Rystad Energy: German power sector’s recent rollercoaster is not over, but the long-term outlook is rosy

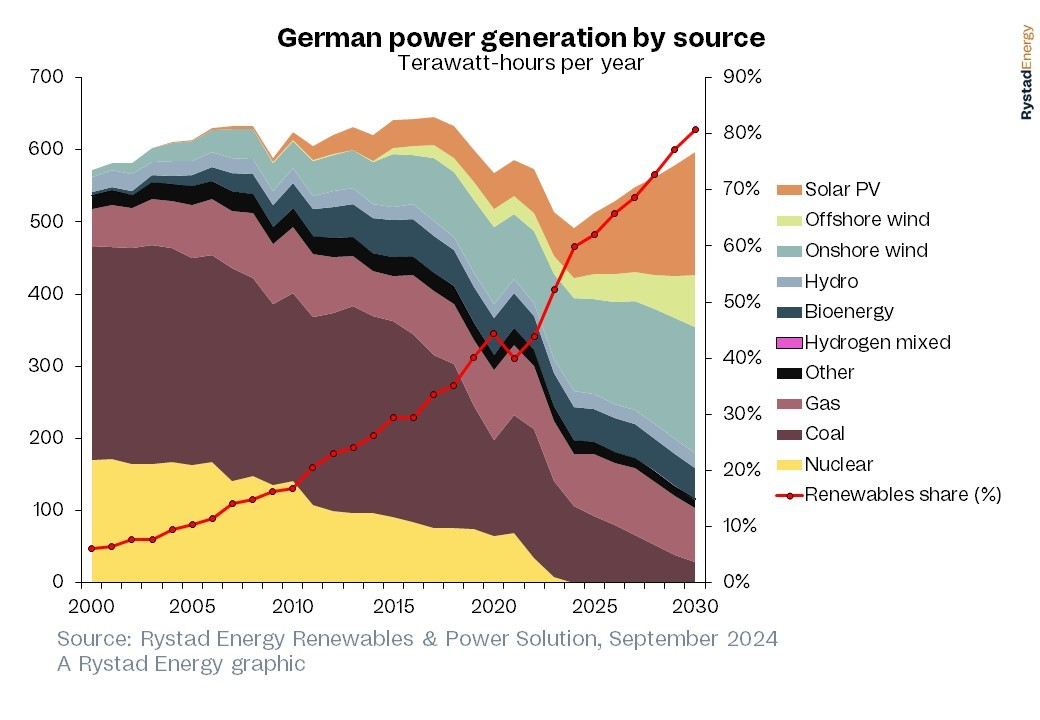

Germany’s power market is in the midst of a significant transition. Demand continues to fall despite normalising prices, and retired coal and nuclear capacity mean the European giant is now heavily reliant on imports from its neighbors. But it’s not all bad news for the sector. Rystad Energy projections show Germany will surpass its policy goal of 80% renewable energy generation by 2030, largely thanks to the rapid capacity build-up of solar and wind. While the country’s quick adoption of renewable energy systems has helped to offset the loss of traditional power capacity to a degree, the speed of the transition has not been sufficient to keep up with demand.

Renewable energy capacity in Germany has grown significantly in recent years. With 143 gigawatts of alternating current (GWac) installed by the end of 2023, the nation is the stand-out leader in Europe. New solar and wind installations hit a record last year, but that record is set to be broken again in 2024. Renewable energy auctions have been the primary driver of utility-scale additions, and much more capacity is planned to be auctioned in the coming years.

Between 2024 and 2028, more than 120 GWac will be auctioned off, spread across solar photovoltaic (PV) and offshore and onshore wind. Onshore wind will see the most significant capacity increase, with 50 GWac planned for auction in the next five years. Of course, these auctions are not set in stone, and achieving 100% of these targets is unlikely, but recent progress is a promising start. Rystad Energy research and analysis forecasts that by 2030, Germany will boast nearly 300 GWac of renewable energy capacity, more than doubling the total at the start of 2024.

“The German power sector is a fascinating case study in the global decarbonisation and electrification of the grid. Although there has been some short-term pain, the long-term gains appear all but secured. If policymakers stick to their current goals and strategies, Germany will likely continue dominating the European renewables landscape and shed its reliance on imports in the imminent future,” says Fabian Ronningen, Vice President of Renewables & Power Research at Rystad Energy.

