Iron Ore’s Reset to $100 Heralds China’s New Economy Shift

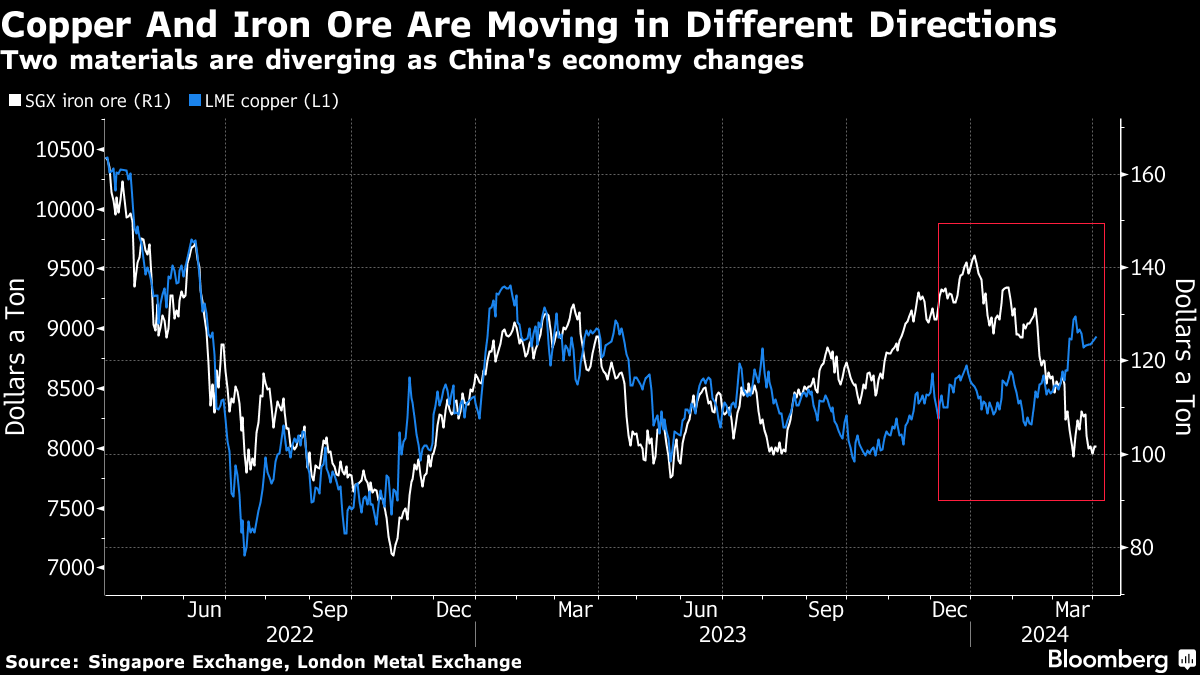

(Bloomberg) -- Iron ore’s reset to around $100 a ton is indicative of a broader reshaping of China’s commodities markets that favors the new economy over the old.

The steelmaking material plunged to $95.40 a ton on Monday, a 10-month low, before nosing back into three figures, testimony to the damage still being wrought by a years-long property crisis that appears far from over. In early January, Singapore futures hit $143.50 a ton, their highest since June 2022. They last traded at $100.85, marking a 30% slump.

Iron ore’s weakness comes amid tentative signs that the wider economy is beginning to heal. Factory activity snapped a five-month contraction in March, beating estimates and adding to modest signs of recovery.

That divergence between a manufacturing-led upswing and a languishing property market is likely to deepen as Beijing pursues new drivers of growth in sectors like renewable energy and advanced technology. At its peak in 2018, real estate accounted for nearly a quarter of China’s economy, according to Bloomberg Economics. Now it’s less than a fifth.

Property still makes up the bulk of steel demand. But Beijing has held off on delivering the degree of fiscal stimulus — principally infrastructure spending — that could fully offset the housing crash. Ballooning debt levels at local governments are one obstacle. Meanwhile, the usual lift to construction activity in the spring has also failed to properly materialize, creating uncertainty over when consumption might revive.

China’s mills including Angang Steel Co. and Maanshan Iron & Steel Co. reported worse-than-expected net losses in their 2023 earnings reports. Maanshan warned that conditions “will remain grim due to the mismatch between supply and demand in 2024.”

All to say, President Xi Jinping’s crackdown on property and his drive for “new productive forces” could well herald an era in which iron ore and steel play a lesser role to the metals set to benefit from the energy transition.

Structural Shift

“It’s understandable if the weakness lasts for a week or two,” said Cao Ying, chief ferrous metals analyst at SDIC Essence Futures Co. “Any longer than that and the market will start to adjust its expectations as it will look more like a structural shift.”

Iron ore can’t stay below $100 a ton for too long without higher cost producers shutting up shop. That would thin out supply and put a floor under prices in the near term. But it’s the long-term demand side of the equation that’s causing most concern. The government in Australia, China’s biggest supplier, expects free-on-board prices of $95 a ton this year, $84 next year, and then levels in the $70s out through 2029.

The market’s crash contrasts starkly with another commodities bellwether, copper, which is closing in on a yearly high. Supply issues are the immediate driver, but the metal’s central role in the energy transition is driving predictions of outsized gains in the years to come. Steel and iron ore markets just won’t enjoy the same level of support from that secular shift in commodities consumption.

“There seems to be no end to the real estate crisis, local governments can’t sustain current investment levels, consumers are still very cautious,” said Tomas Gutierrez, analyst at Kallanish Commodities Ltd. There should be a seasonal demand recovery in the second quarter, “but this is not likely to be strong enough to really turn markets around,” he said.

On the Wire

Hong Kong-listed shares of China Vanke Co. got their first sell rating from Wall Street brokerages, as the developer grapples with deepening liquidity pressure and slumping profits.

Chinese oil giant PetroChina Co.’s market value has surpassed that of the nation’s top lender, making it the second-largest listed company in mainland China.

A popular equities strategy to “buy India, sell China” has reached an inflection point for some investors.

The Week’s Diary

(All times Beijing unless noted.)

Tuesday, April 2:

- China’s industry ministry meets with domestic steelmakers

Wednesday, April 3:

- Caixin’s China services & composite PMIs for March, 09:45

- CCTD’s weekly online briefing on Chinese coal, 15:00

- Shanghai exchange weekly commodities inventory, ~15:30

Thursday, Thursday April 4:

- Holiday in China and Hong Kong

Friday, April 5:

- Holiday in China

Saturday, April 6

- Nothing major scheduled

Sunday, April 7

- China’s foreign reserves for March, including gold

(Updates prices in second paragraph and steel mill earnings in sixth)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Woodside Looks to Build ‘Dream Team of LNG’ at Acquired US Plant

Eni signed exclusivity agreement with KKR for the potential sale of a minority stake in Enilive

Woodside's quarterly revenues exceed $3 billion backed by strategic milestones

Oil Rises as Biden Quits US Race, Blazes Threaten Canadian Wells

Kamala Harris Seen as Tougher Oil Industry Opponent Than Biden

PetroChina joins Oil and Gas Decarbonisation Charter

Galp reports 16% rise in Q2 2024 net profit amid higher oil prices and lower production costs

Nigeria’s Dangote Refinery Targets Output of 550,000 Barrels a Day

Oil Falls With Broader Commodity Weakness Amidst Listless Trade

Occidental Planning to Sell Bonds in Up to Five Parts

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

Partner content

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape