AI, power and the new geopolitics of energy

The global power sector is undergoing transformational change, with demand growth set to accelerate thanks to emerging market development, advancing electrification and an AI-driven data centre boom. But can supply be ramped up fast enough?

Power demand growth will accelerate as emerging markets develop

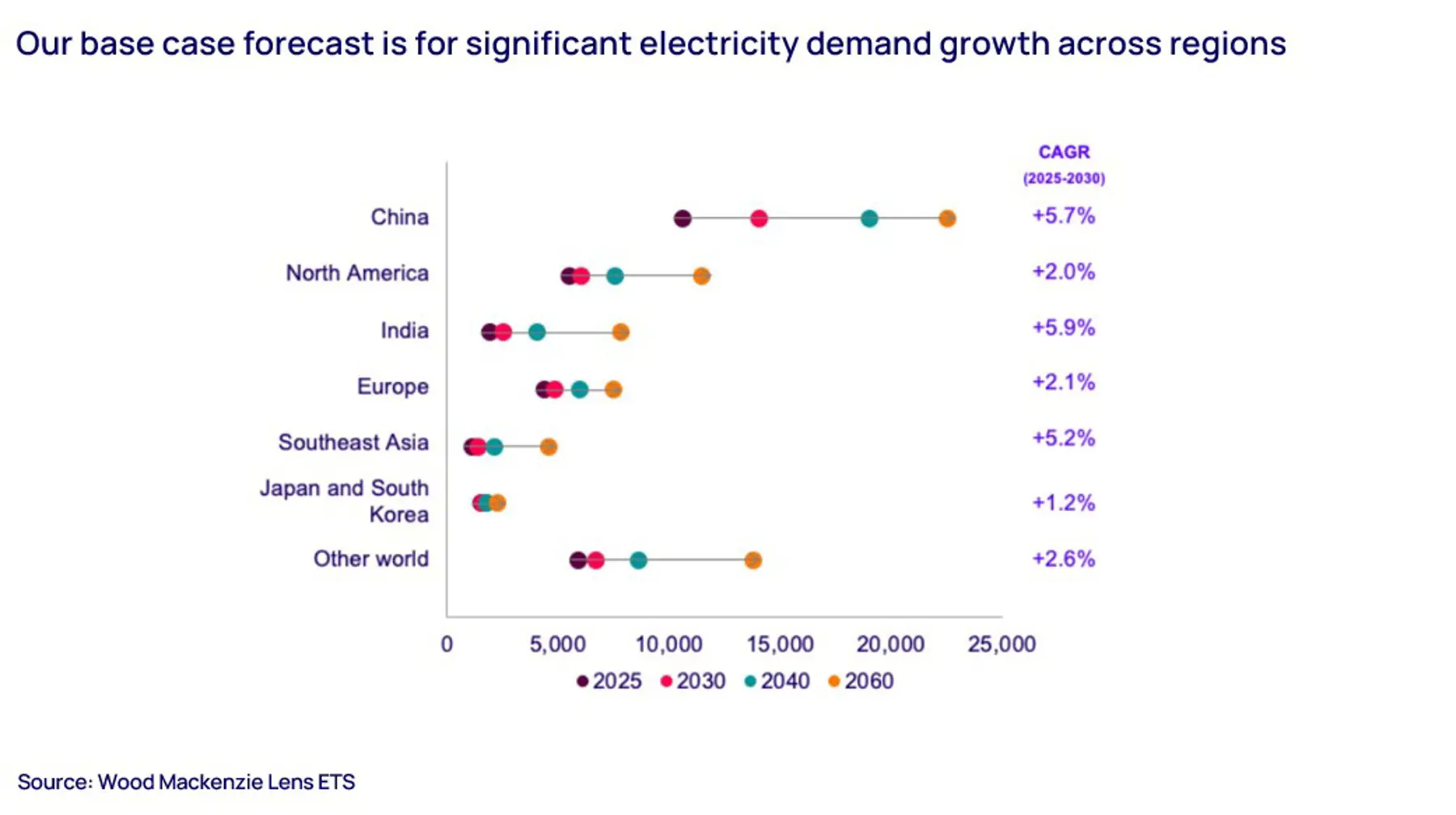

Overall global power demand will surge across the next three decades. Developing markets will be particularly important; base-case projections from Wood Mackenzie Lens Energy Transition Scenarios (ETS) tool see compound annual growth rates (CAGR) for power demand of over 5% in China, India and Southeast Asia, together accounting for over half total global demand growth to 2060.

Even in mature markets where power demand growth has been slow, there is renewed growth prospect. In Europe, we expect an overall CAGR of just over 2% between 2025 and 2050, although demand growth will vary significantly between countries.

Data centres will play an increasingly visible role in power markets

In the US - home to most of the world's biggest tech firms - the massive processing needs of AI are turbocharging power demand from data centres. Spending on facilities by the five largest hyperscalers (companies like Amazon, Microsoft and Google) is forecast to jump 50% to over US$300 billion in 2025. US utilities have already committed to add 116 gigawatts (GW) of large load to their networks, equivalent to around 15% of US peak electricity demand in 2024.

While European data centres currently account for only a small share of national power demand (except Ireland at over 20%), this could change rapidly; developers have already proposed 35 GW of capacity since 2023. Data from Wood Mackenzie's PowerRT monitoring sensor network shows a direct link between fluctuations in loads at major data centres and real-time power prices.

Major bottlenecks in the equipment supply chain continue

Wood Mackenzie’s analysis shows that the rapid ramp-up in demand is already squeezing supply chains, particularly in the US. Rising global demand for gas turbines has led to a supply crunch, with lead times hitting 243 weeks in Q2 2025. Wait times for power transformers remain at two-to-three years.

Resultant price escalation is most evident in the US. Costs for new gas-fired power stand at over US$2,000 per kilowatt (kW) in many US states, while solar photovoltaic (PV) systems average US$1,150 per KW.

China dominates the global solar supply chain. In response to western concerns over overcapacity, Chinese government policies including polysilicon production curbs and export VAT changes have resulted in 20% domestic module price increases, which will continue affecting global solar module prices.

Developed markets face diverging scenarios for pricing

Despite President Trump's ambitious election promise to halve energy costs, Wood Mackenzie’s analysis indicates US power prices will climb 118% between 2025 and 2060, thanks to surging demand, increasing cost of new build, and rising natural gas prices.

By comparison, average European power prices will be volatile but tend to drift lower in real terms for many countries over the long term.

The US and China have chosen different paths on energy

The two global superpowers have pursued very different energy strategies. While the US controls 18% of global oil and 24% of liquefied natural gas (LNG) production, China has sought dominance of solar power, battery storage and EVs. A "petrostate" versus "electrostate" divergence is becoming clearer.

China currently controls 95% of polysilicon wafer production and 80% of lithium-ion cells, plus the vast majority of refined resource production. As a result, it is leading a new club of developing markets towards a sub-US$100 per megawatt-hour (MWh) energy transition.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.