At the beginning of 2024, many market observers expected an eventual upswing in German – and continental European – power demand after two years of significant decline. With close to two-thirds of the year now completed, it is unlikely there will be a considerable demand recovery for Germany this year. Net on-grid power demand in Germany has declined by about 0.7% this year and is now a massive 8.1% behind the level from 2021. Unless there is an unprecedented pick-up in demand for the remaining months of the year, Germany will end 2024 with another year of declining – or, in the best case, flattish – power demand.

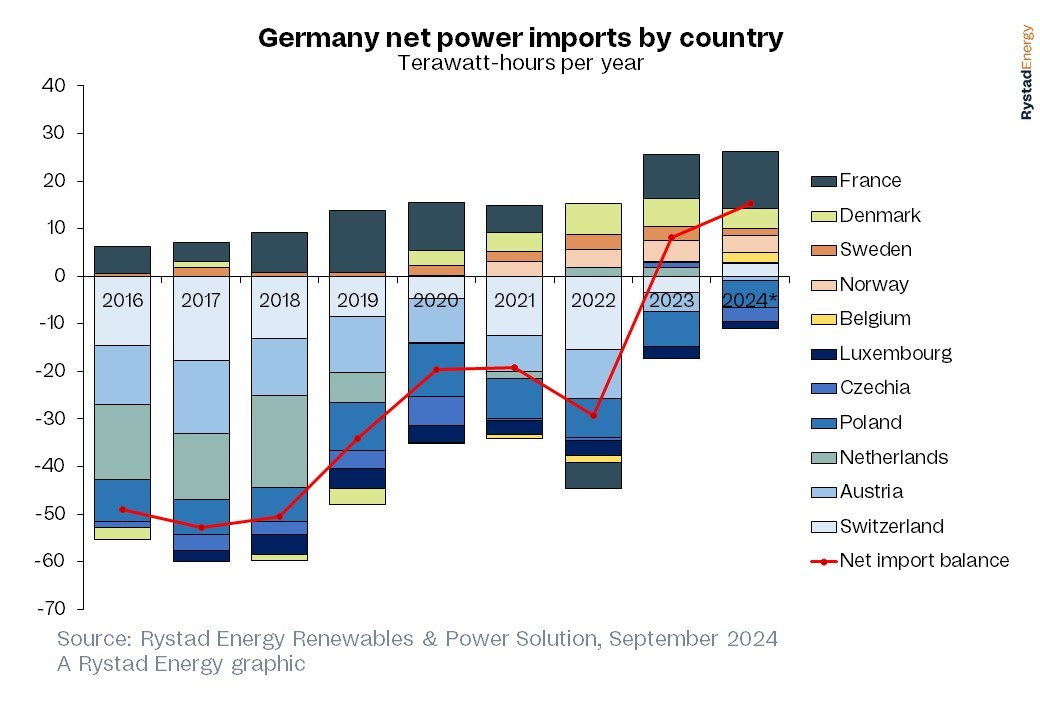

The considerable reduction in power demand has been one of the main factors for a similar movement on the supply side. The decline in supply has, however, been even more substantial than the decline in demand in the last two years, where the difference naturally is made up by higher power imports. After a massive decline in power generation of more than 10% last year, supply has continued to decline this year. Coal and nuclear energy have seen the most significant decline, with 2024 being the first full year with nuclear energy entirely phased out of the power mix and coal still having relatively low-cost competitiveness compared to gas.

The mismatch between supply and demand can be explained by much higher power imports, and with eight months of the year completed at the time of writing, Germany has already imported more power so far in 2024 than the entire year in 2023, with a net import balance of 15.3 terawatt-hours (TWh). Germany has slowly transformed from one of Europe’s largest power exporters to one of its largest importers. We estimate that gross coal power generation in Germany will total 107 TWh this year, a reduction of 163 TWh since 2015. From an environmental perspective, this is the desired outcome. Still, one result has been a greater reliance on power imports, directly contributing to Germany's higher power prices than its neighbors. Although renewable energy has seen impressive growth over the last decade, it is evident in hindsight that it has been far from enough to replace the role of nuclear and coal used in Germany’s power mix.

German power prices are still low compared to similar large European consumers such as Italy, which relies heavily on imports and has low renewable penetration. Even so, prices remain elevated due to supply issues compared to France. In 2021 and 2022, the situation was reversed, with Germany benefiting from ample domestic supply to keep prices below its French neighbors. But that is no longer the case, as France continues utilising its nuclear power generation capacity to keep supply stable and prices low.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.