Oil Extends Losses Amid Pessimism Over Swelling Global Supplies

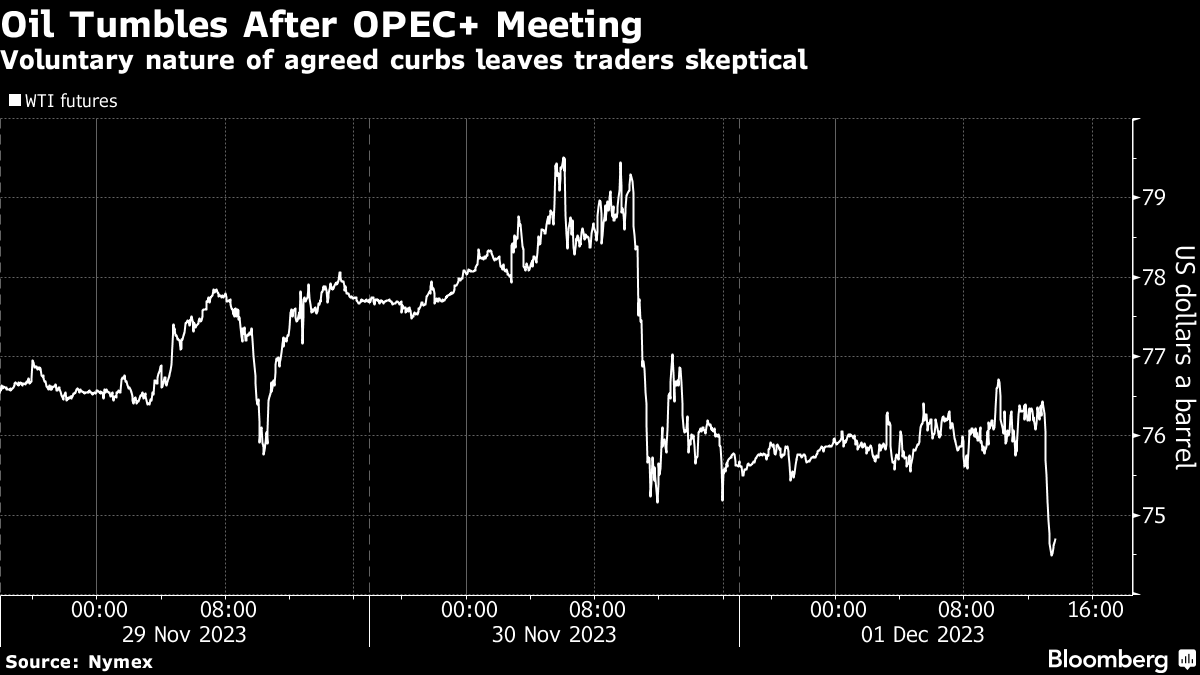

(Bloomberg) -- Oil extended declines amid expectations that the OPEC+ output cuts announced Thursday would do little to tighten the market.

West Texas Intermediate dropped as much as 2.1% to below $75 a barrel, following a 2.4% slide in the previous session. The alliance announced roughly 900,000 barrels a day of fresh output cuts next year, but the curbs are voluntary, with Angola already rejecting its quota. In the US, the oil rig count increased by five in the most recent week, signaling a continued increase in the country’s output.

Crude initially climbed Thursday as the production cartel’s preliminary agreement looked likely to help stem an anticipated surplus at the start of next year. That optimism quickly faded amid a lack of clarity from the meeting and doubts over whether the cuts would be fully implemented.

“Market concerns about compliance may be overblown, but poor communication from the OPEC+ meeting contributed to the downside in oil markets over the last sessions,” said Daniel Ghali, a commodity strategist at TD Securities. “However, as the dust settles, we estimate that the agreement may nonetheless be sufficient to skirt an expected surplus over the coming months.”

Crude is set to end the week down about 1% following the OPEC+ rollercoaster, remaining in the range it has traded in for much of November. Prices have moved into a lower band than in previous months as surging supplies outside of the producer group — including in the US, where output is at a fresh record — risk a market surplus in the first quarter.

Meanwhile, Brazil — which has contributed to the increase in global supplies — said it would join the OPEC+ alliance cooperation charter next year, but won’t take part in any production cuts for now.

The outcome of the OPEC+ meeting was a “confusing, entangled mess,” Vandana Hari, founder of Vanda Insights, said in a Bloomberg TV interview. “These are all still voluntary cuts, and that’s one of the reasons for the disappointment,” she said, adding that whether the extra 900,000 barrels a day of additional curbs are delivered over the first quarter remains to be seen.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Eni signed exclusivity agreement with KKR for the potential sale of a minority stake in Enilive

Woodside's quarterly revenues exceed $3 billion backed by strategic milestones

Oil Rises as Biden Quits US Race, Blazes Threaten Canadian Wells

Kamala Harris Seen as Tougher Oil Industry Opponent Than Biden

PetroChina joins Oil and Gas Decarbonisation Charter

Galp reports 16% rise in Q2 2024 net profit amid higher oil prices and lower production costs

Nigeria’s Dangote Refinery Targets Output of 550,000 Barrels a Day

Oil Falls With Broader Commodity Weakness Amidst Listless Trade

Occidental Planning to Sell Bonds in Up to Five Parts

Bolivia’s YPFB to invest $400 million in new hydrocarbon exploration and development

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

Partner content

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape