recent years with the collapse in electricity prices squeezing margins because of the shale gas boom of the past decade and now the advent of cheap wind and solar.

Selling off its fossil-fuel plants is a key part of PSEG’s goal to reach net-zero emissions by 2030. It is retaining its nuclear assets, including the Salem and Creek nuclear plants in New Jersey that supply about half of the state’s electricity.

As part of the transaction, PSEG will take a impairment charge starting this quarter of as much as $2.2 billion.

“Their main goal was to exit the business,” said Kit Konolige, utility analyst with Bloomberg Intelligence. “They probably weren’t likely to be picky about the price.”

(Updates with share price in second paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.