Oil Ekes Out Second Monthly Gain as Spreads Point to Tightness

(Bloomberg) -- Oil steadied to head for a second monthly gain on expectations that OPEC+ will opt to extend supply cuts, with underlying market metrics pointing to a gradual tightening of near-term conditions.

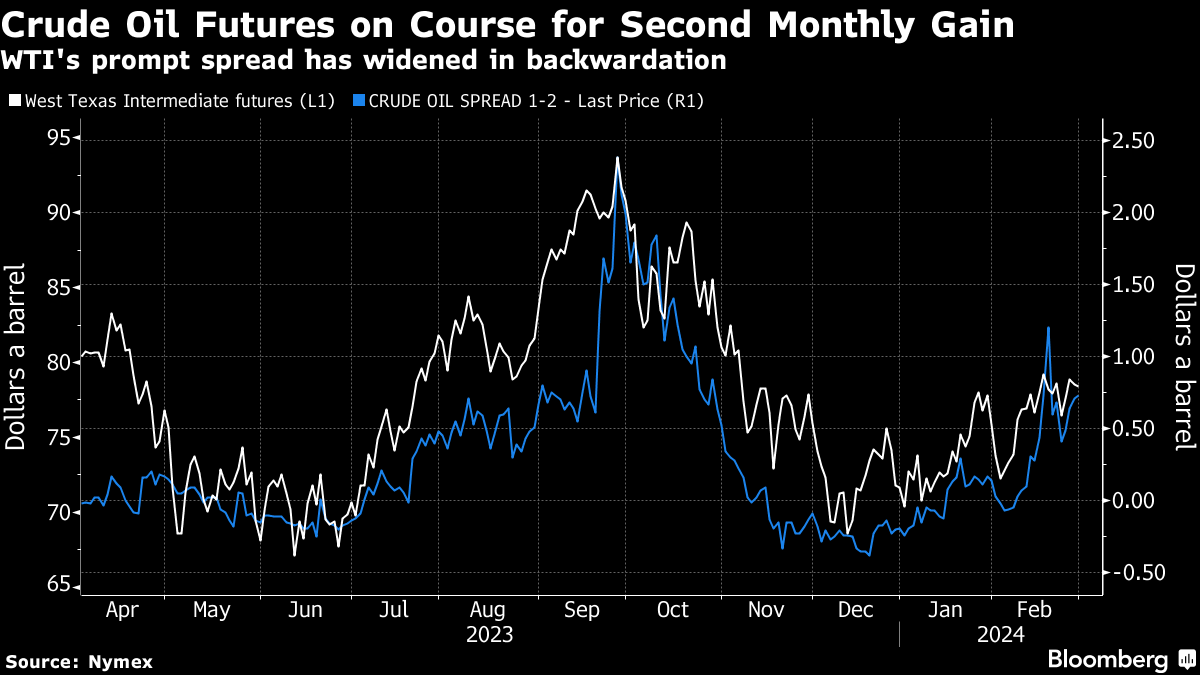

Global benchmark Brent was little changed below $84 a barrel, up more than 2% in February following a bigger gain the month before. West Texas Intermediate was above $78. Crude timespreads have widened further into backwardation, a bullish pattern marked by near-term prices above longer-dated ones.

Crude’s back-to-back monthly advance has lifted prices to the upper end of what’s been a tight year-to-date trading band. The climb has been supported by supply cuts from OPEC and its allies, and the group is widely expected to agree to prolong the reductions into the second quarter. Tensions in the Middle East, including disruptions to Red Sea shipping, have also aided prices.

The market “does feel relatively tight,” according to Trafigura Group’s Chief Economist, Saad Rahim, who cited factors including “signs of life” in global manufacturing and petrochemicals. “You’re hearing the phrase ‘upside risk’ a lot more than you have in the past couple of years.”

WTI’s prompt spread — the difference between its two nearest contracts — was 73 cents a barrel in backwardation. That’s up from 11 cents a month ago, and a shift from contango pricing — the opposite pattern — at the end of December.

Russia’s Deputy Prime Minister Alexander Novak said earlier this week that it was too soon to say whether voluntary output cuts by OPEC+ nations would be extended, according to a report from Interfax. Still, banks including Goldman Sachs Group Inc. have said they expect the reductions would be prolonged.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Eni signed exclusivity agreement with KKR for the potential sale of a minority stake in Enilive

Woodside's quarterly revenues exceed $3 billion backed by strategic milestones

Oil Rises as Biden Quits US Race, Blazes Threaten Canadian Wells

Kamala Harris Seen as Tougher Oil Industry Opponent Than Biden

PetroChina joins Oil and Gas Decarbonisation Charter

Galp reports 16% rise in Q2 2024 net profit amid higher oil prices and lower production costs

Nigeria’s Dangote Refinery Targets Output of 550,000 Barrels a Day

Oil Falls With Broader Commodity Weakness Amidst Listless Trade

Occidental Planning to Sell Bonds in Up to Five Parts

Bolivia’s YPFB to invest $400 million in new hydrocarbon exploration and development

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

Partner content

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape