Backyard Propane Tank Is One German Plant’s Answer to Gas Threat

(Bloomberg) --

A truck carrying a propane storage tank roared through the German city of Mainz before dawn on Friday, the latest move to shield Europe’s industry from the escalating energy crisis.

Glassmaker Schott AG will install the bus-sized container at its factory as it plans to replace natural gas over fears that Russia may fully choke off supplies. The fuel will cover around 20% of Schott’s gas demand and keep its plants running even if Germany were to ration energy in an emergency, said Chief Financial Officer Jens Schulte.

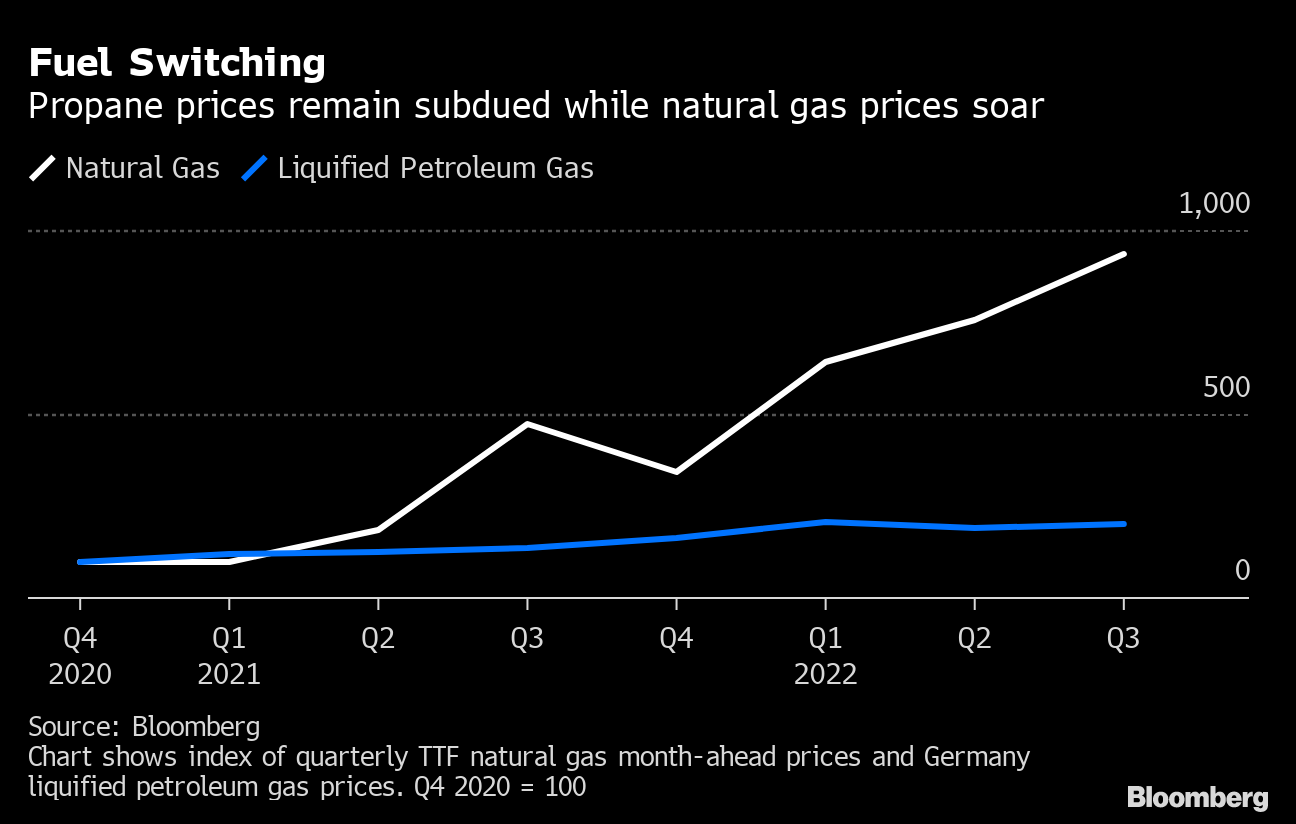

“Propane has similar properties to natural gas -- you can more or less use it without a big change,” Schulte said in an interview, adding that propane currently costs roughly half of natural gas. “As long as gas pricing is where it is, it actually helps us to bring down production costs as well.”

Schott is not alone in bolstering its defenses amid Europe’s energy standoff with Russia. Carlsberg A/S has converted a brewery in Denmark to run on oil instead of gas and is working on similar measures for its other European sites. Mercedes-Benz AG is stockpiling parts it makes using gas to keep production going even if there’s rationing. The region’s biggest carmaker Volkswagen AG has shelved a plan to switch its German power plants from coal to gas.

With a continent-wide recession now seemingly inevitable, chemical producers, steel plants and carmakers in Europe are bracing for a harsh winter with soaring energy bills. The suspected sabotage of Germany’s main pipeline for gas from Russia has prompted a push to bolster defenses, and dashed any last possibility that the Kremlin might turn the taps back on at some point.

Europe has responded to the Russian squeeze by filling up gas stores and trying to source alternative supplies. For now, it looks like those efforts will be enough to get Europe through this winter, though questions remain over the following one.

“It is clear that industrial gas consumption will have to contract sharply for Germany to meet its demand reduction targets and ensure security of supply,” said Stefan Ulrich, an analyst at BloombergNEF.

Even if gas remains available, surging prices for the fuel could make running factories uneconomical. US plastics maker Trinseo Plc said Thursday it may shutter a loss-making factory in Germany over energy inflation. The country’s ceramics industry said last week it expects more plants to close and production to shift abroad because of surging gas prices. Norway’s Yara International ASA has slashed ammonia output, contributing to a fertilizer crunch that sparked unexpected ripple effects on food and drink production in the region.

Governments across Europe have been responding with tens of billions of euros of tax cuts and subsidies for households and businesses. Germany is preparing to borrow an additional €200 billion ($195 billion) to limit the impact of soaring energy costs. Berlin has made appeals to businesses and consumers to rein in demand, but hasn’t made cuts mandatory.

Businesses in Europe’s biggest economy are nevertheless racing to find alternative fuels before winter. The Berchtesgadener Land dairy producer in Bavaria has bought 1 million liters of oil stored at Hamburg harbor -- fuel that would be sent south via trains and trucks in case of rationing. The Veltins beer brewery has stockpiled heating oil to prepare for an emergency shift away from gas.

Schott, which employs around 17,300 people, is on the front line of the crisis. The company supplies glass for anything from mobile phones to vaccine vials and uses mainly gas to melt raw materials. Its energy bill is almost ten times higher for some products this year than in 2021, Schulte said. The company has rented large propane storage tanks in the eastern German city of Halle, from where it plans to supply smaller containers at its factories across the country.

Propane, which burns around the same temperature as natural gas, can be extracted from petroleum products at oil refineries. While Germany will stop buying Russian crude later this year, there are more readily available alternative sources of oil than gas, making propane price spikes and shortages less likely.

Analysts at the Brussels-based Bruegel think tank have said German firms should buy gas-intensive products from abroad to cut their consumption, a method known as import substitution. Schulte said high transportation costs prevented the company from sending over wares from its US facilities.

“There are some products you can produce slightly cheaper in the US than in Europe, but adding the very high transportation costs actually makes it more expensive,” the CFO said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances