Oil Extends Decline for Fourth Session on Hawkish Fed Outlook

(Bloomberg) -- Oil extended losses after closing at the lowest level in three months on Wednesday on signs the Federal Reserve may hold interest rates higher for longer, which could weigh on energy demand.

Brent fell for a fourth session toward $81 a barrel and West Texas Intermediate slid close to $77. Fed minutes from a meeting earlier this month indicated a hawkish stance from officials. That adds another bearish element to an oil market showing signs of weakness ahead of an OPEC+ gathering.

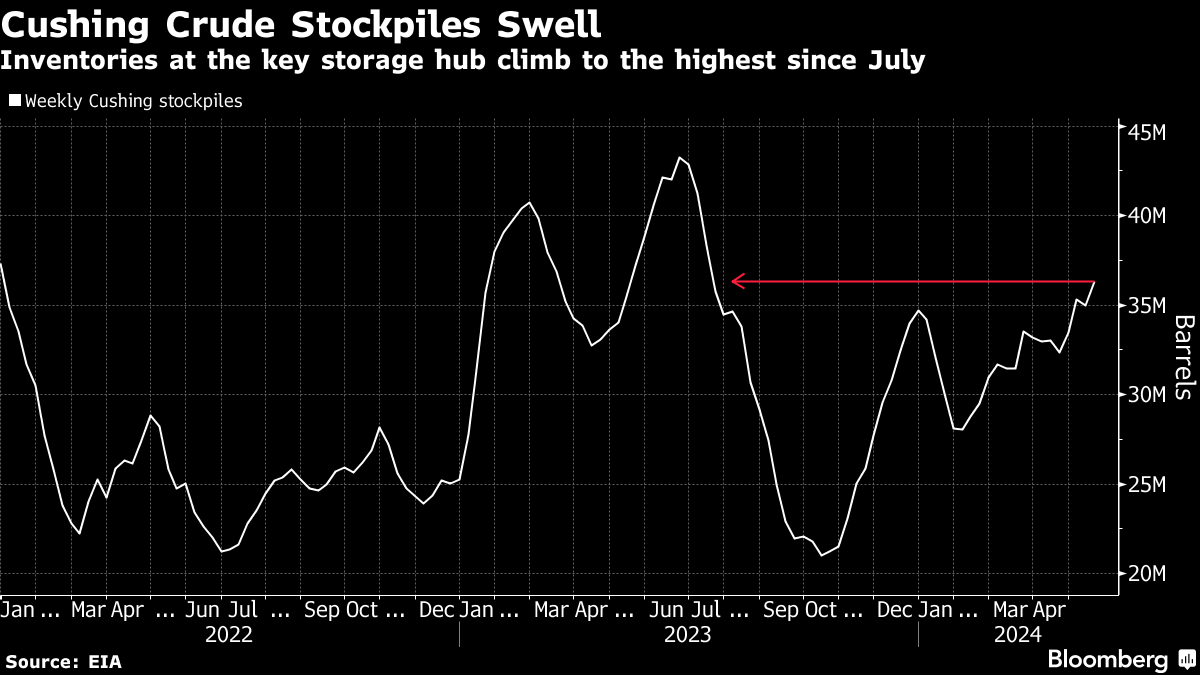

Oil is still higher this year in part due to supply cuts from the producer group, although prices have eased since mid-April. US crude stockpiles rose last week, while inventories at the storage hub at Cushing, Oklahoma, swelled to the highest level since July, according to government data.

“Oil is overall in a bearish momentum,” said Gao Mingyu, Beijing-based chief energy analyst at SDIC Essence Futures Co. “The biggest focus is still whether voluntary production cuts will be prolonged at the OPEC+ meeting.”

The cartel is scheduled to meet on June 1 and the group is largely expected to extend its current output cuts. Alliance member Russia exceeded its production commitment in April and has pledged to make up for the extra supply, the nation’s Energy Ministry said Thursday.

Market measures that are flashing signs of weakness include the prompt spread for Brent, which is close to a bearish contango structure. That would indicate ample supply. Money managers have also trimmed their bets on rising prices.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Woodside Looks to Build ‘Dream Team of LNG’ at Acquired US Plant

Eni signed exclusivity agreement with KKR for the potential sale of a minority stake in Enilive

Woodside's quarterly revenues exceed $3 billion backed by strategic milestones

Oil Rises as Biden Quits US Race, Blazes Threaten Canadian Wells

Kamala Harris Seen as Tougher Oil Industry Opponent Than Biden

PetroChina joins Oil and Gas Decarbonisation Charter

Galp reports 16% rise in Q2 2024 net profit amid higher oil prices and lower production costs

Nigeria’s Dangote Refinery Targets Output of 550,000 Barrels a Day

Oil Falls With Broader Commodity Weakness Amidst Listless Trade

Occidental Planning to Sell Bonds in Up to Five Parts

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

Partner content

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape