European Gas Plunges as Recent Rally Lures Flotilla of U.S. LNG

(Bloomberg) -- European natural gas prices plunged more than 20% on Thursday as this year’s stellar rally attracted a flotilla of U.S. cargoes.

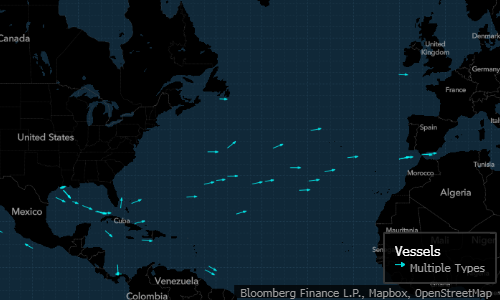

At least 10 vessels are heading to Europe, according to ship-tracking data compiled by Bloomberg. Another 20 ships appear to be crossing the Atlantic, but are yet to declare their final destinations. U.S. cargoes of liquefied natural gas will help offset lower flows from Russia, Europe’s top supplier.

Gas prices in Europe have surged more than sixfold this year as Russia curbed supplies just as pandemic-hit economies reopened, boosting demand. Delayed maintenance work and power-plant outages also contributed to the rally. Prices in Europe are 13 times higher than in the U.S. and the market is also trading at a rare premium to Asia, making the continent a prime destination for LNG.

Europe’s Energy Crisis Deepens as Kosovo Rolls Out Power Cuts

Prices also dropped amid speculation some traders opted to close positions ahead of the holidays.

“Through the festive period, limited market liquidity may spur even greater volatility,” adviser Inspired Energy Plc said in a note. A Lack of clarity on Russia’s supplies is “breeding bullish sentiment, while growing appetite for energy complex profit-taking adds downside potential.”

Benchmark Dutch front-month gas slid 23% to 132.579 euros ($150) a megawatt-hour, after hitting a record 187.785 euros on Tuesday. The U.K. equivalent dropped 25% to 325.60 pence a therm.

Lower gas prices dragged down power, with German electricity for next year slumping as much as 17% to 269 euros per megawatt-hour, the biggest loss since Oct. 7. Prices also declined as weather forecasts for Northwest Europe turned milder, with temperatures expected to rise above seasonal norms next week.

U.S. LNG export terminals are operating at or above capacity after reaching record flows on Sunday. That will help plug Europe’s gas shortage as Russia has already signaled it may keep supplies capped in January.

In the short term, Russian gas flows sent through Ukraine dropped, while shipments into Germany via a key transit route remain halted. The Yamal-Europe pipeline has instead been shipping fuel in the reverse direction, eastward from Germany to Poland, since Tuesday.

Gazprom Signals No Flows Into Germany’s Mallnow for Fourth Day

Russian exporter Gazprom PJSC isn’t booking Yamal-Europe capacities because its buyers, mainly in France and Germany, didn’t make requests for the supplies, Russian President Vladimir Putin said Thursday. Some buyers under long-term deals have already hit their contracted supply limits for the year, according to people with direct knowledge of the matter.

More U.S. LNG will also help ease France’s power crunch, as countries will need to produce more electricity from gas, coal and even oil to cope with nuclear outages. At the start of January, about 30% of France’s nuclear reactor capacity will be offline.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis