Oil Extends Decline as Market Metrics Point to a Weaker Outlook

(Bloomberg) -- Oil fell as metrics showed signs of a weaker market despite an uptick in geopolitical tensions before an OPEC+ meeting on supply.

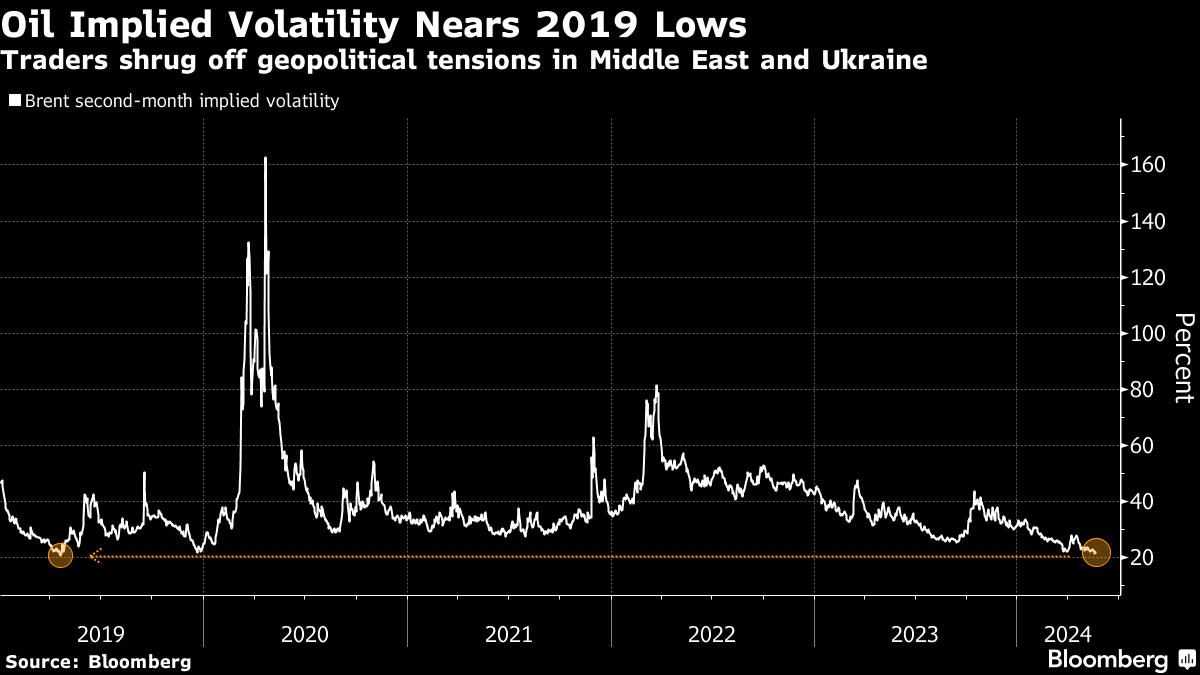

Brent’s prompt spread narrowed to its smallest backwardation since January, while money managers continued to reduce bets on gains. Futures have been trading in a tight range, with implied volatility near the lowest since 2019.

The global benchmark dropped toward $83 a barrel, after ending 0.3% lower on Monday, while West Texas Intermediate was near $79, despite more Ukrainian drone attacks on Russian refineries, and another Houthi strike against a tanker in the Red Sea over the weekend.

Oil is about 8% higher this year due to the OPEC+ cuts, but Brent has eased since mid-April. Traders are looking to a meeting of the cartel in early June that will set the group’s supply policy for the second half, with market watchers largely expecting a rollover of curbs.

The value of swaps tied to physical North Sea cargoes was negative for the first time since February on Monday, adding to the bearish signs. Some refiners have also cut processing rates, citing poor demand for fuels.

“Dented demand prospects are casting a shadow over the oil markets,” said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova Pte in Singapore. “Whatever support we see in oil prices is purely a function of an anticipatory disruption in supplies, and it’s becoming tougher day by day to justify that premium,” she said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Woodside Looks to Build ‘Dream Team of LNG’ at Acquired US Plant

Eni signed exclusivity agreement with KKR for the potential sale of a minority stake in Enilive

Woodside's quarterly revenues exceed $3 billion backed by strategic milestones

Oil Rises as Biden Quits US Race, Blazes Threaten Canadian Wells

Kamala Harris Seen as Tougher Oil Industry Opponent Than Biden

PetroChina joins Oil and Gas Decarbonisation Charter

Galp reports 16% rise in Q2 2024 net profit amid higher oil prices and lower production costs

Nigeria’s Dangote Refinery Targets Output of 550,000 Barrels a Day

Oil Falls With Broader Commodity Weakness Amidst Listless Trade

Occidental Planning to Sell Bonds in Up to Five Parts

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

Partner content

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape